Budgeting 500 a Month: How to Manage Your Finances Wisely

Introduction

Welcome, readers! Today, we will delve into the world of budgeting and discover the secrets of managing your finances effectively. In this article, we will focus on budgeting with a monthly limit of $500. By following the tips and strategies provided, you can make the most out of your limited budget and achieve financial stability. So, let’s dive in and learn how to budget $500 a month like a pro!

Before we begin, it is important to understand the significance of budgeting. Budgeting is the process of creating a plan for your money, ensuring that you allocate your funds wisely and reach your financial goals. It allows you to track your income and expenses, prioritize your spending, and save for the future. With a budget, you have better control over your finances and can avoid unnecessary debt and stress.

The Basics of Budgeting

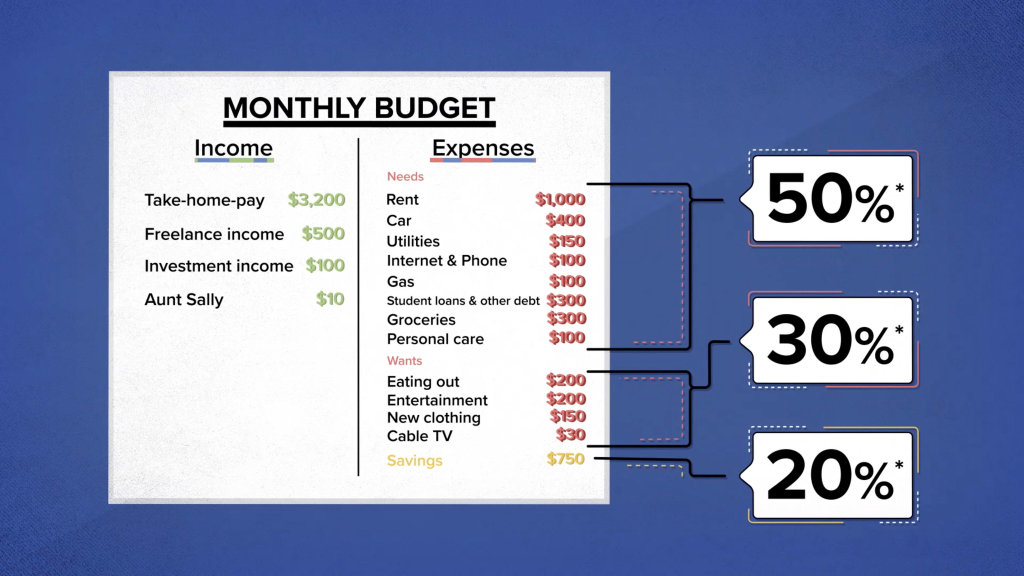

What is budgeting? Budgeting is the process of creating a financial plan to manage your income and expenses. It involves tracking your spending, setting financial goals, and making informed decisions about how you allocate your funds.

Image Source: cnbcfm.com

Who should budget? Budgeting is essential for everyone, regardless of their income level. It helps individuals and families make the most of their money, whether they have a small or large budget. By budgeting, you can have a clear understanding of your financial situation and make informed decisions to improve it.

When should you budget? It is never too late to start budgeting. Whether you are just starting your career or are already well-established, budgeting can benefit you at any stage of life. The earlier you start, the better, as it allows you to build good financial habits and secure your financial future.

Where to start budgeting? Budgeting can be done using various methods and tools. You can use spreadsheets, budgeting apps, or even pen and paper. Choose a method that suits your preferences and helps you stay organized and accountable for your spending.

Why is budgeting important? Budgeting is crucial because it provides you with financial clarity and control. It helps you track your income and expenses, avoid overspending, and save for future goals. By budgeting, you can make informed financial decisions and achieve financial stability.

How to budget $500 a month? Budgeting with a limited income requires careful planning and prioritization. By following the steps below, you can effectively manage your $500 monthly budget:

1. Determine Your Income and Fixed Expenses

Image Source: pinimg.com

Start by calculating your monthly income, which includes your salary, freelance earnings, or any other regular source of income. Next, identify your fixed expenses, such as rent, utilities, and loan payments. Subtract these fixed expenses from your income to determine the amount available for discretionary spending.

2. Prioritize Your Needs

With a limited budget, it is crucial to prioritize your needs over wants. Focus on essential expenses like groceries, transportation, and healthcare before allocating funds for discretionary spending. Cut back on non-essential expenses to make room for savings.

3. Set Realistic Goals

While budgeting $500 a month, it is important to set realistic financial goals. Whether it’s saving for emergencies, paying off debt, or investing in your future, establish achievable targets that align with your income. Divide your goals into short-term and long-term objectives to stay motivated.

4. Track Your Spending

Monitor your spending regularly to ensure you stay within your budget. Use budgeting apps or spreadsheets to track your expenses, categorize them, and make adjustments if necessary. Being aware of your spending habits will help you identify areas where you can save and make adjustments accordingly.

5. Look for Ways to Save

With a limited budget, finding ways to save becomes even more critical. Look for opportunities to reduce your expenses, such as cooking at home instead of eating out, using public transportation, or finding affordable alternatives for entertainment. Every small saving can add up over time.

6. Build an Emergency Fund

Having an emergency fund is essential for financial security. Allocate a portion of your budget to build an emergency fund, which can help you navigate unexpected expenses without falling into debt. Aim to save at least three to six months’ worth of living expenses.

7. Seek Professional Advice

If you find it challenging to manage your $500 monthly budget or have specific financial goals, consider seeking professional advice. Financial advisors can provide personalized guidance and help you create a budgeting plan that suits your unique circumstances.

Advantages and Disadvantages of Budgeting $500 a Month

Like any financial strategy, budgeting $500 a month has its pros and cons. Let’s take a closer look at the advantages and disadvantages:

Advantages:

1. Financial Discipline: Budgeting with a limited income cultivates good financial habits and discipline, helping you make the most of your money.

2. Debt Prevention: By budgeting, you can avoid accumulating unnecessary debt and stay on top of your financial obligations.

3. Savings Opportunities: Budgeting encourages you to prioritize saving, even with a modest income. Every dollar saved brings you closer to achieving your financial goals.

4. Better Financial Awareness: With a budget, you gain a deeper understanding of your spending habits, enabling you to make informed financial decisions.

5. Reduced Stress: Knowing that you have a plan in place and are in control of your finances can significantly reduce financial stress and anxiety.

Disadvantages:

1. Restricted Spending: Budgeting $500 a month means you have limited funds for discretionary spending, which may require sacrifices and adjustments.

2. Limited Flexibility: A strict budget may leave little room for unexpected expenses or spontaneous purchases.

3. Unrealistic Expectations: It is crucial to set realistic expectations when budgeting with a limited income. It may take longer to achieve certain financial goals, but patience and perseverance are key.

4. Potential for Frustration: Sticking to a budget requires discipline and may lead to frustration if you struggle to stay within your allocated funds.

5. External Factors: Economic fluctuations and unforeseen circumstances can impact your budgeting plans, making it necessary to adapt and adjust accordingly.

Frequently Asked Questions (FAQ)

1. Can I save money while budgeting with $500 a month?

Yes, it is possible to save money even with a limited budget by prioritizing your needs, cutting back on non-essential expenses, and finding ways to save on everyday items.

2. How can I handle unexpected expenses within my budget?

Building an emergency fund is crucial to handle unexpected expenses. Allocate a portion of your budget towards savings to prepare for such situations.

3. Is it necessary to track every cent while budgeting?

While tracking every cent can provide a detailed overview of your spending habits, it may not be necessary for everyone. Focus on tracking major expenses and ensuring you stay within your overall budget.

4. What if my income fluctuates each month?

If your income fluctuates, focus on creating a budget based on your average monthly income. Consider saving any excess income during months when you earn more to compensate for leaner months.

5. How long does it take to see the benefits of budgeting?

The benefits of budgeting can be seen in the short term, as it helps you gain control over your finances and reduce unnecessary spending. However, achieving long-term financial goals may take time and require patience and consistency.

Conclusion

To conclude, budgeting $500 a month is an effective way to manage your finances wisely. By following the tips outlined in this article, you can make the most of your limited budget and achieve financial stability. Remember, budgeting is a continuous process that requires discipline and adaptation. Start today and take control of your financial future!

Final Remarks

Friends, managing your finances is a crucial aspect of leading a stress-free and secure life. While budgeting $500 a month may present its challenges, it is essential to prioritize your needs, save diligently, and make informed financial decisions. Remember, everyone’s financial journey is unique, so tailor your budgeting strategies to align with your goals and circumstances. Seek professional advice when needed, and always stay committed to your financial well-being. Good luck on your budgeting journey!