5 Budgeting Strategies

Introduction

Hello Readers, budgeting is a crucial aspect of personal finance management. It helps individuals and families allocate their income wisely, save for future goals, and reduce financial stress. In this article, we will explore five effective budgeting strategies that can help you achieve your financial goals and improve your overall financial well-being.

What is a Budget?

A budget is a financial plan that outlines your income and expenses. It helps you track your spending, identify areas where you can cut back, and allocate funds towards savings and investments. Creating and following a budget is essential for achieving financial stability and reaching your financial goals.

Who Should Budget?

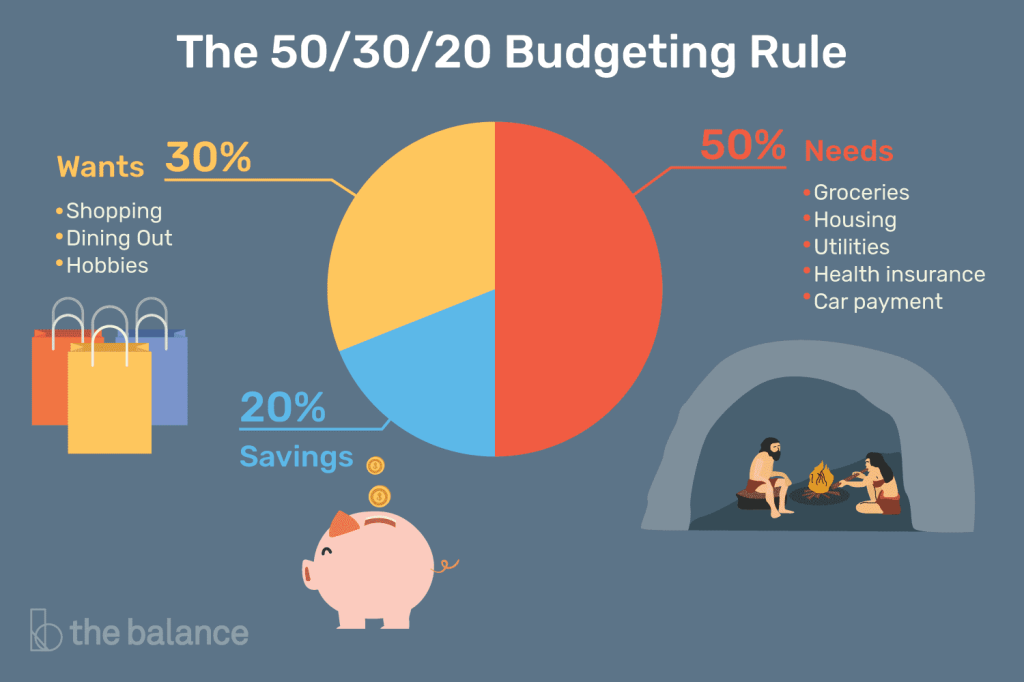

Image Source: thebalancemoney.com

Everyone can benefit from budgeting, regardless of their income level or financial situation. Whether you are a high-earner or living paycheck to paycheck, budgeting can help you make informed financial decisions, reduce debt, and build savings. It is a valuable tool for individuals, families, and even businesses.

When Should You Start Budgeting?

The sooner you start budgeting, the better. It is never too early or too late to take control of your finances. Whether you are just starting your career, planning for retirement, or facing financial difficulties, creating a budget can provide clarity and help you make better financial choices.

Where to Begin?

Creating a budget starts with understanding your income and expenses. Start by tracking your expenses for a few months to get an idea of where your money is going. Identify areas where you can reduce spending and set realistic savings goals. Utilize budgeting tools or apps to organize your finances and stay on track.

Why is Budgeting Important?

Image Source: thebalancemoney.com

Budgeting is important for several reasons. It allows you to prioritize your financial goals, save money for emergencies, and avoid unnecessary debt. It also helps you make informed spending decisions, avoid impulsive purchases, and maintain a healthy financial life. Budgeting provides financial security and empowers you to achieve your dreams.

How to Budget Effectively?

Effective budgeting requires discipline and consistency. Start by setting clear financial goals and create a realistic budget that aligns with your objectives. Track your expenses regularly, identify areas where you can cut back, and allocate funds towards your savings and investments. Review your budget periodically and make necessary adjustments to stay on track.

Advantages and Disadvantages of Budgeting

Image Source: charcap.com

Advantages:

Allows you to track and control your spending.

Helps you save money for future goals.

Enables you to prioritize your financial needs.

Reduces financial stress and improves financial well-being.

Provides a clear overview of your financial situation.

Disadvantages:

Requires discipline and commitment to follow the budget consistently.

May restrict your freedom to spend on certain items.

Can be time-consuming to track expenses and maintain the budget.

May require adjustments and revisions as circumstances change.

Can be challenging to stick to the budget during unexpected expenses or emergencies.

FAQs (Frequently Asked Questions)

1. How often should I review my budget?

It is recommended to review your budget at least once a month. This allows you to assess your progress, make necessary adjustments, and ensure that your budget is still aligned with your financial goals and priorities.

2. Should I include savings in my budget?

Absolutely! Savings should be a part of your budget. Allocate a specific percentage of your income towards savings to ensure that you are building an emergency fund and working towards your long-term financial goals.

3. What if I have irregular income?

If you have irregular income, budgeting can be a bit more challenging. Start by estimating your average monthly income based on the past few months and create a budget that aligns with that estimation. Set aside a portion of your income for irregular expenses or fluctuations in income.

4. How can I stick to my budget?

To stick to your budget, it is important to stay disciplined and motivated. Regularly track your expenses, avoid impulsive purchases, and find ways to stay accountable, such as using budgeting apps or involving a trusted friend or family member in your financial journey.

5. Can budgeting help me pay off debt?

Yes, budgeting can be a powerful tool for paying off debt. Allocate a portion of your income towards debt repayment and create a debt payoff plan. By prioritizing debt repayment and reducing unnecessary expenses, you can accelerate your journey towards becoming debt-free.

Conclusion

In conclusion, budgeting is an essential aspect of personal finance management. By implementing effective budgeting strategies, you can take control of your finances, reduce debt, and achieve your financial goals. Remember to review and adjust your budget regularly to ensure that it remains aligned with your changing circumstances and priorities. Start budgeting today and pave the way for a financially secure future.

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as financial advice. Each individual’s financial situation is unique, and it is recommended to consult with a financial advisor or professional before making any financial decisions. Remember to do thorough research and consider your own circumstances before implementing any budgeting strategies mentioned in this article.