Budgeting 101 for High School Students

Introduction

Dear Readers,

Welcome to our guide on budgeting 101 for high school students. In today’s world, financial literacy is crucial, and learning how to effectively manage your money at a young age can set you up for a successful future. Budgeting is an essential skill that can help you make wise financial decisions, save for your goals, and avoid unnecessary debt. In this article, we will provide you with a comprehensive overview of budgeting and its importance for high school students. So, let’s dive in and learn the basics of budgeting!

What is Budgeting?

Image Source: collegexpress.com

📝 Budgeting is the process of creating a plan for your income and expenses. It involves tracking your income, setting financial goals, estimating your expenses, and allocating your money accordingly. By creating a budget, you can have better control over your finances and make informed decisions about how to spend and save.

📝 Budgeting is not about restricting yourself from spending but rather about understanding your financial situation and making conscious choices. It helps you prioritize your needs, identify areas where you can cut back, and save for the future.

📝 As a high school student, budgeting can empower you to manage your allowance, part-time job earnings, or any other income source effectively. It will teach you financial responsibility and prepare you for the financial challenges that lie ahead.

Who Should Budget?

Image Source: oklahomamoneymatters.org

📝 Budgeting is beneficial for everyone, regardless of age or financial status. However, as a high school student, budgeting is particularly important because it sets the foundation for your financial journey. Learning to manage your money early on can help you avoid bad financial habits and build a strong financial future.

📝 Whether you have a part-time job, receive an allowance from your parents, or earn money through other means, budgeting can help you make the most out of your income and develop a responsible approach to money management.

Image Source: ytimg.com

📝 By budgeting, you will gain a better understanding of your spending habits, develop saving skills, and learn how to set realistic financial goals. These skills will serve you well throughout your life and contribute to your long-term financial success.

When Should You Start Budgeting?

📝 The earlier you start budgeting, the better. High school is a great time to begin learning about personal finance and budgeting. It allows you to develop good financial habits and avoid common financial pitfalls.

📝 Starting to budget as a high school student enables you to take control of your money, make smart financial decisions, and develop a strong foundation for your future financial well-being. The skills you acquire now will benefit you throughout your college years and beyond.

📝 So, don’t wait to start budgeting! The sooner you begin, the more prepared you will be to handle your finances as you enter adulthood.

Where Can You Implement Budgeting?

📝 Budgeting can be implemented in various aspects of your life, including your personal expenses, education, social activities, and savings. It is essential to have a clear understanding of where your money is going and how it can be allocated to achieve your financial goals.

📝 Personal expenses: Tracking your spending on items such as clothing, entertainment, and personal care products can help you identify areas where you might be overspending and make adjustments accordingly.

📝 Education: If you plan to attend college, budgeting for tuition fees, textbooks, and other educational expenses can help you plan ahead and ensure that you are financially prepared.

📝 Social activities: Budgeting for outings with friends, movies, or other leisure activities can help you strike a balance between enjoying your social life and being mindful of your finances.

📝 By implementing budgeting in these areas, you can make better financial decisions and have a clearer understanding of how your money is being used.

Why is Budgeting Important for High School Students?

📝 Budgeting is essential for high school students because it helps you develop financial responsibility and prepares you for the future. Here’s why budgeting is important:

1️⃣ Financial independence: Budgeting allows you to take control of your money and become independent in managing your finances. It gives you the confidence to make informed decisions and avoid unnecessary debt.

2️⃣ Goal setting: Budgeting helps you set realistic financial goals and work towards achieving them. Whether it’s saving for college, buying a car, or starting a business, budgeting allows you to allocate your money towards your goals.

3️⃣ Wise spending habits: By budgeting, you learn to differentiate between needs and wants. This helps you develop wise spending habits and avoid impulsive purchases that can lead to financial stress.

4️⃣ Avoiding debt: Budgeting teaches you the importance of living within your means and avoiding debt. It helps you understand the consequences of overspending and guides you to make responsible financial decisions.

5️⃣ Building savings: Budgeting encourages you to save a portion of your income regularly. This habit allows you to build an emergency fund and save for future expenses or goals.

How Can You Start Budgeting?

📝 Starting your budgeting journey as a high school student is simple. Here are some steps to help you get started:

1️⃣ Track your income: Make a note of all the money you receive, including allowances, part-time job earnings, or any other sources of income.

2️⃣ Identify your expenses: Determine where your money is going and categorize your expenses. This can include personal expenses, education-related expenses, and social activities.

3️⃣ Set financial goals: Determine what you want to achieve with your money. It could be saving for college, buying a car, or funding your hobbies.

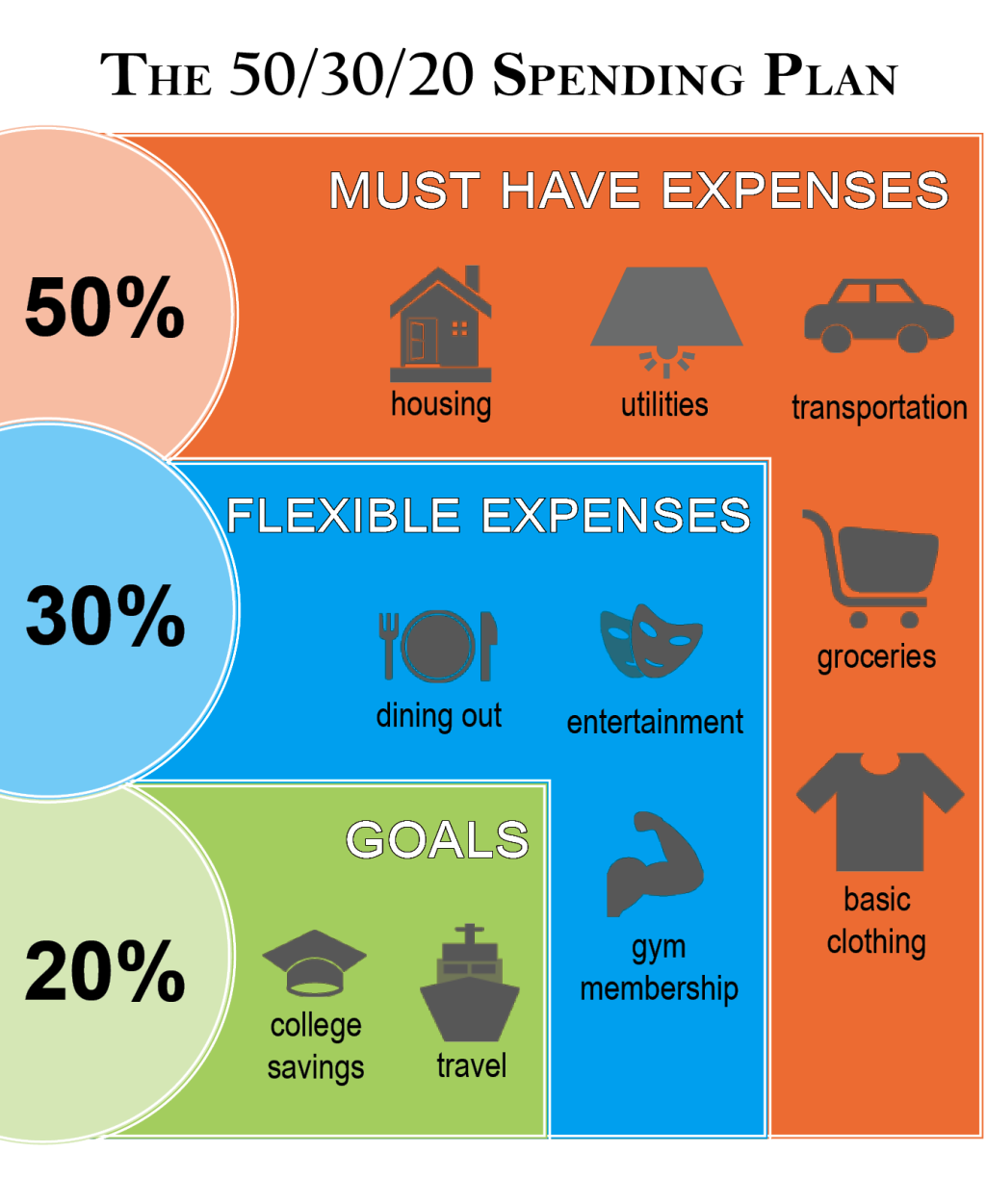

4️⃣ Allocate your money: Divide your income into different categories based on your expenses and financial goals. Make sure to allocate funds for savings as well.

5️⃣ Track your spending: Keep a record of all your expenses to ensure that you are sticking to your budget. Use budgeting apps or spreadsheets to help you track your spending.

6️⃣ Review and adjust: Regularly review your budget and make adjustments as necessary. Track your progress towards your financial goals and make changes if needed.

7️⃣ Seek guidance: If you need help with budgeting, don’t hesitate to seek guidance from financial advisors, teachers, or trusted adults. They can provide valuable insights and support you in your budgeting journey.

Advantages and Disadvantages of Budgeting for High School Students

📝 Like any financial strategy, budgeting has its advantages and disadvantages. Let’s explore both sides:

Advantages:

1️⃣ Financial control: Budgeting gives you control over your finances and helps you make conscious decisions about how you spend your money.

2️⃣ Goal achievement: By budgeting, you can set specific financial goals and work towards achieving them.

3️⃣ Reduced stress: Budgeting helps you avoid financial stress by ensuring that you have enough money for your needs and future goals.

Disadvantages:

1️⃣ Restrictive: Some may find budgeting restrictive as it requires you to plan and allocate your money carefully.

2️⃣ Time-consuming: Creating and maintaining a budget requires time and effort, which can be seen as a disadvantage for some.

3️⃣ Unexpected expenses: Despite budgeting, unexpected expenses can still arise, which may require adjustments and flexibility in your budget.

Frequently Asked Questions (FAQs)

Q1: How often should I review my budget?

A1: It’s recommended to review your budget on a monthly basis or whenever there are significant changes in your income or expenses. Regular monitoring allows you to stay on track and make necessary adjustments.

Q2: Is it necessary to have a savings account as a high school student?

A2: While not mandatory, having a savings account is highly beneficial. It helps you develop saving habits, keeps your money safe, and allows you to earn interest on your savings.

Q3: What if I overspend in a certain category?

A3: If you overspend in a particular category, you may need to adjust your budget for the following month. Look for areas where you can cut back to make up for the overspending.

Q4: Can I use budgeting apps to track my expenses?

A4: Yes, budgeting apps are a convenient way to track your expenses. They provide real-time updates and help you stay organized with your budget.

Q5: Should I involve my parents in my budgeting process?

A5: Involving your parents in your budgeting process can be beneficial. They can provide guidance, share their experiences, and support you in achieving your financial goals.

Conclusion

📝 Congratulations, you have now learned the essentials of budgeting 101 for high school students! By implementing budgeting in your life, you can gain control over your finances, make informed decisions, and work towards achieving your financial goals. Remember, budgeting is a lifelong skill that will benefit you at every stage of your financial journey. Start budgeting today and set yourself up for a successful future!

Final Remarks

📝 Budgeting is a powerful tool that can positively impact your financial well-being. However, it’s essential to remember that everyone’s financial situation is unique, and what works for one person may not work for another. The information provided in this article is for educational purposes only and should not be considered as financial advice. If you have specific financial concerns or need personalized guidance, it’s recommended to consult with a financial professional. Happy budgeting!