3 Budgeting Techniques

Introduction

Hello Readers,

Welcome to this article where we will discuss three effective budgeting techniques that can help you manage your finances better. Budgeting is an essential skill that everyone should develop to achieve their financial goals and secure their future. By implementing these techniques, you can gain control over your expenses, save money, and plan for a brighter financial future. So let’s dive into the details and explore these three budgeting techniques.

What is Budgeting?

Before we delve into the techniques, let’s first understand what budgeting is. Budgeting is the process of creating a plan to manage your income and expenses effectively. It involves tracking your income sources and allocating funds to various categories such as housing, transportation, groceries, savings, and more. With a well-planned budget, you can prioritize your spending, avoid unnecessary debt, and achieve your financial goals.

Who Can Benefit from Budgeting?

Anyone and everyone can benefit from budgeting, regardless of their income level or financial situation. Whether you are a student, a working professional, a business owner, or a retiree, budgeting can help you gain control over your finances and make informed financial decisions. It is never too early or too late to start budgeting, so why not take the first step towards financial freedom?

When Should You Start Budgeting?

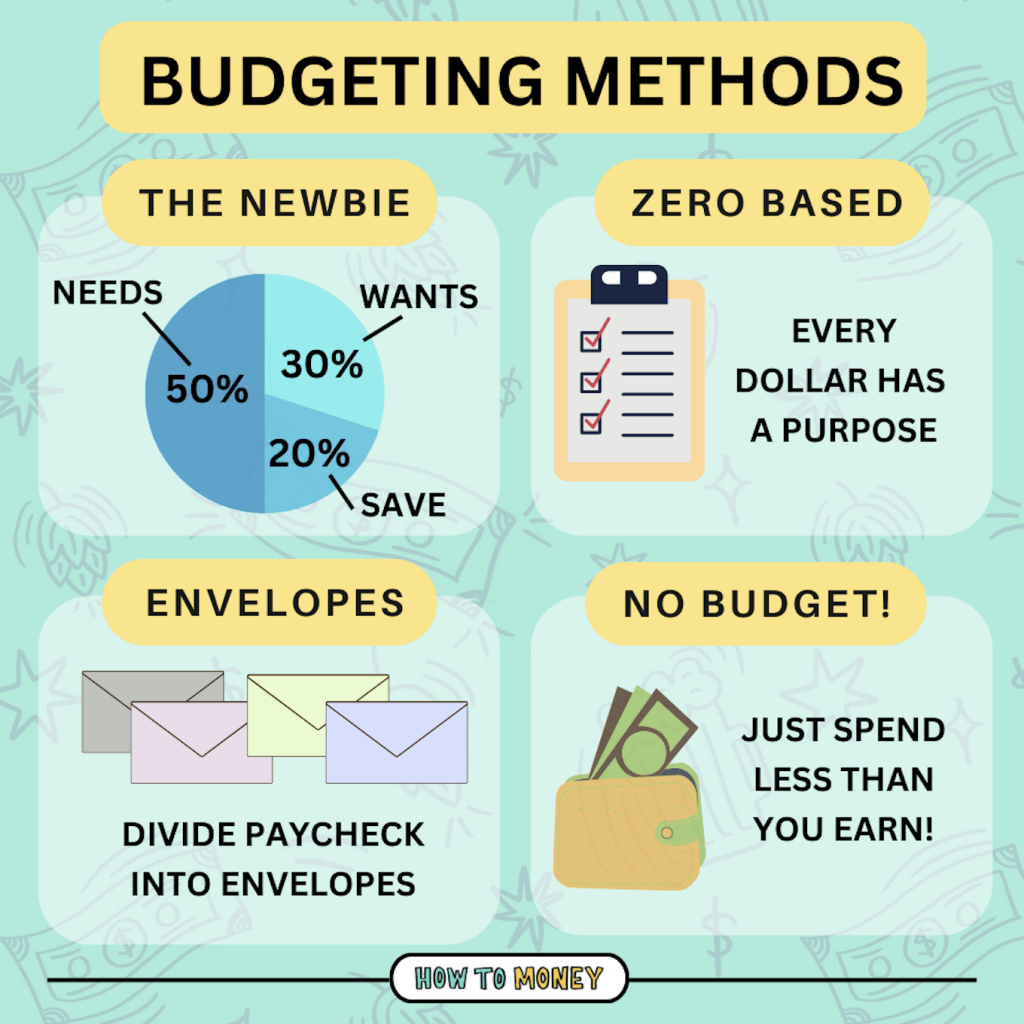

Image Source: howtomoney.com

The best time to start budgeting is now! It doesn’t matter if you are just starting your career or nearing retirement. The sooner you start budgeting, the better control you will have over your finances. Budgeting allows you to track your spending, identify areas where you can cut back, and allocate funds towards savings and investments. So don’t wait for the perfect time – start budgeting today!

Where Can You Implement Budgeting Techniques?

You can implement budgeting techniques in various aspects of your life, including personal finances, household expenses, business finances, and even event planning. Regardless of the specific area, the principles of budgeting remain the same – allocating funds wisely and tracking your income and expenses. So whether it’s managing your personal expenses or planning a big event, budgeting techniques can be applied anywhere.

Why Should You Budget?

There are several compelling reasons why you should consider budgeting:

1️⃣ Financial Control: Budgeting gives you control over your money and helps you make conscious spending decisions. It prevents impulsive purchases and ensures that your expenses align with your financial goals.

2️⃣ Savings: Budgeting allows you to allocate funds towards savings and investments. By setting aside money for emergencies and future goals, you can build a strong financial foundation.

3️⃣ Debt Management: With a budget in place, you can identify areas where you are overspending and make necessary adjustments. This can help you avoid unnecessary debt and pay off existing debts more efficiently.

4️⃣ Financial Goals: Budgeting helps you set and achieve financial goals. Whether it’s buying a house, starting a business, or retiring comfortably, a budget can provide a roadmap to reach these milestones.

How Can You Implement Budgeting Techniques?

Implementing budgeting techniques is relatively simple, and here’s how you can get started:

1️⃣ Create a Budget: Start by tracking your income and expenses to get a clear picture of your financial situation. Then, allocate funds to different categories, such as housing, transportation, groceries, entertainment, savings, and debt repayment.

2️⃣ Track Your Spending: Monitor your expenses regularly to ensure that you are sticking to your budget. Use budgeting apps or spreadsheets to make it easier to track your spending and identify any areas where you are overspending.

3️⃣ Adjust as Needed: Life is dynamic, and so should be your budget. Review your budget periodically and make adjustments based on changes in your income, expenses, or financial goals. Be flexible and adapt your budget to suit your evolving needs.

Advantages and Disadvantages of Budgeting Techniques

Like any financial strategy, budgeting techniques have their pros and cons. Let’s explore them in detail:

1️⃣ Advantages:

– Enhanced Financial Control: Budgeting allows you to have a clear overview of your finances, giving you better control over your money.

– Improved Saving Habits: By setting aside a portion of your income for savings, you can develop good saving habits and build an emergency fund.

– Debt Reduction: Budgeting helps you identify areas where you can cut back on expenses, allowing you to pay off your debts faster.

– Goal Achievement: With a budget, you can allocate funds towards specific financial goals and work towards achieving them.

– Stress Reduction: Having a budget in place can reduce financial stress and provide peace of mind knowing that your money is being managed effectively.

2️⃣ Disadvantages:

– Restrictive: Budgeting may require you to limit your spending in certain areas, which could be challenging for some individuals.

– Time-Consuming: Creating and maintaining a budget requires time and effort, especially when you have multiple income sources or complex financial situations.

– Unexpected Expenses: While budgeting helps you plan for expected expenses, it may be more challenging to handle unexpected expenses that may arise.

FAQs (Frequently Asked Questions)

1. Can budgeting help me save money?

Yes, budgeting can definitely help you save money. By tracking your expenses and allocating funds towards savings, you can build a financial cushion and achieve your savings goals.

2. Is budgeting only for people with limited income?

No, budgeting is beneficial for everyone, regardless of their income level. It helps you make intentional financial decisions and manage your money effectively, regardless of how much you earn.

3. How often should I review my budget?

It is recommended to review your budget regularly, ideally on a monthly basis. This allows you to track your progress, make necessary adjustments, and ensure that your budget aligns with your financial goals.

4. Can I modify my budget if my financial situation changes?

Absolutely! Your budget should be flexible and adaptable to accommodate any changes in your income, expenses, or financial goals. Review and modify your budget as needed to stay on track.

5. What if I overspend in a specific category?

If you find yourself overspending in a particular category, you can make adjustments in other areas to compensate for it. Look for areas where you can cut back temporarily and reallocate funds to cover the overspending.

Conclusion

In conclusion, budgeting is a powerful tool that can help you achieve financial stability and reach your goals. By implementing the three budgeting techniques discussed in this article, you can gain better control over your finances, save money, and make informed financial decisions. Remember, budgeting is not a one-time task but a continuous process that requires regular monitoring and adjustments. So take charge of your financial future today and start budgeting!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only. It is not intended as financial advice. Please consult a professional financial advisor before making any financial decisions.