Budgeting 101 Template: A Comprehensive Guide to Managing Your Finances

Greetings, Readers! Today, we will delve into the world of budgeting and explore the benefits of utilizing a budgeting 101 template to effectively manage your finances. With this template, you will gain a clear understanding of your income, expenses, and savings, enabling you to make informed financial decisions. So, let’s dive in and discover the power of budgeting!

Introduction

1. What is Budgeting?

In its simplest form, budgeting is the process of creating a plan for your money. It involves setting goals, tracking your income and expenses, and making adjustments to ensure you are spending within your means.

2. Why is Budgeting Important?

Image Source: budgethelden.de

Budgeting is crucial for several reasons. It helps you understand where your money is going, enables you to prioritize your spending, and allows you to save for future goals. A budget also provides financial security and peace of mind.

3. Who Can Benefit from Budgeting?

Everyone can benefit from budgeting, regardless of their income level. Whether you are a student, a young professional, or a seasoned adult, budgeting can help you achieve financial stability and reach your financial goals.

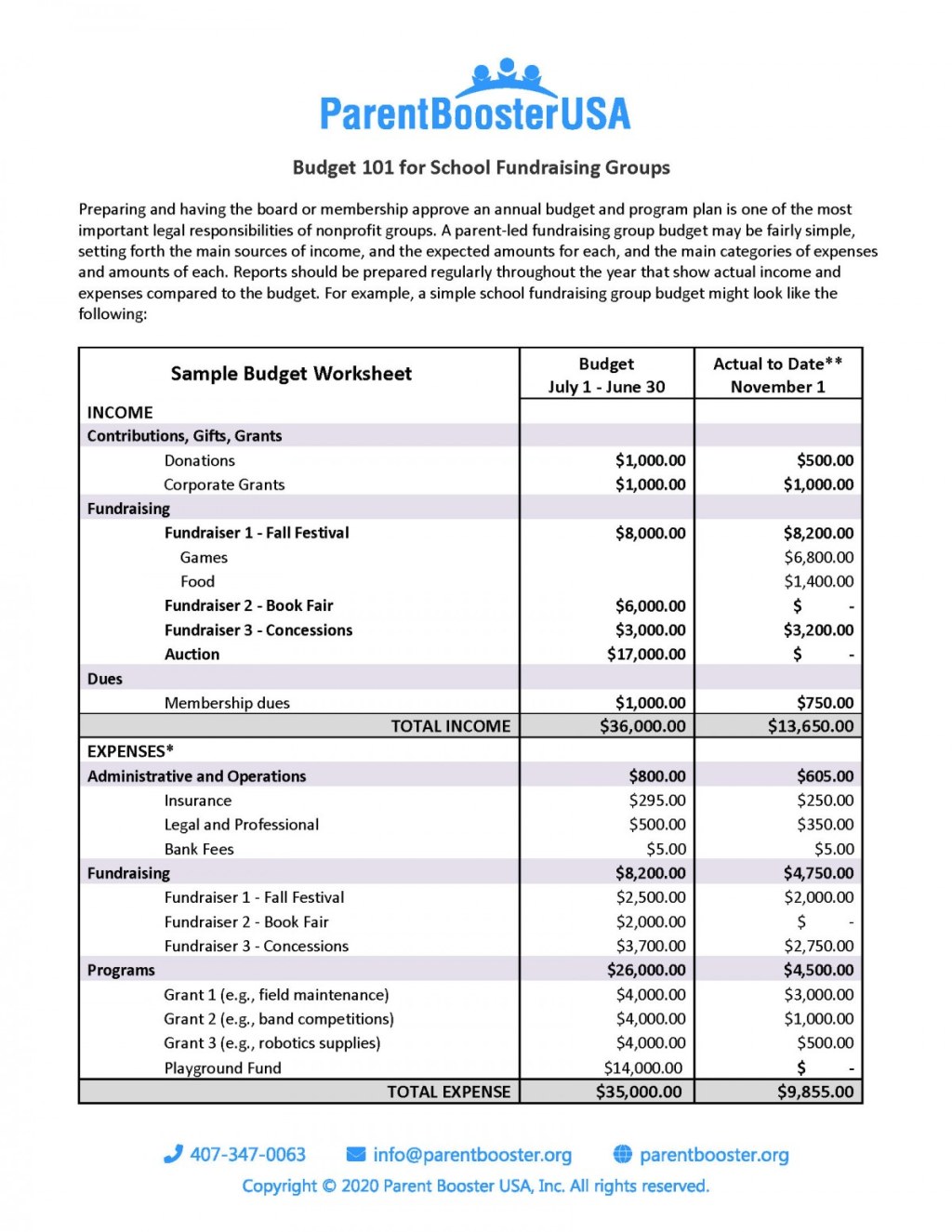

Image Source: parentbooster.org

4. When Should You Start Budgeting?

The ideal time to start budgeting is now! It’s never too early or too late to take control of your finances and start making informed financial decisions. The sooner you start budgeting, the sooner you can begin building a solid financial foundation.

5. Where Can You Find Budgeting 101 Templates?

You can find budgeting 101 templates on various financial websites, personal finance apps, or you can create your own using spreadsheet software or budgeting apps. These templates provide a structured format to help you effectively manage your finances.

6. How Does Budgeting Work?

Budgeting involves several steps. First, you need to determine your income sources and track your expenses. Then, you allocate your income towards different categories such as housing, transportation, food, and savings. Finally, you monitor your spending and make adjustments to stay on track with your financial goals.

7. What Are the Benefits of Using a Budgeting 101 Template?

Using a budgeting 101 template simplifies the budgeting process. It provides a framework to track your income, expenses, and savings, making it easier to identify areas where you can reduce spending or increase savings. With a template, you can visualize your financial situation and make informed decisions to achieve your financial goals.

Advantages and Disadvantages of Budgeting 101 Template

1. Advantages of Budgeting 101 Template

✅ Enhanced Financial Awareness: By using a budgeting template, you gain a clear understanding of your financial situation, enabling you to make informed decisions.

✅ Improved Financial Planning: A budgeting template helps you plan and allocate your income towards various expenses and savings goals, ensuring you stay on track.

✅ Increased Savings Potential: With a budgeting template, you can identify areas where you can reduce unnecessary expenses and increase your savings, ultimately helping you achieve your financial goals faster.

2. Disadvantages of Budgeting 101 Template

❌ Initial Time Investment: Setting up and maintaining a budgeting template requires some initial time investment. However, the long-term benefits outweigh the initial effort.

❌ Need for Regular Updates: To ensure the accuracy of your budget, you need to update it regularly with your income, expenses, and savings. This might require some discipline and commitment.

❌ Limited Flexibility: While budgeting templates provide a structured approach, they might not cater to everyone’s unique financial situations. You might need to customize the template to accommodate your specific needs.

Frequently Asked Questions About Budgeting 101 Template

1. Is budgeting only for people with a fixed income?

No, budgeting is beneficial for individuals with both fixed and variable incomes. It helps you prioritize your spending and allocate your income effectively.

2. Can I use budgeting templates on my smartphone?

Absolutely! Many personal finance apps offer budgeting templates that you can access and update conveniently on your smartphone.

3. How often should I review my budget?

It is recommended to review your budget monthly to ensure it aligns with your financial goals and to make any necessary adjustments.

4. What if I overspend in a particular category?

If you overspend in a specific category, you can either adjust your budget to accommodate the extra expense or reduce spending in another category to balance it out.

5. Can a budgeting template help me save for long-term goals?

Yes, a budgeting template is an excellent tool for saving towards long-term goals. It allows you to allocate a portion of your income specifically for savings, ensuring you make progress towards your goals.

Conclusion

In conclusion, implementing a budgeting 101 template can have a profound impact on your financial well-being. It allows you to understand your income, expenses, and savings better, empowering you to make informed financial decisions. By utilizing a budgeting template, you can achieve your financial goals, build financial security, and pave the way for a brighter financial future.

Take action now and start using a budgeting 101 template to take control of your finances. Your future self will thank you!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only. Consult a financial advisor or professional before making any financial decisions or implementing a budget. Results may vary based on individual circumstances.