Zopa Personal Finance: Revolutionizing the Way You Manage Your Finances

Introduction

Hello Readers, welcome to our article on Zopa Personal Finance! In this digital age, managing our finances has become more important than ever. With the rise of technology, a new wave of financial services has emerged, providing individuals with innovative solutions to their financial needs. One such platform is Zopa Personal Finance, a game-changer in the industry. In this article, we will take a closer look at Zopa Personal Finance and explore how it can transform the way you handle your money.

What is Zopa Personal Finance?

📚 Zopa Personal Finance is an online lending platform that connects borrowers with investors, cutting out the middlemen like traditional banks. It offers a range of products, including loans and investments, making it a versatile platform for individuals looking for financial solutions. With Zopa Personal Finance, you can access funds for various purposes, whether it’s for debt consolidation, home improvements, or starting a new business.

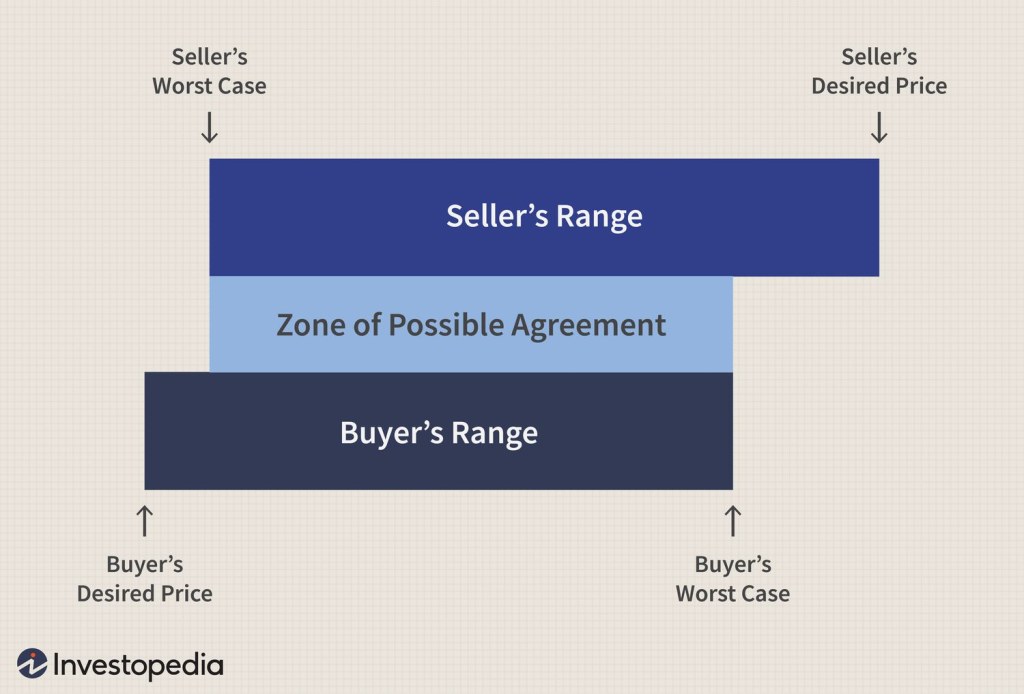

Image Source: investopedia.com

📚 Who can Benefit from Zopa Personal Finance?

📚 When Can You Use Zopa Personal Finance?

📚 Where is Zopa Personal Finance Available?

📚 Why Choose Zopa Personal Finance?

📚 How Does Zopa Personal Finance Work?

Advantages and Disadvantages of Zopa Personal Finance

👍 Advantages of Zopa Personal Finance

1. Flexibility: Zopa Personal Finance offers flexible loan terms, allowing borrowers to choose the repayment period that suits their needs.

2. Competitive Interest Rates: Zopa Personal Finance offers competitive interest rates, often lower than those offered by traditional financial institutions.

3. Transparent and Fair: Zopa Personal Finance prides itself on transparent and fair practices, ensuring borrowers and investors have access to all the necessary information.

4. Quick and Easy Application Process: Applying for a loan or investment with Zopa Personal Finance is straightforward and can be done online within minutes.

5. Excellent Customer Service: Zopa Personal Finance provides top-notch customer service, ensuring that any queries or concerns are addressed promptly.

👎 Disadvantages of Zopa Personal Finance

1. Limited Availability: Zopa Personal Finance is currently only available in select countries, limiting its accessibility to a global audience.

2. Risk of Default: As with any lending platform, there is a risk of borrowers defaulting on their loans, which can impact the returns for investors.

3. Potential for Higher Interest Rates: While Zopa Personal Finance generally offers competitive rates, some borrowers with lower credit scores may be subject to higher interest rates.

Frequently Asked Questions (FAQ)

1. Q: Is Zopa Personal Finance safe to use?

A: Yes, Zopa Personal Finance is regulated by the financial authorities in the countries where it operates, ensuring the safety and security of your funds.

2. Q: Can I repay my Zopa loan early?

A: Yes, you can repay your Zopa loan early without incurring any additional charges.

3. Q: How long does it take to get approved for a loan with Zopa Personal Finance?

A: The approval process for a loan with Zopa Personal Finance can take as little as 24 hours, depending on the completeness of your application.

4. Q: What is the minimum investment amount on Zopa Personal Finance?

A: The minimum investment amount on Zopa Personal Finance varies depending on the country of operation, but it is typically around £1,000.

5. Q: Can I trust the creditworthiness of the borrowers on Zopa Personal Finance?

A: Zopa Personal Finance conducts thorough credit assessments on all borrowers to ensure their creditworthiness and reduce the risk for investors.

Conclusion

In conclusion, Zopa Personal Finance offers an innovative and convenient way to manage your finances. Whether you are in need of a loan or looking to invest your money, Zopa Personal Finance provides a secure and transparent platform to meet your financial goals. With its competitive rates, flexible terms, and excellent customer service, Zopa Personal Finance is definitely worth considering. Take advantage of this revolutionary platform and take control of your financial future today.

Final Remarks

Disclaimer: The information provided in this article is for informational purposes only and should not be construed as financial advice. It is always recommended to consult with a qualified financial advisor before making any financial decisions.