Budgeting on $50,000 Salary: A Comprehensive Guide to Managing Your Finances

Greetings, Readers!

Welcome to our comprehensive guide on budgeting on a $50,000 salary. In today’s fast-paced world, managing your finances effectively is crucial for a secure and stress-free life. This guide aims to provide you with valuable insights and strategies to make the most out of your income and achieve your financial goals.

Table of Contents

Introduction

What is Budgeting on a $50,000 Salary?

Who Should Consider Budgeting on a $50,000 Salary?

When Should You Start Budgeting on a $50,000 Salary?

Where to Begin with Budgeting on a $50,000 Salary?

Why is Budgeting on a $50,000 Salary Important?

How to Budget Effectively on a $50,000 Salary?

Advantages and Disadvantages of Budgeting on a $50,000 Salary

Frequently Asked Questions

Conclusion

Final Remarks

Introduction

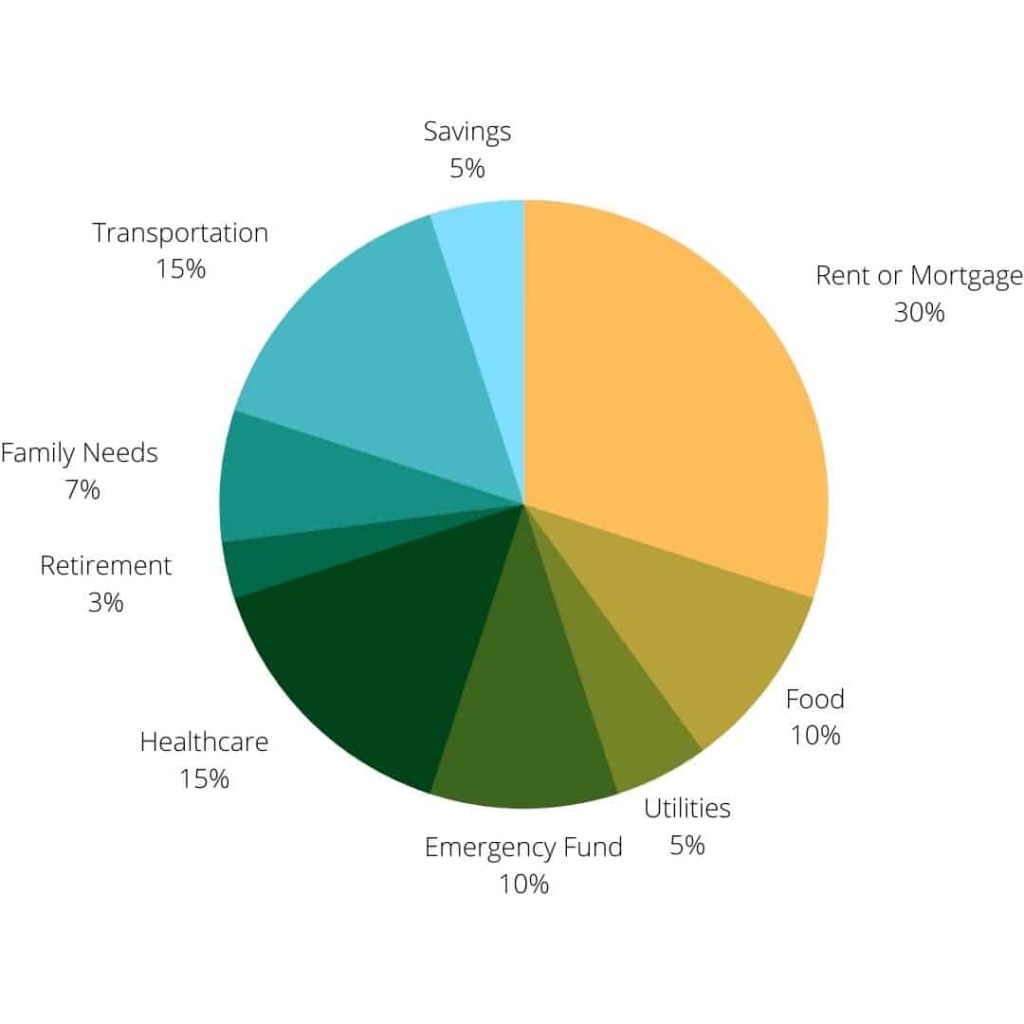

Image Source: barefootbudgeting.com

Budgeting on a $50,000 salary is a smart financial move that can help you take control of your money and achieve your financial goals. By creating a budget, you can track your income and expenses, prioritize your spending, and save for the future.

However, budgeting effectively requires careful planning and discipline. In this guide, we will walk you through the steps of budgeting on a $50,000 salary, providing you with practical tips and strategies to make the most of your income.

Whether you are just starting your career, looking to improve your financial situation, or wanting to save for a big purchase or retirement, budgeting on a $50,000 salary can help you achieve your goals.

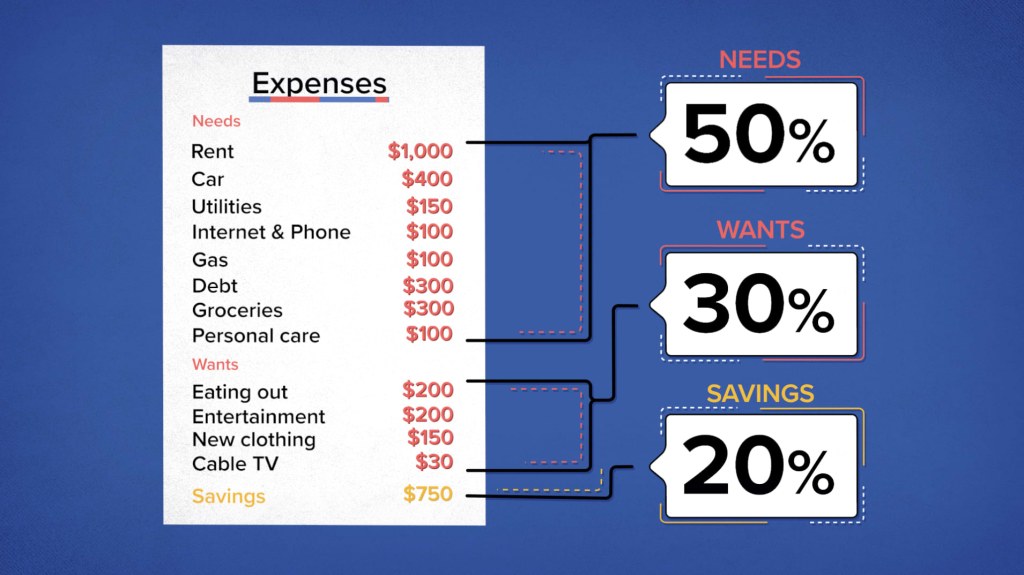

Image Source: howtofire.com

Now, let’s delve deeper into the different aspects of budgeting on a $50,000 salary.

What is Budgeting on a $50,000 Salary?

At its core, budgeting on a $50,000 salary involves creating a financial plan that outlines your income, expenses, and savings goals. It allows you to allocate your money in a way that aligns with your priorities and helps you achieve financial stability and success.

Image Source: cnbcfm.com

Creating a budget on a $50,000 salary involves analyzing your expenses, identifying areas where you can cut back, setting savings goals, and tracking your progress regularly. By doing so, you can make informed decisions about your spending habits and ensure that your money is working for you.

Understanding Your Income and Expenses

One of the first steps in budgeting on a $50,000 salary is understanding your income and expenses. Take the time to gather all the necessary information, such as your monthly salary, bonuses, and any additional sources of income.

Next, analyze your expenses and categorize them into fixed expenses (e.g., rent, utilities) and variable expenses (e.g., groceries, entertainment). This will give you a clear picture of where your money is going and help you identify areas where you can potentially save.

Setting Realistic Savings Goals

Saving money is an essential part of budgeting on a $50,000 salary. It allows you to build an emergency fund, plan for future expenses, and work towards your long-term financial goals, such as buying a house or retiring comfortably.

When setting savings goals, it’s important to be realistic and prioritize them based on your needs and aspirations. Start by saving a small percentage of your income and gradually increase it over time. This will make it easier to stick to your budget and ensure a steady progress towards your goals.

Tracking and Adjusting Your Budget

Creating a budget is not a one-time task. To make it effective, you need to track your expenses regularly and make adjustments as needed. Use budgeting tools and apps to monitor your spending, categorize your expenses, and identify areas where you can cut back.

Furthermore, be prepared to make adjustments to your budget as your financial situation changes. Life is full of unexpected events, and your budget should be flexible enough to accommodate them. By regularly reviewing and adjusting your budget, you can stay on track and ensure that your money is being used wisely.

Building Good Financial Habits

Budgeting on a $50,000 salary is not just about the numbers; it’s also about developing good financial habits. This includes practicing self-discipline when it comes to spending, avoiding impulsive purchases, and finding ways to save money.

Consider implementing strategies such as meal planning, buying in bulk, and seeking out discounts and deals. Additionally, educate yourself about personal finance and investment options to make informed decisions and maximize your savings.

Seeking Professional Guidance

If you find budgeting on a $50,000 salary challenging or overwhelming, don’t hesitate to seek professional guidance. Financial advisors can provide valuable insights and help you create a customized budgeting plan that suits your unique needs and goals.

Remember, budgeting on a $50,000 salary is a journey, and it requires time, patience, and commitment. By taking control of your finances and making thoughtful choices about your money, you can create a solid foundation for a secure and prosperous future.

Who Should Consider Budgeting on a $50,000 Salary?

Budgeting on a $50,000 salary is beneficial for individuals from various walks of life. Whether you are a recent graduate starting your first job or an experienced professional looking to gain control over your finances, budgeting can help you navigate the complexities of money management.

Here are some individuals who can benefit from budgeting on a $50,000 salary:

Recent Graduates

Starting your career with a $50,000 salary can be a significant milestone. Budgeting during this phase can help you develop good financial habits from the beginning and set yourself up for a strong financial future.

By creating a budget, you can manage your student loan payments, save for emergencies, and work towards your future goals, such as homeownership or retirement.

Young Professionals

As you progress in your career and earn a higher salary, it’s essential to establish a budget that aligns with your newfound income. Budgeting on a $50,000 salary can help you avoid lifestyle inflation and ensure that you are saving and investing for your future.

By being proactive about your finances, you can make the most out of your income and work towards achieving financial independence and security.

Families and Parents

Raising a family comes with added financial responsibilities. Budgeting on a $50,000 salary can help families prioritize their spending, save for their children’s education, and plan for their own future needs, such as retirement.

By involving your family members in the budgeting process, you can teach them valuable financial skills and work together towards common financial goals.

Individuals with Debt

If you have accumulated debt from student loans, credit cards, or other sources, budgeting on a $50,000 salary can help you pay off your debt more efficiently. By allocating a portion of your income towards debt repayment, you can gradually reduce your debt burden and improve your financial situation.

Creating a budget will also help you avoid additional debt and develop healthy financial habits that can contribute to long-term financial success.

Pre-Retirees and Retirees

Even if you are close to retirement or have already retired, budgeting remains crucial to ensure financial stability and make the most of your retirement savings. Budgeting on a $50,000 salary can help you manage your expenses, plan for healthcare costs, and ensure that your retirement funds last throughout your lifetime.

By creating a realistic budget and monitoring your spending, you can enjoy your retirement years without financial stress.

Everyone!

In reality, budgeting is beneficial for everyone, regardless of income level. It enables you to have a clear understanding of your financial situation, make informed decisions about your money, and work towards your goals.

No matter the size of your salary, budgeting can help you manage your money effectively and achieve financial stability.

When Should You Start Budgeting on a $50,000 Salary?

The earlier you start budgeting on a $50,000 salary, the better. Regardless of your age or financial situation, creating a budget is a valuable tool that can benefit you in many ways.

Here are a few reasons why you should start budgeting on a $50,000 salary as soon as possible:

Establish Financial Discipline

By starting early, you can develop good financial habits and establish discipline when it comes to spending and saving. Budgeting on a $50,000 salary allows you to make thoughtful decisions about your money and prioritize your goals.

By practicing financial discipline from the beginning, you can avoid excessive debt, build savings, and achieve long-term financial success.

Build Emergency Savings

Life is unpredictable, and unexpected expenses can arise at any time. By creating a budget and allocating a portion of your income towards emergency savings, you can build a financial safety net.

Having emergency savings on a $50,000 salary can help you handle unexpected car repairs, medical bills, or job loss without derailing your financial progress.

Save for Future Goals

Whether it’s buying a house, starting a business, or planning for retirement, budgeting on a $50,000 salary allows you to save for your future goals. By setting aside a portion of your income regularly, you can make steady progress towards achieving your dreams.

Starting early gives you a longer timeframe to save and invest, increasing the likelihood of accomplishing your goals.

Reduce Financial Stress

Financial stress can take a toll on your mental and physical well-being. Budgeting on a $50,000 salary can help you take control of your finances and reduce stress related to money.

By having a clear understanding of your income, expenses, and savings, you can make informed decisions and avoid financial hardships.

Maximize Your Income

Creating a budget on a $50,000 salary allows you to maximize your income and make the most out of every dollar. By tracking your expenses, you can identify areas where you can cut back and save money.

Furthermore, budgeting helps you avoid unnecessary debt and prioritize your spending, ensuring that your money is used wisely.

Where to Begin with Budgeting on a $50,000 Salary?

Starting the budgeting process on a $50,000 salary may seem overwhelming, but with the right approach, it can be a manageable and rewarding experience. Here are some steps to help you get started:

Create a List of Expenses

The first step in budgeting on a $50,000 salary is to create a list of all your expenses. This includes both fixed expenses (e.g., rent, utilities, loan payments) and variable expenses (e.g., groceries, entertainment, dining out).

Take the time to gather all your bills, bank statements, and receipts to get an accurate picture of your spending habits. This will serve as a starting point for creating your budget.

Calculate Your Income

Next, calculate your monthly income, taking into account your $50,000 salary as well as any additional sources of income, such as bonuses or freelance work.

Having a clear understanding of your income will help you set realistic savings goals and allocate your money effectively.

Analyze Your Expenses

Once you have your list of expenses and income, analyze your spending habits. Identify areas where you can potentially cut back and save money.

Separate your expenses into categories, such as housing, transportation, food, and entertainment. This will help you visualize where your money is going and make informed decisions about your spending.

Create a Budget

Using the information gathered, create a budget that aligns with your income and goals. Allocate a portion of your income towards essential expenses, such as rent and utilities, and set aside money for savings and discretionary spending.

Be realistic and flexible when creating your budget. Allow room for unexpected expenses and adjust your spending habits as needed.

Track Your Expenses

Once your budget is in place, it’s essential to track your expenses and monitor your progress. There are many budgeting apps and tools available that can help you keep track of your spending, categorize your expenses, and set reminders for bill payments.

Regularly reviewing your expenses will allow you to identify areas where you can improve and make adjustments to your budget accordingly.

Review and Adjust Regularly

As your financial situation changes, it