6.4 Budgeting in the Gig Economy

Gig economy refers to the labor market where temporary or freelance jobs are more prevalent than permanent positions. In recent years, gig work has become increasingly popular, providing individuals with greater flexibility and control over their work schedule. However, budgeting in the gig economy can be challenging due to the variable income and lack of job stability. In this article, we will explore the key aspects of budgeting in the gig economy, including its definition, advantages, disadvantages, and practical tips to effectively manage finances in this type of work arrangement.

Table of Contents:

Introduction

What is budgeting in the gig economy?

Who can benefit from budgeting in the gig economy?

When is budgeting in the gig economy necessary?

Where does budgeting in the gig economy apply?

Why is budgeting important in the gig economy?

How to budget effectively in the gig economy?

What are the advantages and disadvantages of budgeting in the gig economy?

Advantages and Disadvantages of Budgeting in the Gig Economy

Advantage 1: Flexibility

Advantage 2: Diversified Income

Advantage 3: Potential for Higher Earnings

Disadvantage 1: Inconsistent Income

Disadvantage 2: Lack of Benefits

FAQs

Image Source: cloudfront.net

FAQ 1: Is budgeting necessary if my income is irregular?

FAQ 2: How can I create a budget when my income varies from month to month?

FAQ 3: What are some useful budgeting tools for gig workers?

FAQ 4: How can I save for emergencies when I have an inconsistent income?

FAQ 5: Should I consider getting additional insurance coverage as a gig worker?

Conclusion

Final Remarks/Disclaimer

Introduction

What is budgeting in the gig economy? Budgeting in the gig economy refers to the process of managing and allocating financial resources for gig workers who rely on freelance or temporary work for their income. It involves creating a plan to effectively allocate earnings, expenses, and savings in order to maintain financial stability.

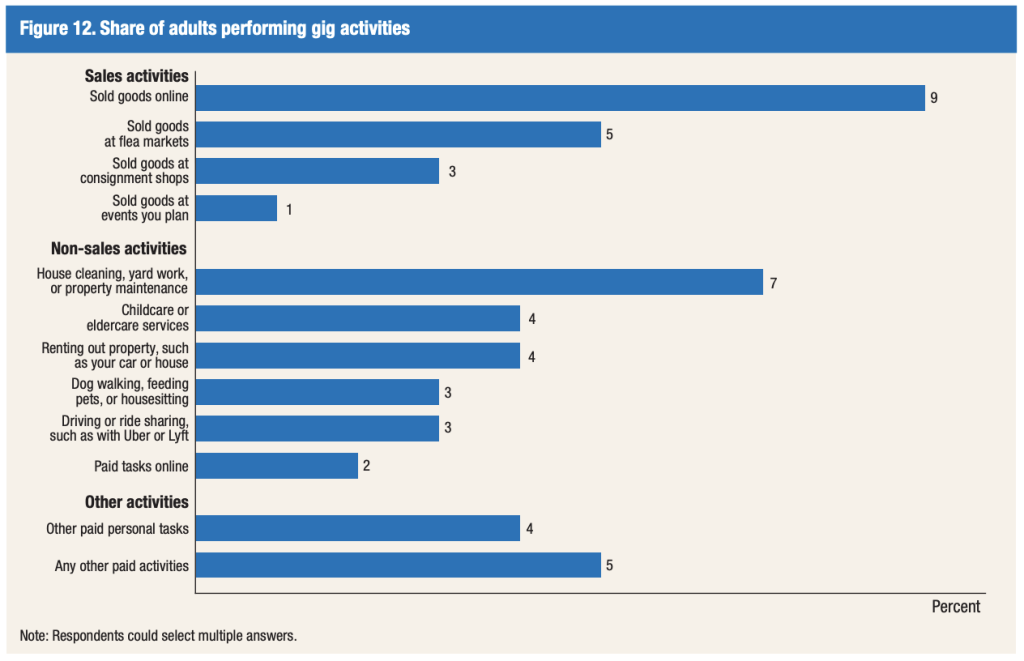

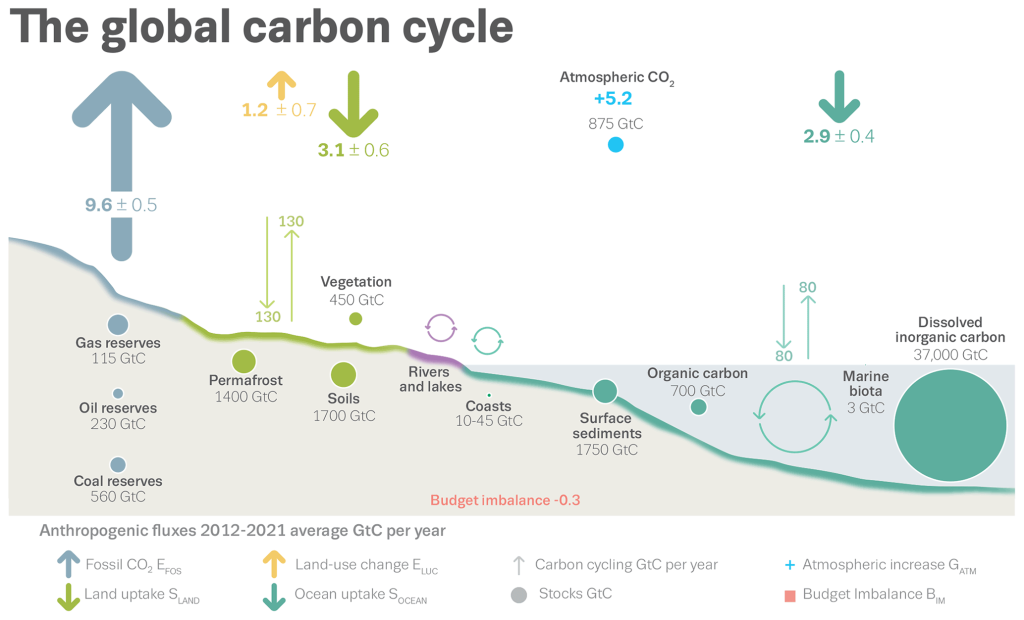

Image Source: copernicus.org

Who can benefit from budgeting in the gig economy? Budgeting is essential for anyone working in the gig economy, including freelancers, independent contractors, and part-time workers. It helps individuals to actively plan their finances and make informed decisions about their income, expenses, and savings.

When is budgeting in the gig economy necessary? Budgeting becomes necessary in the gig economy due to the variable nature of income and the lack of job stability. Without a budget, gig workers may struggle to cover their living expenses, save for the future, or handle unexpected financial emergencies.

Where does budgeting in the gig economy apply? Budgeting in the gig economy applies to various industries and sectors where gig work is prevalent, such as ride-sharing, online freelancing, delivery services, and short-term rentals. It is a relevant practice for gig workers worldwide.

Why is budgeting important in the gig economy? Budgeting is crucial in the gig economy as it allows individuals to gain control over their finances and make informed financial decisions. It helps gig workers to plan for irregular income, save for the future, and effectively manage their expenses.

How to budget effectively in the gig economy? Effective budgeting in the gig economy requires a proactive approach. Gig workers should track their income and expenses, set financial goals, prioritize savings, create a contingency fund, and seek professional financial advice if needed.

What are the advantages and disadvantages of budgeting in the gig economy? Budgeting in the gig economy has its benefits, such as providing financial control, promoting savings habits, and reducing financial stress. On the other hand, it can be challenging due to the unpredictable nature of income, lack of benefits, and potential difficulty in obtaining credit.