6.2 Budgeting Strategies

Introduction

Dear Readers,

Welcome to this informative article on 6.2 budgeting strategies. In today’s fast-paced world, it is crucial to manage our finances effectively. Budgeting is an essential skill that helps individuals and businesses alike to plan their expenses, save money, and achieve their financial goals. In this article, we will explore six budgeting strategies that can assist you in maximizing your financial resources and making sound financial decisions. So, let’s dive in and discover these effective budgeting strategies together!

What are 6.2 Budgeting Strategies?

Image Source: opengroup.org

🔍 Before we delve into the details, let’s understand what 6.2 budgeting strategies are. These strategies refer to a set of approaches and techniques that individuals and organizations use to organize and manage their finances effectively. Each strategy focuses on specific aspects of budgeting, such as income allocation, expense tracking, savings planning, and debt management. By implementing these strategies, you can gain better control over your financial situation and make informed financial decisions.

1. The Envelope System

📥 The Envelope System is a budgeting strategy that involves dividing your income into different categories and allocating specific amounts to each category. Each category is represented by an envelope, and you place the designated cash amount in each envelope. This strategy helps you stay within your budget and prevents overspending, as you can only spend the amount available in each envelope.

2. Zero-Based Budgeting

📋 Zero-Based Budgeting is a budgeting strategy that requires you to allocate every dollar of your income to a specific purpose. With this approach, you start with zero dollars and assign each dollar to categories such as rent, groceries, savings, etc. This strategy helps you track your expenses closely and ensures that your income is fully utilized towards your financial goals.

3. 50/30/20 Rule

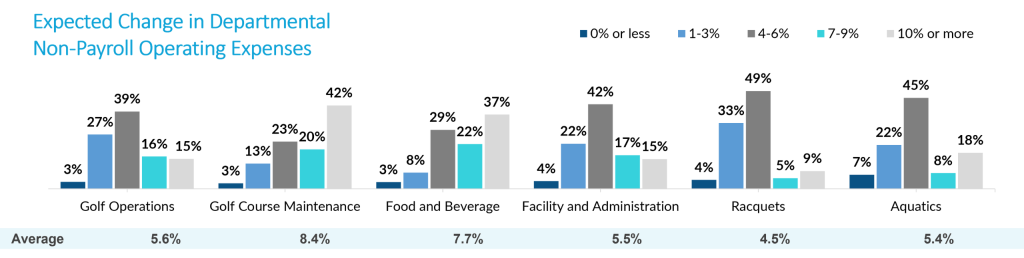

Image Source: ggapartners.com

🔢 The 50/30/20 Rule is a budgeting strategy that suggests allocating your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt repayment. This strategy provides a balanced approach to budgeting, allowing you to meet your essential expenses, indulge in discretionary spending, and save for the future.

4. Pay Yourself First

💰 Pay Yourself First is a budgeting strategy that prioritizes saving a portion of your income before allocating it to other expenses. With this strategy, you set aside a predetermined amount or percentage of your income for savings or investments. By paying yourself first, you ensure that you prioritize your financial well-being and build a solid foundation for the future.

5. The 30-Day Rule

⏳ The 30-Day Rule is a budgeting strategy that helps you control impulsive spending and focus on your needs rather than wants. According to this rule, before making a non-essential purchase, you wait for 30 days. During this waiting period, you can evaluate whether the purchase is necessary and aligns with your financial goals. This strategy helps prevent impulse buying and promotes mindful spending.

6. The Cash-Only Method

💵 The Cash-Only Method is a budgeting strategy that involves using only cash for all your expenses. With this approach, you withdraw a specific amount of cash for each spending category and limit your spending to the available cash. This strategy helps you visualize your spending and stay accountable as you physically see the money leaving your hands.

Advantages and Disadvantages of 6.2 Budgeting Strategies

✅ Let’s now explore the advantages and disadvantages of implementing these 6.2 budgeting strategies:

Advantages:

Improved Money Management: These strategies help you gain better control over your finances and manage your money effectively.

Financial Goal Achievement: By following these strategies, you can allocate your resources towards your financial goals and work towards achieving them.

Reduced Debt: Budgeting strategies enable you to allocate funds for debt repayment, helping you reduce your debt burden over time.

Savings Growth: With a well-defined budget, you can allocate a specific portion of your income towards savings, allowing your savings to grow steadily.

Increased Financial Awareness: These strategies promote financial awareness, helping you understand your spending patterns and make informed financial decisions.

Disadvantages:

Initial Adjustment Period: Implementing a new budgeting strategy may require some time to adjust and adapt to the new system.

Strict Discipline: Successful budgeting requires discipline and the ability to stick to your budget, which may be challenging for some individuals.

Unexpected Expenses: Despite careful planning, unexpected expenses may arise, requiring flexibility in your budget and adjustments to your strategy.

Limited Flexibility: Some budgeting strategies may limit your flexibility in spending, as you need to stick to predefined allocations and categories.

Time and Effort: Effective budgeting requires regular tracking of expenses and ongoing commitment, which may require time and effort.

Frequently Asked Questions (FAQs)

1. Can budgeting strategies help me save money?

🤔 Yes, budgeting strategies can help you save money by allocating a specific portion of your income towards savings and optimizing your spending.

2. How do I choose the right budgeting strategy?

🤔 The right budgeting strategy depends on your financial goals, spending habits, and personal preferences. It is essential to assess each strategy’s pros and cons and choose one that aligns with your needs.

3. Are budgeting strategies only for individuals?

🤔 No, budgeting strategies are beneficial for both individuals and businesses. They help organizations manage their finances and make informed financial decisions.

4. Can budgeting strategies help me get out of debt?

🤔 Yes, budgeting strategies can assist you in managing debt by allocating funds for debt repayment and helping you control your expenses.

5. How long does it take to see results with budgeting strategies?

🤔 The time to see results with budgeting strategies varies for each individual. With consistent implementation and discipline, you can observe positive changes in your financial situation over time.

Conclusion

📝 In conclusion, implementing effective budgeting strategies is crucial for managing your finances and achieving your financial goals. By incorporating the 6.2 budgeting strategies mentioned in this article, you can gain better control over your money, reduce debt, save for the future, and make informed financial decisions. Remember, budgeting is a continuous process that requires commitment and discipline, but the long-term benefits are well worth the effort. Start implementing these strategies today, and take charge of your financial well-being!

Final Remarks

📍 The information provided in this article is for educational purposes only and should not be considered as financial advice. It is essential to consult with a financial professional or advisor before making any significant financial decisions. The authors and publishers are not liable for any damages or losses arising from the use of this information. Budgeting is a personal process, and it is crucial to tailor any strategy to your unique financial situation and goals. Stay informed, stay empowered, and make the best choices for your financial future.