6 Budgeting Apps

Introduction

Dear Readers,

Welcome to this informative article about 6 budgeting apps that can help you manage your finances effectively. In today’s fast-paced world, keeping track of your expenses and sticking to a budget can be challenging. However, with the help of these budgeting apps, you can simplify the process and gain better control over your money.

In this article, we will explore six popular budgeting apps, their features, advantages, and disadvantages. Whether you are a student, professional, or someone who wants to improve their financial management skills, these apps can assist you in achieving your goals.

1. What are Budgeting Apps?

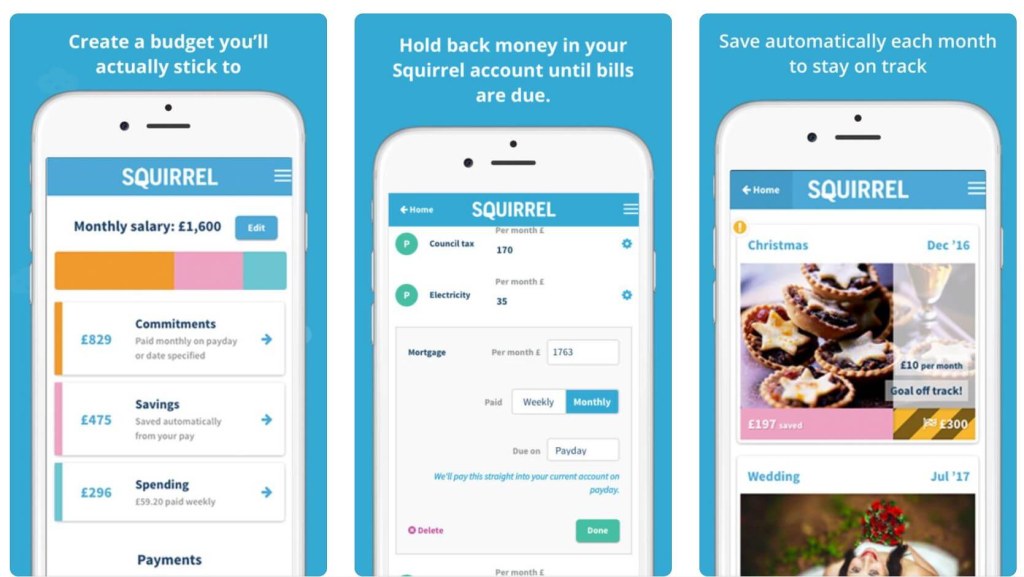

Budgeting apps are mobile applications designed to help individuals track, plan, and manage their finances. These apps offer various features such as expense tracking, bill reminders, budget creation, savings goals, and financial reports. With the convenience of smartphones, budgeting apps have become essential tools for individuals looking to improve their money management habits.

How do Budgeting Apps Work?

Budgeting apps work by allowing users to input their financial information, such as income and expenses. Based on this data, the app creates a personalized budgeting plan, highlighting areas where users can cut back on spending and save money. The app also provides real-time updates on their financial status, helping users stay on track with their financial goals.

Why Use Budgeting Apps?

Image Source: unitestudents.com

Budgeting apps offer numerous benefits for individuals seeking to improve their financial well-being. These apps provide a clear overview of their financial situation, facilitate better budgeting decisions, and help them save money. By tracking expenses and setting savings goals, users can better understand their spending habits and make necessary adjustments for a more secure financial future.

Who Can Benefit from Budgeting Apps?

Whether you are a student, young professional, or someone with a family, budgeting apps can benefit anyone who wants to gain control over their finances. These apps are particularly useful for individuals with irregular income, as they can help manage fluctuating expenses and ensure savings. Additionally, budgeting apps can also be beneficial for individuals looking to save money for specific goals, such as a vacation or purchasing a home.

When to Use Budgeting Apps?

The best time to start using budgeting apps is now! Regardless of your financial situation, it is never too early or too late to take control of your finances. The sooner you start tracking your expenses and creating a budget, the sooner you can identify areas for improvement and start saving towards your financial goals.

Where to Find Budgeting Apps?

There are numerous budgeting apps available for both Android and iOS devices. You can find these apps on various app stores, such as Google Play Store and Apple App Store. Some popular budgeting apps include Mint, Personal Capital, YNAB (You Need a Budget), PocketGuard, Goodbudget, and Wally.

How to Choose the Right Budgeting App?

Choosing the right budgeting app depends on your individual preferences and needs. Consider factors such as the app’s features, user interface, compatibility with your device, and user reviews. It is also a good idea to try out different apps and see which one suits you best before committing to a specific app.

2. Advantages and Disadvantages of Budgeting Apps

Like any tool, budgeting apps have their pros and cons. Let’s explore the advantages and disadvantages of using budgeting apps:

Advantages

1. Convenience: Budgeting apps provide the convenience of managing your finances on the go, anytime, anywhere.

2. Expense Tracking: These apps offer automatic expense tracking, eliminating the need for manual data entry.

3. Budget Creation: Budgeting apps help users create personalized budgets based on their financial goals and spending habits.

4. Savings Goals: These apps allow users to set savings goals and provide reminders to stay on track.

5. Financial Reports: Budgeting apps generate detailed financial reports, providing insights into spending patterns and areas for improvement.

Disadvantages

1. Learning Curve: Some budgeting apps may have a learning curve, requiring time and effort to understand and navigate.

2. Data Security: Users need to ensure the app they choose has robust security measures in place to protect their financial information.

3. Reliance on Technology: Budgeting apps rely on technology, so technical issues or app failures may hinder their functionality.

4. Paid Features: Certain budgeting apps offer additional features at a cost, which may not be suitable for users on a tight budget.

5. User Engagement: Budgeting apps require consistent user engagement for optimal results. Without regular input and monitoring, the apps may lose their effectiveness.

3. Frequently Asked Questions (FAQ)

1. Are budgeting apps safe to use?

Yes, most budgeting apps prioritize user data security. However, it is essential to choose reputable apps and follow recommended security practices, such as using strong passwords and enabling two-factor authentication.

2. Can budgeting apps help me save money?

Yes, budgeting apps can help you save money by providing insights into your spending habits and suggesting areas where you can cut back on expenses. They also allow you to set savings goals and track your progress.

3. Can I use budgeting apps for business expenses?

While some budgeting apps are designed for personal use, there are also apps available specifically for business expense tracking and budgeting. These apps offer features tailored to the needs of entrepreneurs and small business owners.

4. Can budgeting apps sync with my bank accounts?

Many budgeting apps offer the option to sync with your bank accounts, credit cards, and other financial institutions. This feature allows for automatic expense tracking and provides a comprehensive overview of your financial transactions.

5. Do budgeting apps require an internet connection?

Most budgeting apps require an internet connection to sync your financial data and provide real-time updates. However, some apps may offer limited offline functionality for times when internet access is not available.

4. Conclusion

In conclusion, budgeting apps are valuable tools for anyone looking to improve their financial management skills. By utilizing these apps, individuals can track their expenses, create personalized budgets, and work towards their savings goals. While budgeting apps offer numerous advantages, it is important to consider their limitations and choose the app that best fits your needs. Start using a budgeting app today and take control of your finances for a brighter financial future.

5. Final Remarks

Dear Readers,

We hope this article has provided you with valuable insights into the world of budgeting apps. While these apps can be highly beneficial, it is important to remember that they are tools to assist you in managing your finances. Ultimately, your financial success depends on your commitment, discipline, and understanding of your own financial situation. Use budgeting apps wisely and make informed decisions to achieve your financial goals.

Best regards,

Your friends at Budgeting Apps