Budgeting $1500 per Month: Managing Your Finances with Ease

Introduction

Welcome, Readers! Managing your finances effectively is crucial for a stable and stress-free life. In this article, we will discuss budgeting $1500 per month, offering you valuable insights and tips to optimize your financial planning. By following these guidelines, you can achieve your financial goals and secure a brighter future.

Before diving into the details, let’s understand the importance of budgeting and how it can positively impact your life. Budgeting allows you to take control of your spending, save for emergencies, and achieve long-term financial stability. With a monthly budget of $1500, you can effectively allocate your income to various expenses while still being able to save for the future.

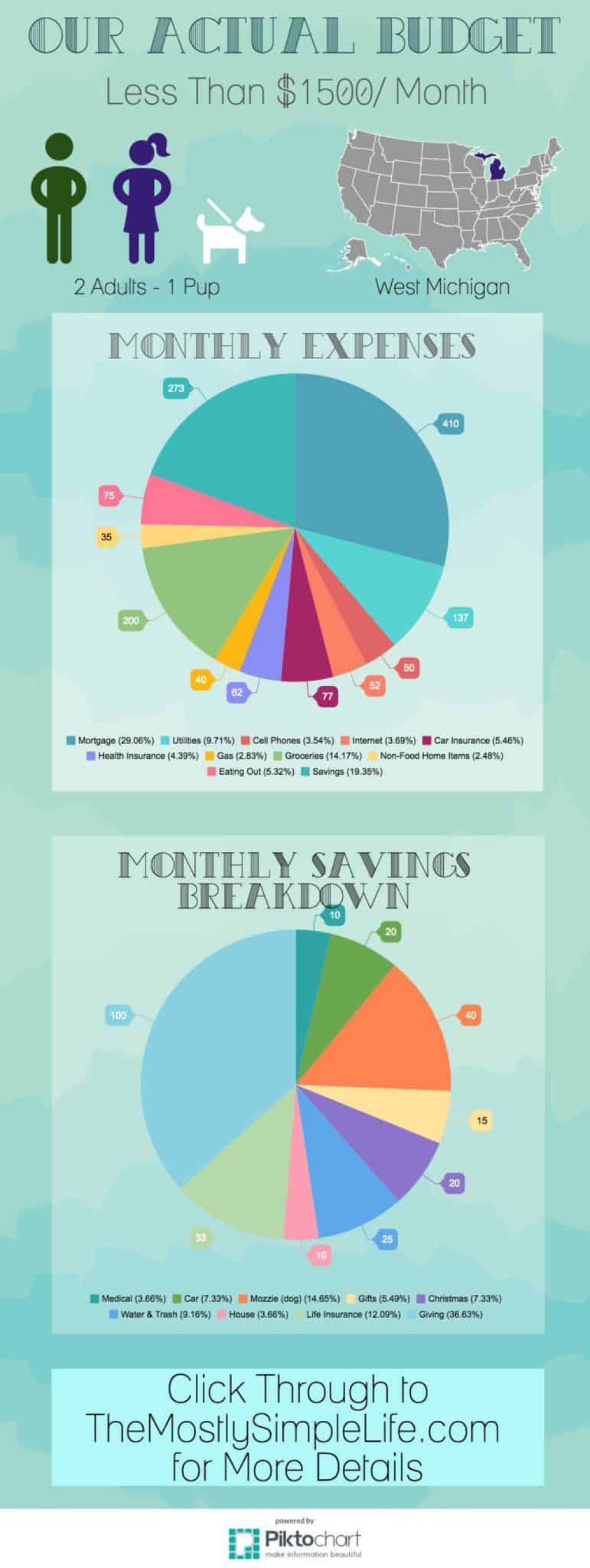

Image Source: themostlysimplelife.com

Now, let’s explore the key aspects of budgeting $1500 per month and understand how it can bring you financial peace of mind.

Table: Budgeting $1500 per Month

Expense Category

Allocation Amount

Housing

$600

Transportation

$200

Groceries

$250

Utilities

$100

Debt Payments

$150

Entertainment

$100

Savings

$100

Miscellaneous

$100

What is Budgeting $1500 per Month?

🔹 Budgeting $1500 per month refers to the practice of managing your finances by allocating a specific amount of money to different expenses, savings, and debt payments with the purpose of living within your means.

🔹 This budgeting approach allows you to prioritize your financial goals and make informed decisions about your spending habits.

🔹 With a monthly budget of $1500, you can cover essential expenses, save for the future, and enjoy a modest lifestyle.

🔹 It requires discipline, tracking your expenses, and making adjustments as necessary to ensure your financial stability.

🔹 Budgeting $1500 per month is suitable for individuals with moderate income or those who are looking to save money while meeting their essential needs.

🔹 By implementing this budgeting strategy, you can gain control over your finances and work towards achieving your financial goals.

Who Can Benefit from Budgeting $1500 per Month?

🔹 Budgeting $1500 per month is beneficial for individuals or families with a moderate income looking to effectively manage their finances.

🔹 It can be particularly useful for young adults starting their careers, recent graduates, or individuals in the early stages of building their financial stability.

🔹 People facing financial challenges or trying to overcome debt can also benefit from budgeting $1500 per month as it allows them to allocate their income effectively and work towards becoming debt-free.

🔹 Those who prioritize saving for the future and want to build an emergency fund or invest in long-term goals can also benefit from this budgeting approach.

🔹 Budgeting $1500 per month can be easily customized to suit different lifestyles and priorities, making it a versatile financial management technique.

When Should You Start Budgeting $1500 per Month?

🔹 It is never too early or too late to start budgeting $1500 per month. Developing good financial habits early on can set you on the path to long-term financial success.

🔹 If you find yourself struggling to manage your expenses or lacking a clear financial plan, it is a sign that you should start budgeting $1500 per month.

🔹 Life events such as starting a new job, getting married, or having children can also serve as triggers to begin budgeting and ensure you can meet your financial responsibilities.

🔹 The sooner you start budgeting $1500 per month, the quicker you can regain control over your finances and work towards your financial goals.

🔹 Remember, budgeting is an ongoing process, and you may need to make adjustments along the way as your financial situation evolves.

Where Can You Implement Budgeting $1500 per Month?

🔹 You can implement budgeting $1500 per month regardless of where you live or your financial circumstances.

🔹 Whether you reside in a metropolitan city or a small town, budgeting $1500 per month allows you to tailor your expenses to your income and meet your financial obligations.

🔹 It can be implemented in various living arrangements, such as renting an apartment, sharing a house, or owning a home.

🔹 Additionally, budgeting $1500 per month can be utilized in different economic scenarios, including stable economies or during times of economic uncertainty.

🔹 With this budgeting strategy, you gain the flexibility to adapt your spending habits to your unique circumstances.

Why is Budgeting $1500 per Month Important?

🔹 Budgeting $1500 per month is important for several reasons:

🔸 It allows you to stay within your means and avoid overspending, leading to financial stress and debt accumulation.

🔸 By allocating a specific amount for each expense category, you can prioritize your needs and adjust your lifestyle accordingly.

🔸 Budgeting helps you set realistic financial goals and work towards achieving them, whether it’s saving for a down payment, paying off debt, or investing for retirement.

🔸 It provides a clear overview of your financial situation, helping you identify areas where you can cut costs and make improvements.

🔸 Budgeting $1500 per month promotes financial discipline, allowing you to develop healthy spending habits and make informed financial decisions.

🔸 It acts as a safeguard against unexpected expenses by ensuring you have enough savings to cover emergencies.

🔸 Budgeting $1500 per month instills a sense of financial security and empowers you to take control of your future.

How to Budget $1500 per Month Effectively?

🔹 To budget $1500 per month effectively, follow these steps:

🔸 Determine your income: Calculate your monthly income from all sources, including salary, freelance work, or any additional revenue streams.

🔸 Identify fixed expenses: List all your recurring fixed expenses, such as rent/mortgage payments, utilities, insurance, loan payments, and subscriptions.

🔸 Allocate funds to essential expenses: Assign a portion of your budget to essential expenses like groceries, transportation, healthcare, and other necessities.

🔸 Set aside savings: Prioritize savings by allocating a specific amount to build an emergency fund or contribute to your long-term goals.

🔸 Plan for discretionary spending: Allocate a reasonable amount for discretionary expenses like dining out, entertainment, and hobbies.

🔸 Track your expenses: Regularly monitor your spending to ensure you stay within your budget and identify areas for improvement.

🔸 Make adjustments: If necessary, adjust your budget based on changes in your income, expenses, or financial goals.

By following this process, you can effectively manage your finances and allocate $1500 per month to meet your needs and achieve your financial aspirations.

Advantages and Disadvantages of Budgeting $1500 per Month

Advantages:

1. 🌟 Financial control: Budgeting $1500 per month provides you with a sense of control over your finances, allowing you to make informed decisions and avoid overspending.

2. 🌟 Debt reduction: By allocating a specific amount towards debt payments, you can work towards becoming debt-free and improve your financial well-being.

3. 🌟 Savings growth: Budgeting $1500 per month enables you to save for emergencies, future goals, or unexpected expenses, providing you with financial security.

4. 🌟 Goal achievement: With a structured budget, you can prioritize your financial goals and make progress towards achieving them, whether it’s buying a house, traveling, or retiring comfortably.

5. 🌟 Improved financial habits: Consistently following a budget fosters discipline and promotes healthy financial habits, leading to long-term financial success.

Disadvantages:

1. ⚠️ Restrictive: Budgeting $1500 per month may require you to limit certain expenses or adjust your lifestyle, which can be challenging for some individuals.

2. ⚠️ Unexpected expenses: While budgeting helps prepare for emergencies, unforeseen expenses can still arise, potentially requiring adjustments to your budget or dipping into your savings.

3. ⚠️ Time-consuming: Creating and tracking a budget requires time and effort, especially when considering multiple income sources and expense categories.

4. ⚠️ Flexibility limitations: Strict adherence to a budget may restrict your ability to indulge in spontaneous purchases or experiences, requiring careful planning.

5. ⚠️ Stressful for some: For individuals who find managing finances challenging or stressful, adhering to a budget can increase anxiety or feelings of restriction.

FAQs About Budgeting $1500 per Month

1. What if I have irregular income?

If your income fluctuates, it is essential to create a flexible budget that accounts for lean months and times of abundance. Consider averaging your income over several months to determine a baseline for budgeting purposes.

2. Can I still enjoy life while budgeting $1500 per month?

Absolutely! Budgeting helps you prioritize your spending and allocate funds for discretionary expenses. By making conscious choices, you can still enjoy life within the limits of your budget.

3. Should I include savings in my budget?

Yes, allocating a portion of your budget towards savings is essential for long-term financial security. Treat savings as an expense and prioritize it accordingly.

4. What if I overspend in a particular month?

If you exceed your budget in a specific month, evaluate the reasons behind the overspending and make adjustments accordingly. It is crucial to learn from the experience and make necessary changes to prevent future occurrences.

5. Can I modify my budget as my income or expenses change?

Absolutely! Budgeting is a dynamic process that adapts to your financial circumstances. Modify your budget whenever necessary to reflect changes in income, expenses, or financial goals.

Conclusion

In conclusion, budgeting $1500 per month is a powerful tool that allows you to take control of your finances and achieve your financial goals. By allocating your income effectively, prioritizing essential expenses, and saving for the future, you can enjoy financial stability and peace of mind.

Remember, budgeting is an ongoing process that requires discipline and occasional adjustments. With determination and commitment, you can master the art of budgeting $1500 per month and pave the way for a brighter financial future.

Final Remarks

🔹 Budgeting $1500 per month is a personal financial decision that requires careful consideration of your income, expenses, and financial goals.

🔹 The information provided in this article is for educational purposes only and should not be considered as financial advice. Please consult with a financial professional before making any significant financial decisions.

🔹 Remember, everyone’s financial situation is unique, and what works for one person may not work for another. It’s crucial to tailor your budget to your specific needs and priorities.

🔹 Stay committed, be flexible, and continue to educate yourself about personal finance to ensure long-term financial success.