Budgeting 50 Rule: A Practical Guide to Managing Your Finances

Greetings, Readers! In today’s article, we will delve into the Budgeting 50 Rule and explore how it can help you effectively manage your finances. Budgeting is a crucial aspect of financial planning, and the 50 Rule provides a simple yet effective method to allocate your income wisely. By following this rule, you can gain control over your expenses, save for the future, and achieve your financial goals. So, let’s dive in and discover the benefits of implementing the Budgeting 50 Rule in your life.

Introduction

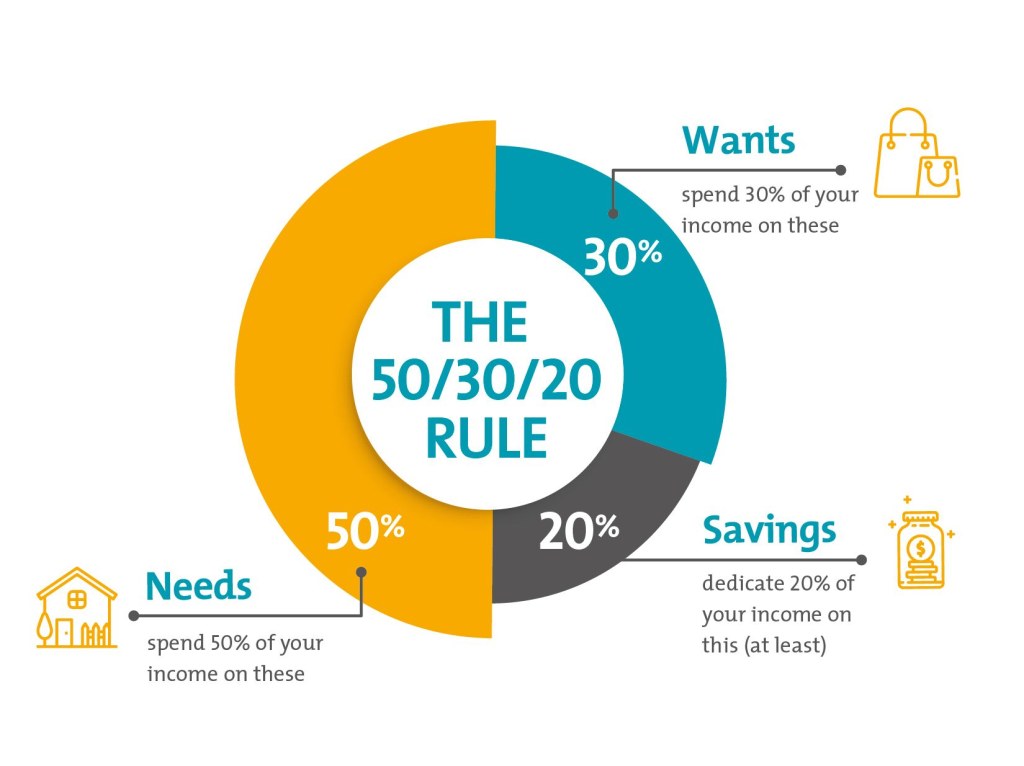

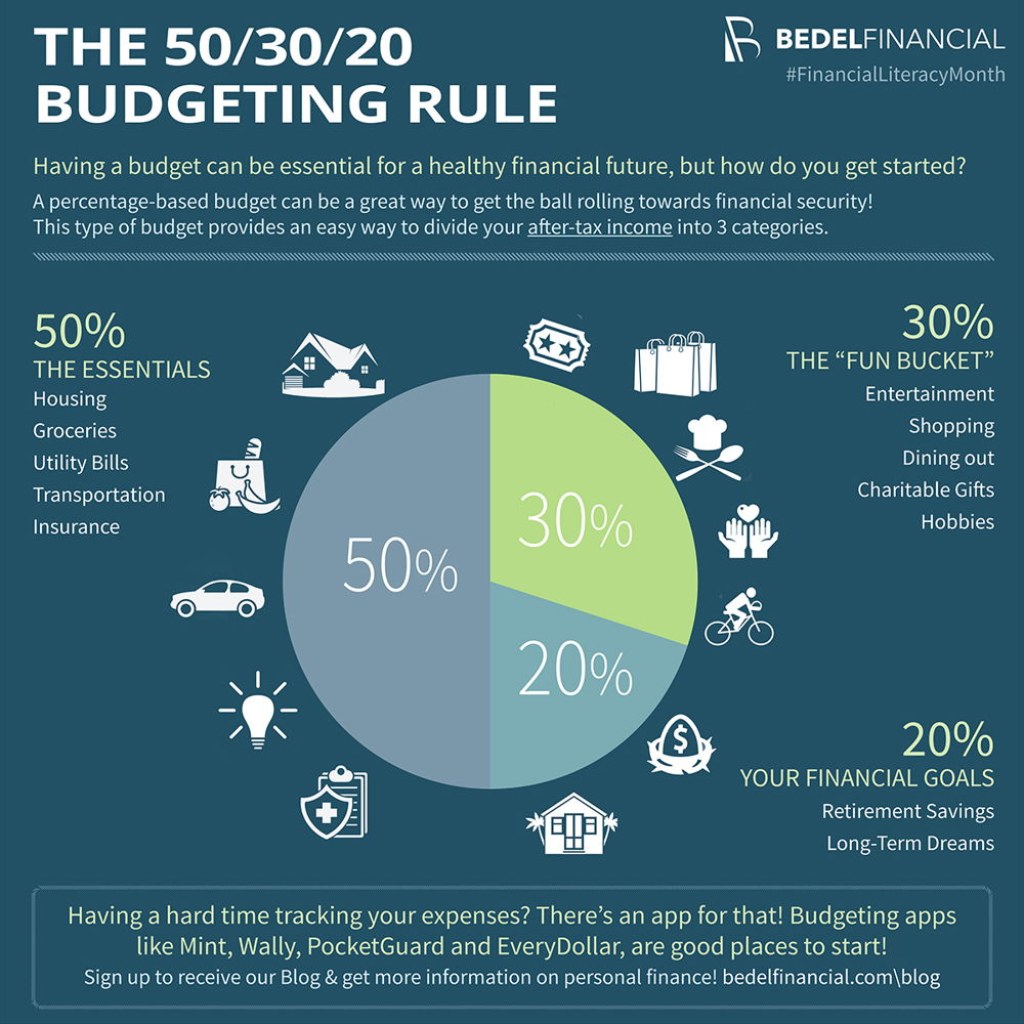

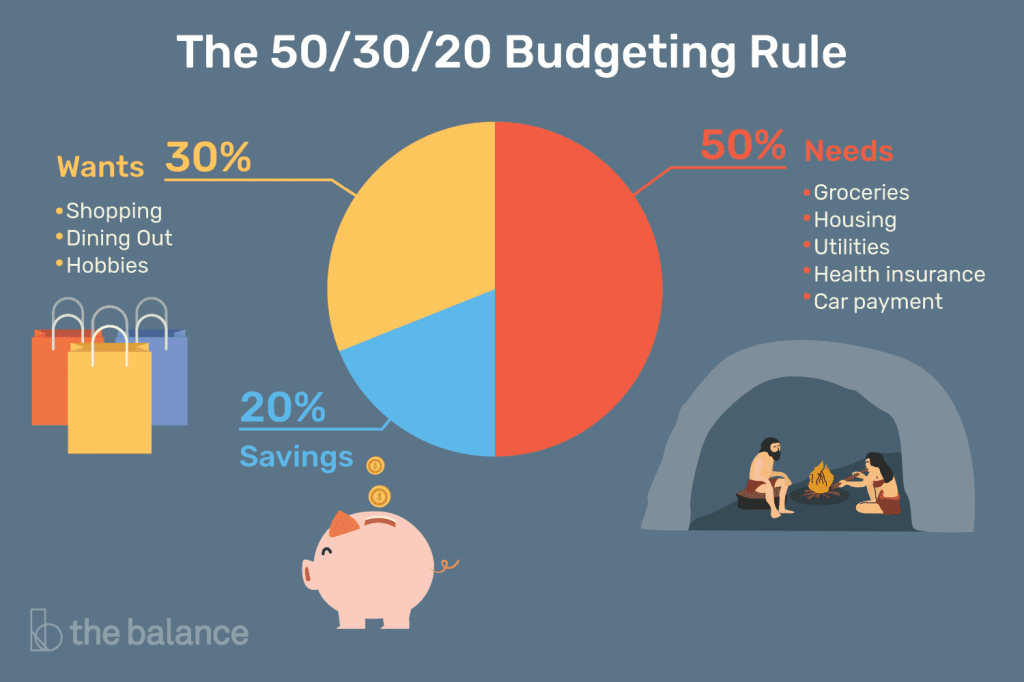

Understanding the Budgeting 50 Rule is essential for anyone seeking financial stability. This rule suggests allocating 50% of your income towards essential expenses, 30% towards discretionary spending, and the remaining 20% towards savings and debt repayment. By following this rule, you can strike a balance between enjoying your hard-earned money and securing your financial future.

The Budgeting 50 Rule not only helps you manage your day-to-day expenses but also enables you to plan for long-term goals such as buying a house, starting a business, or retiring comfortably. Let’s take a closer look at the various aspects of this rule and how it can benefit you.

What is the Budgeting 50 Rule?

🔍 The Budgeting 50 Rule is a financial guideline that suggests allocating a specific percentage of your income towards essential expenses, discretionary spending, savings, and debt repayment. This rule provides a structured approach to managing your finances, ensuring that you prioritize and allocate your money effectively.

🔍 Essential expenses refer to the fundamental costs you incur to maintain a decent standard of living, such as rent or mortgage payments, utilities, groceries, transportation, and healthcare. This category should ideally account for 50% of your income according to the Budgeting 50 Rule.

Image Source: nitrocdn.com

🔍 Discretionary spending includes non-essential expenses such as dining out, entertainment, travel, and shopping. This category should be limited to 30% of your income, allowing you to enjoy your money without compromising your financial stability.

🔍 The remaining 20% of your income should be allocated towards savings and debt repayment. This portion will help you build an emergency fund, save for retirement, pay off debts, and invest in your future.

Who Can Benefit from the Budgeting 50 Rule?

🔍 The Budgeting 50 Rule is beneficial for individuals of all income levels. Whether you are a fresh graduate starting your career or an experienced professional, this rule provides a practical framework to manage your finances responsibly.

🔍 If you find yourself living paycheck to paycheck or struggling to save, the Budgeting 50 Rule can help you regain control over your financial situation. By allocating your income wisely, you can break the cycle of living beyond your means and start building a strong financial foundation.

🔍 Moreover, the Budgeting 50 Rule is particularly useful for those with irregular income, such as freelancers or entrepreneurs. By planning and budgeting based on percentages rather than fixed amounts, you can adapt to fluctuating income streams and still maintain financial stability.

When Should You Implement the Budgeting 50 Rule?

Image Source: zephyrcms.com

🔍 The Budgeting 50 Rule can be implemented at any stage of your financial journey. Whether you are just starting to earn an income or have been working for years, this rule can help you organize your finances and achieve your financial goals.

🔍 If you have never followed a budget before, now is the perfect time to start. The Budgeting 50 Rule provides a simple and effective framework to guide your financial decisions and ensure that you are using your money wisely.

🔍 Similarly, if you have been struggling to save or find yourself overspending, implementing the Budgeting 50 Rule can help you regain control over your finances. By consciously allocating your income towards essential expenses, discretionary spending, and savings, you can break free from the cycle of financial stress.

Where Can You Apply the Budgeting 50 Rule?

🔍 The Budgeting 50 Rule can be applied to various aspects of your financial life. Whether you are managing your personal finances or running a business, this rule provides a versatile framework to allocate your income effectively.

🔍 On a personal level, you can apply this rule to manage your monthly budget, track your expenses, and plan for future financial milestones. By setting aside 50% for essential expenses, 30% for discretionary spending, and 20% for savings and debt repayment, you can ensure that your income is utilized efficiently.

Image Source: thebalancemoney.com

🔍 For business owners, the Budgeting 50 Rule can be used to determine the allocation of profits. By setting aside a portion of the income for essential expenses, reinvesting in the business, and saving for expansion or emergencies, you can maintain financial stability and set your business up for long-term success.

Why Is the Budgeting 50 Rule Effective?

🔍 The Budgeting 50 Rule is effective due to its simplicity and flexibility. By providing clear percentages for each category, this rule eliminates the guesswork and ensures that you prioritize your financial commitments.

🔍 The allocation of 50% towards essential expenses allows you to cover your basic needs while keeping your lifestyle in check. This ensures that you have a solid foundation without overspending.

🔍 The 30% allocation for discretionary spending provides room for enjoyment and leisure, allowing you to indulge in non-essential expenses guilt-free. This category promotes a healthy balance between saving and enjoying your hard-earned money.

🔍 Lastly, the 20% allocation for savings and debt repayment helps you build a safety net, pay off debts, and invest in your future. This category ensures that you are actively working towards your long-term financial goals and preparing for unexpected expenses.

How to Implement the Budgeting 50 Rule?

🔍 Implementing the Budgeting 50 Rule requires careful planning and tracking of your expenses. Here are some steps to help you get started:

1. Calculate your monthly income: Determine your total monthly income from all sources.

2. Identify essential expenses: Make a list of your necessary expenses, such as rent, utilities, transportation, groceries, and healthcare.

3. Allocate 50% to essential expenses: Calculate 50% of your monthly income and allocate it towards essential expenses.

4. Determine discretionary spending: Identify non-essential expenses, such as dining out, entertainment, and shopping.

5. Allocate 30% to discretionary spending: Calculate 30% of your monthly income and allocate it towards discretionary spending.

6. Plan for savings and debt repayment: Set aside 20% of your monthly income for savings, debt repayment, and investments.

7. Regularly track and adjust: Monitor your expenses and make adjustments as needed to ensure you stay within the allocated percentages.

Advantages and Disadvantages of the Budgeting 50 Rule

Advantages:

👍 Simplicity: The Budgeting 50 Rule provides a straightforward framework that is easy to understand and implement.

👍 Flexibility: The rule allows for adjustments based on individual circumstances and financial goals.

👍 Financial stability: By prioritizing essential expenses and savings, the rule promotes a balanced approach to money management.

👍 Long-term planning: The allocation for savings ensures that you are actively working towards your future financial goals.

👍 Debt repayment: The rule encourages allocating a portion of your income towards paying off debts, helping you become financially free.

Disadvantages:

👎 Rigidity: The strict allocation percentages may not suit everyone’s financial situation or priorities.

👎 Lifestyle adjustments: Adhering to the rule may require making changes to your spending habits and lifestyle.

👎 Income fluctuations: The rule may be challenging to implement for individuals with irregular or fluctuating incomes.

👎 Lack of personalization: The rule does not account for individual financial goals or circumstances.

👎 Discipline required: Adhering to the rule requires discipline and consistent monitoring of expenses.

Frequently Asked Questions (FAQs)

1. Can I allocate more than 50% towards essential expenses?

Yes, the 50% allocation is a guideline, and you can modify it based on your individual needs and circumstances. However, it is crucial to strike a balance and ensure that you have enough left for savings and discretionary spending.

2. What if my income is not enough to cover all categories?

If your income is insufficient to cover all categories adequately, you may need to reevaluate your expenses and consider ways to increase your income or reduce your spending. Prioritize essential expenses and savings to ensure financial stability.

3. Should I include debt repayment in the savings category?

While debt repayment can be considered a form of saving, it is advisable to separate the two. Allocating a portion of your income specifically towards debt repayment ensures that you are actively working towards becoming debt-free.

4. Can I adjust the allocation percentages as my financial situation changes?

Absolutely! The allocation percentages can be adjusted based on your evolving financial goals and circumstances. Regularly reassess and make necessary changes to ensure your budget aligns with your current needs.

5. Is it possible to save more than 20% of my income?

Yes, saving more than 20% is commendable and can accelerate your progress towards financial goals. The percentages provided by the Budgeting 50 Rule are a starting point, and you can increase your savings based on your income and future aspirations.

Conclusion

In conclusion, the Budgeting 50 Rule is a practical and effective method to manage your finances. By allocating your income towards essential expenses, discretionary spending, savings, and debt repayment, you can achieve a balance between present enjoyment and future financial security.

Remember, implementing this rule requires discipline and consistent monitoring of expenses. Regularly review your budget, make adjustments as needed, and stay committed to your financial goals.

Start implementing the Budgeting 50 Rule today and take control of your financial future. Your financial well-being is in your hands!

Final Remarks

Disclaimer: The Budgeting 50 Rule is a general guideline and may not be suitable for everyone’s financial situation. It is essential to assess your individual needs, goals, and circumstances when managing your finances. Consult with a financial advisor or expert for personalized advice.

Friends, we hope this article has provided you with valuable insights into the Budgeting 50 Rule. Take charge of your finances, make informed decisions, and pave the way for a financially secure future.