Budgeting on $45,000 Salary

Introduction

Dear Readers,

Welcome to our comprehensive guide on budgeting with a $45,000 salary. In today’s fast-paced world, managing our finances effectively is crucial to achieving our financial goals and ensuring a secure future. With this article, we aim to provide you with valuable insights and practical tips on budgeting with a modest salary. By implementing these strategies, you can make the most out of your income and achieve financial stability.

Image Source: moneybliss.org

Now, let’s dive into the world of budgeting together!

Table of Contents

1. What is Budgeting?

7. Advantages and Disadvantages

2. Who Should Budget?

8. FAQ

3. When Should You Start Budgeting?

9. Conclusion

4. Where to Begin with Budgeting?

10. Final Remarks

Image Source: howtofire.com

5. Why is Budgeting Important?

6. How to Budget with a $45,000 Salary?

1. What is Budgeting?

📚 Budgeting is the process of creating a plan for your income and expenses. It involves tracking and managing your financial resources to ensure that you are spending within your means and saving for future goals.

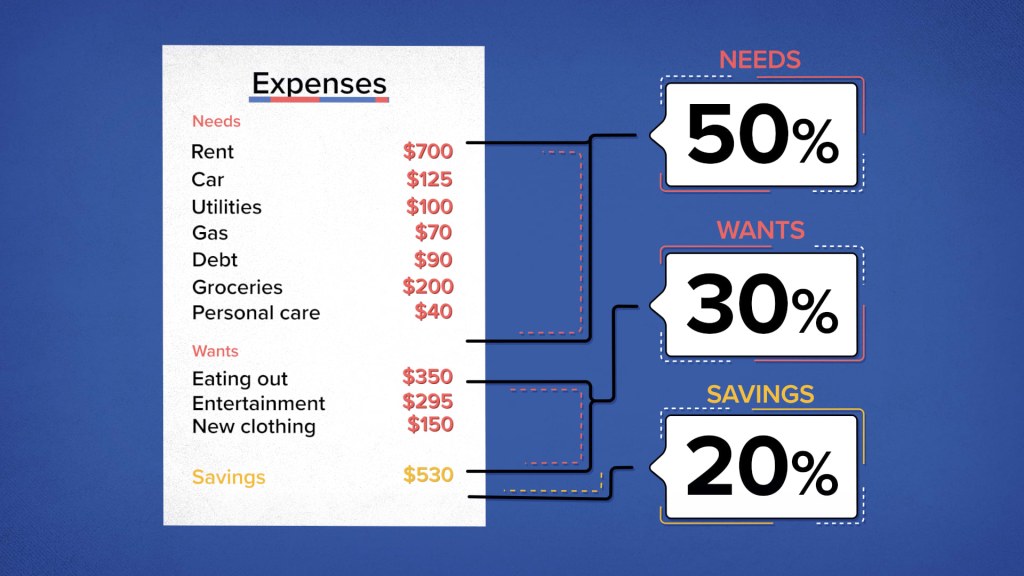

Image Source: cnbcfm.com

📚 Budgeting allows you to have control over your money, make informed financial decisions, and prioritize your spending based on your needs and values.

📚 By creating a budget, you can allocate funds for essential expenses, such as housing, transportation, groceries, and healthcare, while also setting aside money for savings and discretionary spending.

📚 The goal of budgeting is to achieve financial stability, reduce debt, and work towards long-term financial goals, such as buying a home, saving for retirement, or taking a dream vacation.

📚 Now that we understand what budgeting is, let’s explore who can benefit from having a budget.

2. Who Should Budget?

📚 Budgeting is a valuable tool for everyone, regardless of your income level. It is especially crucial for individuals with a $45,000 salary or lower, as every dollar counts.

📚 If you find yourself living paycheck to paycheck, struggling to pay bills, or unable to save for the future, budgeting can help you gain control over your finances and improve your financial situation.

📚 Budgeting is also beneficial for those who want to save for specific goals, such as buying a car, paying off debt, or starting an emergency fund.

📚 Even if you have a higher income, budgeting can still provide you with a clear overview of your finances and ensure that you are making the most of your money.

📚 Next, let’s discuss when you should start budgeting.

3. When Should You Start Budgeting?

📚 The answer is simple: now! It’s never too early or too late to start budgeting. The sooner you begin, the better equipped you will be to manage your finances and achieve your financial goals.

📚 Whether you are just starting your career, have recently experienced a change in income, or want to regain control over your finances, budgeting is a valuable skill that can benefit you throughout your life.

📚 By starting early, you can develop good financial habits, avoid unnecessary debt, and make progress towards long-term financial security.

📚 Now that you know when to start budgeting, let’s explore where to begin.

4. Where to Begin with Budgeting?

📚 Starting a budget may seem overwhelming, but with the right approach, it can be a straightforward and empowering process.

📚 Begin by assessing your current financial situation. Take note of your income, expenses, debts, and savings. This will give you a clear understanding of your financial landscape.

📚 Create a monthly budget that includes all your necessary expenses, such as rent, utilities, groceries, transportation, and healthcare. Dedicate a portion of your income to savings and identify areas where you can cut back on discretionary spending.

📚 Utilize budgeting tools and apps to help you track your expenses and stay on top of your financial goals. These tools can provide valuable insights into your spending habits and help you make more informed financial decisions.

📚 Regularly review your budget and make adjustments as needed. Life circumstances may change, and your budget should reflect those changes.

📚 With a solid foundation in place, you can now explore why budgeting is important.

5. Why is Budgeting Important?

📚 Budgeting is essential for several reasons:

📚 It helps you gain control over your finances and avoid debt.

📚 It allows you to prioritize your spending based on your values and goals.

📚 It helps you save for emergencies and future expenses.

📚 It provides peace of mind and reduces financial stress.

📚 It enables you to make informed financial decisions.

📚 It helps you achieve your short-term and long-term financial goals.

📚 With the understanding of why budgeting is important, let’s dive into the specifics of budgeting with a $45,000 salary.

6. How to Budget with a $45,000 Salary?

📚 Budgeting with a $45,000 salary requires careful planning and prioritization. Here are some tips to help you make the most out of your income:

📚 1. Track your expenses: Start by monitoring your spending habits to identify areas where you can cut back.

📚 2. Set financial goals: Define your short-term and long-term financial goals, such as paying off debt or saving for a down payment.

📚 3. Create a budget: Allocate your income towards essential expenses, savings, and discretionary spending. Stick to your budget as closely as possible.

📚 4. Reduce non-essential expenses: Identify areas where you can reduce discretionary spending, such as dining out or entertainment.

📚 5. Save automatically: Set up automatic transfers to your savings account to ensure consistent saving habits.

📚 6. Prioritize debt repayment: If you have outstanding debts, allocate a portion of your income towards paying them off.

📚 7. Seek additional sources of income: Consider taking on a side hustle or freelancing to supplement your salary.

📚 By following these steps, you can create a budget that aligns with your income and works towards your financial goals.

7. Advantages and Disadvantages

📚 Budgeting with a $45,000 salary has its advantages and disadvantages. Let’s explore them:

📚 Advantages:

📌 Provides a clear overview of your finances.

📌 Helps you prioritize your spending.

📌 Allows you to save for future goals.

📌 Reduces financial stress.

📌 Enables you to make informed financial decisions.

📚 Disadvantages:

📌 Limited room for discretionary spending.

📌 May require careful planning and budgeting.

📌 Less flexibility compared to higher-income individuals.

📌 May require additional sources of income to meet financial goals.

📌 Requires discipline and commitment to stick to the budget.

📚 Understanding the advantages and disadvantages will help you make informed decisions and overcome challenges along your budgeting journey.

8. FAQ

Q1: Is budgeting only for people with low incomes?

A1: No, budgeting is beneficial for everyone, regardless of income level. It provides financial clarity and helps you achieve your goals.

Q2: How can I prepare for unexpected expenses?

A2: Set up an emergency fund and contribute to it regularly. Aim to save at least three to six months’ worth of living expenses.

Q3: What if my income fluctuates?

A3: If your income varies, create a budget based on your average monthly income. Save during high-income periods to cover expenses during low-income periods.

Q4: How can I handle debt while budgeting?

A4: Allocate a portion of your income towards debt repayment. Prioritize high-interest debts and consider debt consolidation or refinancing options.

Q5: Can I still have fun while budgeting?

A5: Absolutely! Budgeting doesn’t mean sacrificing all enjoyment. Allocate a portion of your income towards discretionary spending and find ways to have fun within your budget.

9. Conclusion

📚 Congratulations, you’ve reached the end of our guide on budgeting with a $45,000 salary! By implementing the strategies outlined in this article, you can take control of your finances and work towards achieving your financial goals.

📚 Remember, budgeting is a journey, and it requires commitment and discipline. Regularly review and adjust your budget as needed, and stay focused on your long-term financial well-being.

📚 With the right mindset and financial habits, you can make the most out of your $45,000 salary and build a solid foundation for your future.

10. Final Remarks

📚 Budgeting is a powerful tool that can transform your financial life. It empowers you to make informed decisions, prioritize your goals, and achieve financial freedom.

📚 While the information provided in this article aims to guide you in budgeting with a $45,000 salary, it’s essential to customize your budget based on your unique circumstances and financial goals.

📚 We encourage you to seek professional financial advice if needed and continue educating yourself on personal finance topics to enhance your financial literacy.

📚 Remember, everyone’s financial journey is different, and with determination and perseverance, you can achieve the financial future you desire.

📚 Best of luck on your budgeting journey!