Personal Finance High School Syllabus

Introduction

Introduction

Greetings, Readers! Today, we will delve into a topic that is essential for young individuals to grasp – personal finance. In this article, we will explore the importance of incorporating personal finance into high school syllabi and how it can benefit students in the long run.

Financial literacy is a skill that is often overlooked, yet it plays a crucial role in shaping the future of our youth. By introducing personal finance into high school curricula, we equip students with the necessary knowledge and tools to make informed financial decisions. Let’s dive into the details of what a personal finance high school syllabus entails.

What is Personal Finance High School Syllabus?

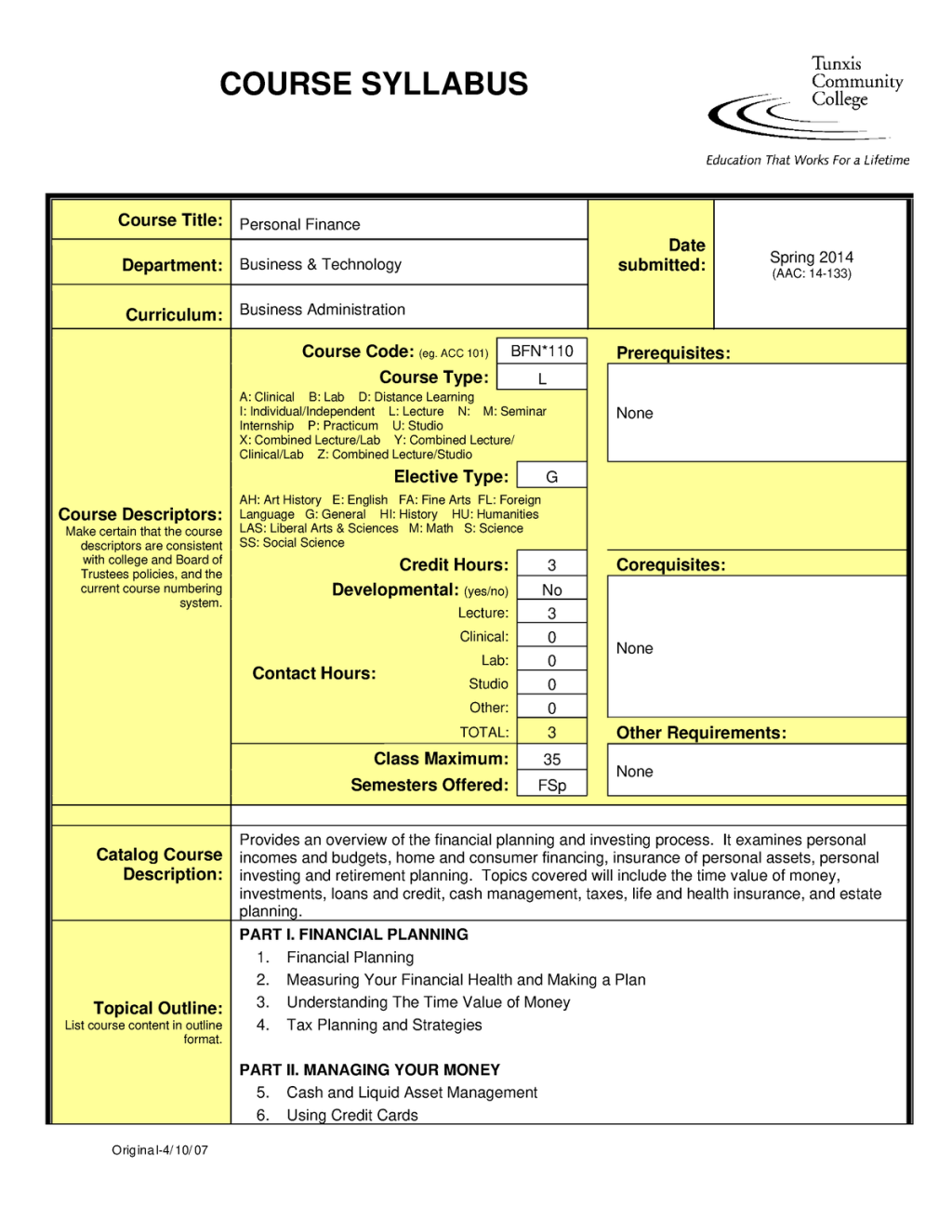

Image Source: cloudfront.net

🔍 Personal finance high school syllabus refers to the inclusion of financial education in the curriculum of high school students. It covers various topics such as budgeting, saving, investing, debt management, and financial planning. This syllabus aims to provide students with the necessary skills and knowledge to navigate the complex world of personal finance.

By integrating personal finance into the high school syllabus, students can develop a solid foundation in financial literacy, enabling them to make informed decisions about their finances both now and in the future.

Who Benefits from Personal Finance High School Syllabus?

🔍 The benefits of a personal finance high school syllabus extend to both students and society as a whole. Firstly, students gain valuable knowledge and skills that will empower them to make sound financial decisions throughout their lives. They become financially responsible individuals who are better equipped to handle challenges such as managing debt, saving for the future, and investing wisely.

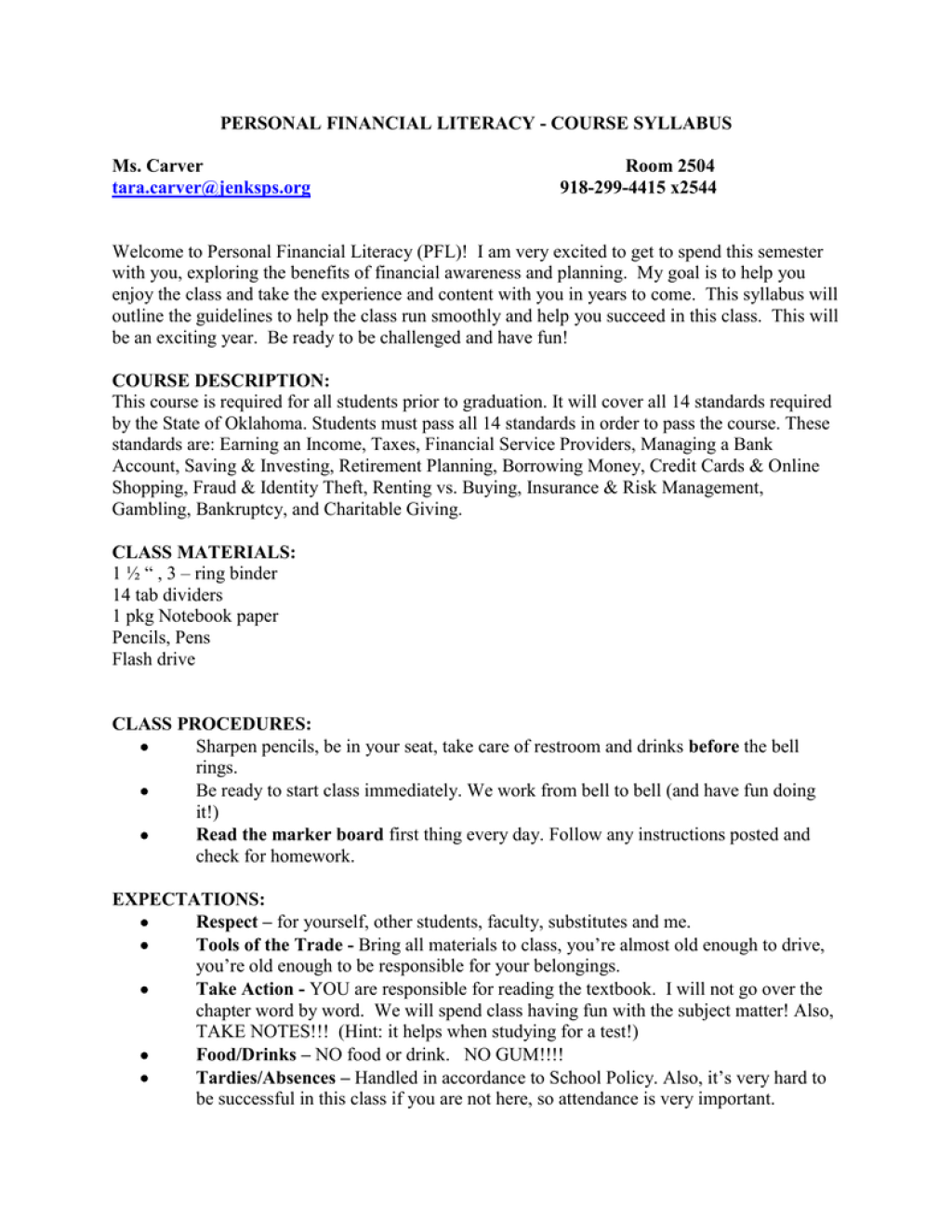

Image Source: studylib.net

Furthermore, society benefits from a financially literate population. By educating students about personal finance at a young age, we can reduce the prevalence of financial struggles, debt, and economic instability in our communities. Ultimately, personal finance education contributes to the overall well-being and prosperity of individuals and society.

When Should Personal Finance be Introduced?

🔍 The ideal time to introduce personal finance into the high school syllabus is during the early years of secondary education. By starting early, students have ample time to grasp the fundamental concepts and develop good financial habits.

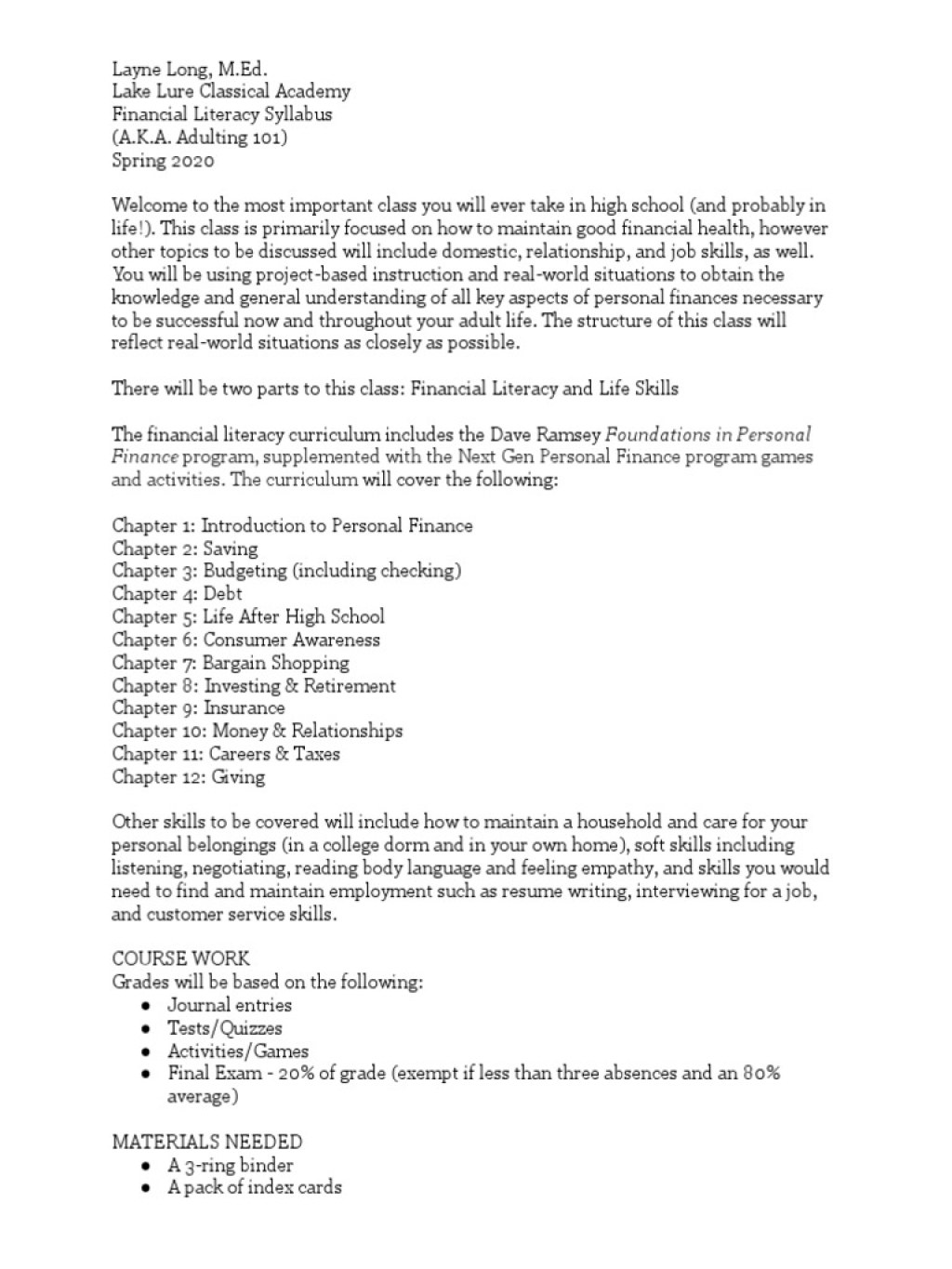

Image Source: scribdassets.com

It is recommended that personal finance be incorporated as a separate subject or integrated into existing subjects such as mathematics or social studies. This ensures that students receive comprehensive financial education throughout their high school years.

Where is Personal Finance High School Syllabus Taught?

🔍 Personal finance high school syllabus can be taught in a variety of settings, including public and private schools. Schools have the responsibility to provide students with a well-rounded education, and financial literacy is a crucial component of this.

Additionally, community organizations, non-profit groups, and financial institutions often collaborate with schools to offer workshops, seminars, and extracurricular activities related to personal finance. These initiatives further enhance students’ understanding of financial concepts and practices.

Why is Personal Finance High School Syllabus Important?

🔍 Personal finance high school syllabus is important for several reasons. Firstly, it equips students with the skills to manage their finances effectively, ensuring they are prepared for the financial challenges they will face in adulthood. By learning about budgeting, saving, and investing, students are better equipped to achieve their financial goals and build a secure future.

Moreover, personal finance education promotes financial responsibility and independence. Students learn the importance of making informed decisions, avoiding excessive debt, and planning for their financial well-being. This knowledge empowers them to take control of their financial futures and avoid common financial pitfalls.

How is Personal Finance High School Syllabus Implemented?

🔍 The implementation of a personal finance high school syllabus requires collaboration between educational institutions, policymakers, and financial experts. It involves developing a comprehensive curriculum that covers various financial topics and aligning it with educational standards.

Additionally, training and professional development opportunities for teachers are essential to ensure they are equipped with the knowledge and skills to effectively teach personal finance. This may involve workshops, seminars, or online courses specifically designed for educators.

Advantages and Disadvantages of Personal Finance High School Syllabus

Advantages:

1. Empowers students with financial knowledge and skills to make informed decisions.

2. Prepares students for financial independence and the challenges of adulthood.

3. Reduces the likelihood of financial struggles and debt in the future.

4. Promotes financial responsibility and the importance of saving and investing.

5. Creates a financially literate society, contributing to overall economic stability.

Disadvantages:

1. Limited resources and funding for personal finance education.

2. Integration into an already packed high school curriculum may be challenging.

3. The effectiveness of personal finance education may vary depending on teaching methods and quality of instruction.

4. Lack of standardized assessments or certifications for personal finance proficiency.

5. Limited emphasis on behavioral and psychological aspects of personal finance.

Frequently Asked Questions (FAQs)

1. Is personal finance education only relevant for students pursuing careers in finance?

No, personal finance education is relevant for all students. It equips them with essential life skills, regardless of their chosen career paths.

2. What are the long-term benefits of personal finance education in high school?

Personal finance education in high school sets the foundation for a lifetime of financial well-being. It helps individuals make smart financial decisions, avoid debt, and achieve their financial goals.

3. Are there any standardized assessments for personal finance proficiency?

Currently, there is no widely recognized standardized assessment for personal finance proficiency. However, some organizations offer certifications or examinations to assess financial literacy.

4. Can personal finance education reduce the wealth gap?

Yes, personal finance education has the potential to reduce the wealth gap by providing individuals with the knowledge and skills to make informed financial decisions and build wealth.

5. How can parents support personal finance education at home?

Parents can support personal finance education by discussing financial topics with their children, setting a good example with their own financial habits, and encouraging saving and responsible spending.

Conclusion

In conclusion, incorporating personal finance into high school syllabi is a crucial step towards ensuring the financial well-being of future generations. By equipping students with the necessary knowledge and skills, we empower them to make sound financial decisions, avoid common pitfalls, and build a secure financial future.

It is essential for educational institutions, policymakers, and parents to recognize the importance of personal finance education and work together to implement comprehensive and effective syllabi. Together, we can create a financially literate society that thrives economically and benefits individuals and communities alike.

Final Remarks

Financial education is a lifelong journey, and personal finance high school syllabi play a vital role in shaping the financial well-being of individuals. It is important to note that personal finance is a dynamic field, and syllabi should be regularly updated to reflect changes in the financial landscape.

While personal finance education in high schools is a step in the right direction, it is crucial for individuals to continue seeking knowledge and improving their financial literacy beyond their high school years. By doing so, we can navigate the complexities of personal finance and achieve financial freedom.