Personal Finance Software New Zealand: A Comprehensive Guide

Introduction

Hello Readers,

Welcome to our comprehensive guide on personal finance software in New Zealand. In this article, we will explore the ins and outs of personal finance software and how it can help you manage your finances effectively. Whether you are an individual, a small business owner, or a corporate executive, personal finance software can be a valuable tool in achieving your financial goals.

So, let’s dive into the world of personal finance software and discover the benefits it offers.

What is Personal Finance Software?

Personal finance software is a digital tool designed to assist individuals and businesses in managing their financial activities. It provides features such as budgeting, expense tracking, investment management, bill payment reminders, and financial goal setting. With the help of personal finance software, users can gain better control over their finances, make informed decisions, and achieve their financial objectives.

Who Can Benefit from Personal Finance Software?

Personal finance software is beneficial for a wide range of individuals and organizations. Whether you are an individual looking to manage your personal finances or a business owner seeking to streamline your financial operations, personal finance software can be a game-changer. It is suitable for:

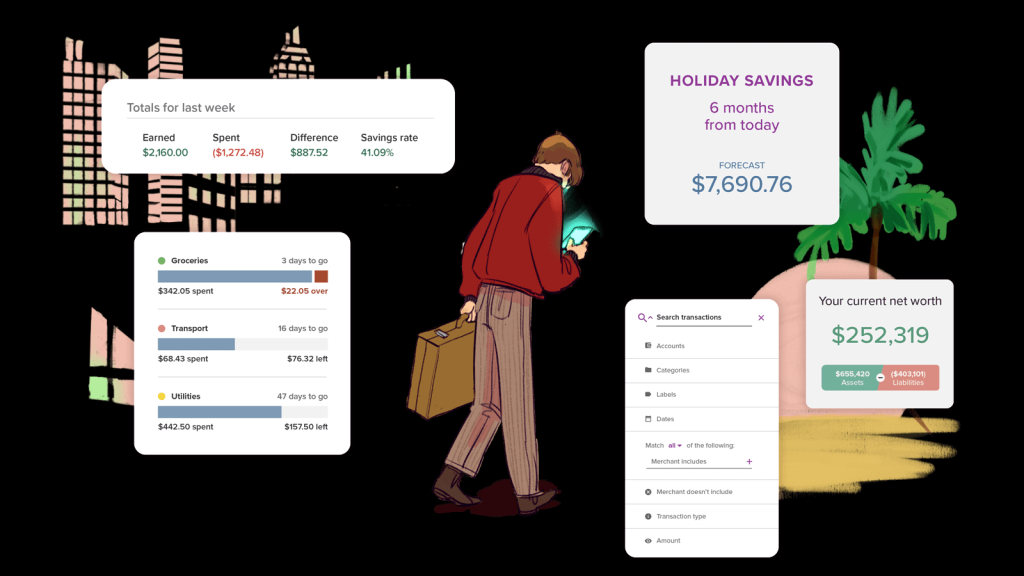

Image Source: pocketsmith.com

Individuals

Small business owners

Freelancers and self-employed professionals

Corporate executives

Non-profit organizations

Regardless of your financial situation, personal finance software can provide valuable insights and tools to optimize your financial management.

When Should You Consider Using Personal Finance Software?

If you find yourself struggling to keep track of your expenses, create and stick to a budget, or achieve your financial goals, it may be time to consider using personal finance software. The software can help you:

Manage your income and expenses efficiently

Track your spending patterns

Create and monitor budgets

Set and track financial goals

Generate financial reports

By using personal finance software, you can gain a clear understanding of your financial situation and take proactive steps towards financial stability.

Where to Find Personal Finance Software in New Zealand?

Personal finance software is widely available in New Zealand, both through online platforms and offline retailers. Some popular options include:

MoneyWorks

Xero

MYOB

QuickBooks

Banktivity

These software solutions offer various features and pricing plans, so you can choose the one that best fits your needs and budget.

Why Should You Use Personal Finance Software?

Personal finance software offers numerous benefits that can significantly improve your financial management. Here are some reasons why you should consider using personal finance software:

1. Easy Expense Tracking

Personal finance software simplifies expense tracking by automatically categorizing your transactions and providing detailed reports. This makes it easier to identify areas where you can cut back on spending and save more.

2. Efficient Budgeting

With personal finance software, creating and sticking to a budget becomes effortless. The software enables you to set spending limits, track your progress, and receive alerts when you exceed your budget.

3. Financial Goal Setting

Whether you want to save for a vacation, pay off debt, or invest in a property, personal finance software helps you set and track your financial goals. It provides insights into your progress and motivates you to stay on track.

4. Streamlined Bill Payments

Personal finance software allows you to automate bill payments, ensuring you never miss a payment deadline again. This saves you time, eliminates late payment fees, and improves your credit score.

5. Investment Management

For individuals interested in investments, personal finance software offers tools to track and manage your investment portfolio. It provides real-time updates, performance analysis, and helps you make informed investment decisions.

6. Financial Reports and Insights

Personal finance software generates detailed financial reports, giving you a comprehensive overview of your financial health. These reports help you identify trends, analyze your spending habits, and make data-driven financial decisions.

Advantages and Disadvantages of Personal Finance Software

As with any financial tool, personal finance software comes with advantages and disadvantages. Let’s explore both sides:

Advantages:

1. Enhanced Financial Control

Personal finance software empowers users with a better understanding of their finances, leading to improved control over their financial situation.

2. Time Savings

Automated expense tracking, bill payments, and budgeting save users significant time and effort.

3. Improved Decision-Making

With accurate and up-to-date financial information at their fingertips, users can make informed decisions about their money.

4. Goal Achievement

Personal finance software helps users set and track their financial goals, increasing the likelihood of achieving them.

5. Financial Security

By keeping track of expenses and ensuring bills are paid on time, personal finance software helps users maintain financial stability and avoid penalties.

Disadvantages:

1. Learning Curve

Some personal finance software can have a steep learning curve, requiring time and effort to master.

2. Cost

While some personal finance software options are free, others require a subscription or one-time purchase, which may not be within everyone’s budget.

3. Security Risks

Storing personal financial information in software applications carries security risks, so users must prioritize data protection.

4. Dependence on Technology

Personal finance software relies on technology, so any technical issues or crashes could disrupt your financial management.

5. Overwhelming Features

Some personal finance software may have an array of features that can be overwhelming to navigate for users who only require basic functionality.

Frequently Asked Questions (FAQs)

1. Is personal finance software suitable for all income levels?

Yes, personal finance software can be used by individuals of all income levels. It helps with budgeting, expense tracking, and financial goal setting, regardless of your income.

2. Can personal finance software be accessed from multiple devices?

Many personal finance software solutions offer cross-device compatibility, allowing users to access their financial information from smartphones, tablets, and computers.

3. How secure is personal finance software?

Personal finance software takes data security seriously. Look for software with secure encryption and regularly updated security patches to ensure your information is protected. Additionally, follow best practices such as using strong, unique passwords.

4. Can personal finance software help with tax preparation?

Some personal finance software integrates tax preparation features, making it easier to organize your financial information and generate reports for tax purposes.

5. Is it necessary to have financial expertise to use personal finance software?

No, personal finance software is designed to be user-friendly and accessible to individuals without financial expertise. However, some advanced features may require a basic understanding of financial concepts.

Conclusion

In conclusion, personal finance software is a valuable tool for individuals and businesses in New Zealand looking to take control of their finances. With features like expense tracking, budgeting, and goal setting, personal finance software empowers users to make informed financial decisions and achieve their financial objectives. While it has its advantages and disadvantages, the benefits outweigh the drawbacks for most users.

We encourage you to explore the various personal finance software options available in New Zealand and find the one that suits your needs. Take charge of your finances today and pave the way for a financially secure future.

Final Remarks

Friends, managing your personal finances effectively is crucial for your financial well-being. While personal finance software can be a game-changer, it’s important to remember that it’s just a tool. Ultimately, your financial success relies on your discipline, commitment, and wise decision-making.

Before choosing personal finance software, thoroughly research the options available and consider your specific needs. Keep in mind that personal finance software should complement your financial goals and provide a seamless user experience.

Happy financial management!