Budgeting 1200 a Month: Managing Your Finances Effectively

Greetings, Readers! In today’s article, we will discuss the importance of budgeting and how you can effectively manage your finances with a monthly budget of $1200. By implementing proper budgeting techniques, you can take control of your expenses and work towards your financial goals. Let’s dive into the details!

Introduction

Proper budgeting is essential for anyone looking to achieve financial stability and meet their financial goals. It involves carefully planning and allocating your income to cover your expenses and save for the future. With a budget of $1200 a month, it is crucial to prioritize your spending and make informed decisions about your financial choices.

To help you understand the importance of budgeting, let’s break it down into several key points:

What is Budgeting?

Budgeting is the process of creating a plan for how you will spend and save your money. It involves tracking your income and expenses, setting financial goals, and making adjustments to ensure you stay on track.

Who Should Budget?

Everyone can benefit from budgeting, regardless of their income level. Whether you are a student, a young professional, or a family, budgeting can help you manage your finances effectively and make the most of your money.

When Should You Start Budgeting?

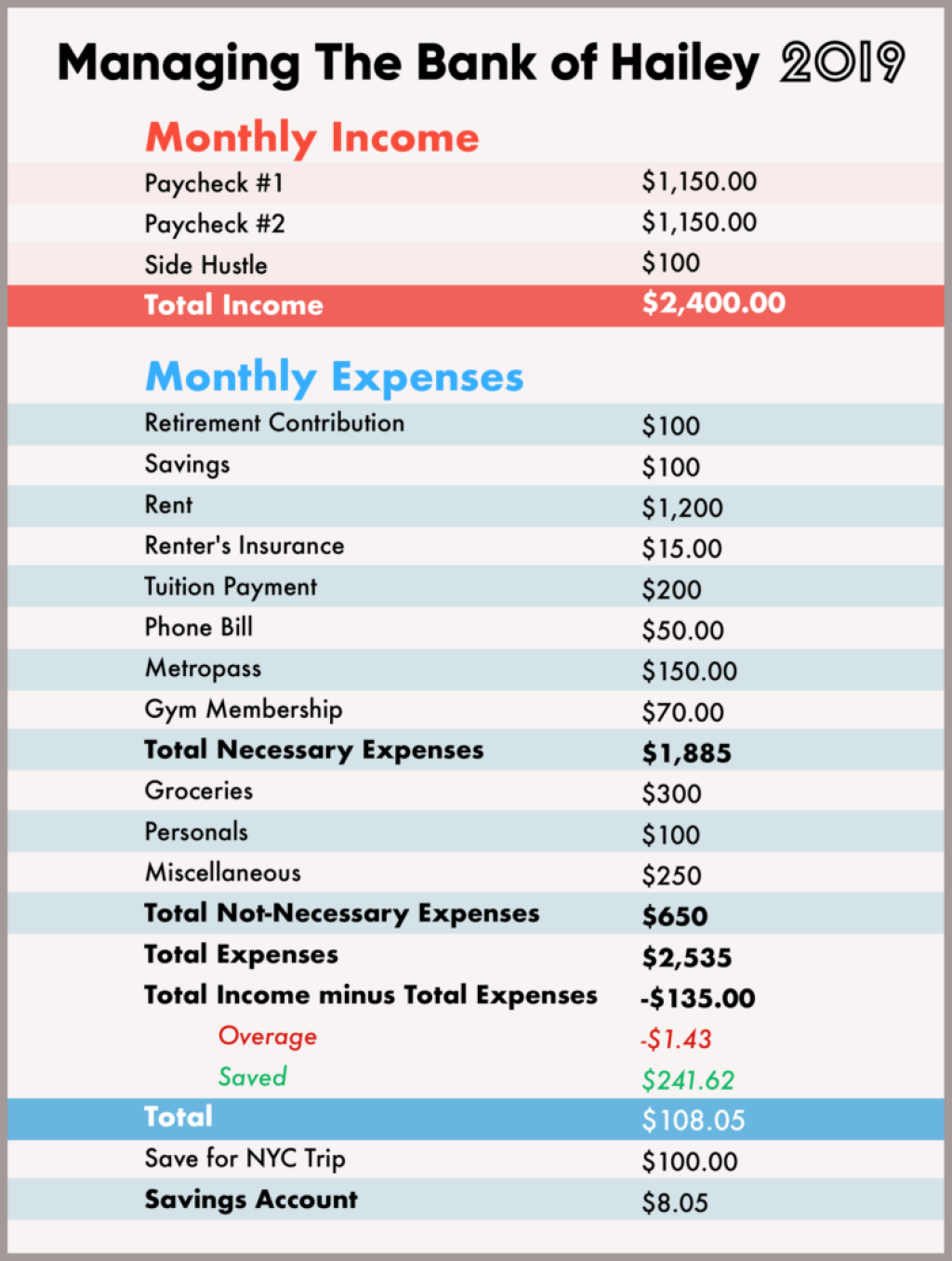

Image Source: themostlysimplelife.com

The sooner you start budgeting, the better. It is never too early or too late to take control of your finances. By starting early, you can develop good financial habits that will benefit you throughout your life.

Where to Begin?

Start by assessing your current financial situation. Calculate your income, including any additional sources such as side hustles or investments. Then, track your expenses and categorize them to identify areas where you can cut back or make adjustments.

Why is Budgeting Important?

By budgeting, you gain a clear understanding of where your money is going and can make informed decisions about your spending. It helps you avoid unnecessary debt, save for emergencies, and work towards your financial goals, such as buying a house or starting a business.

How to Budget with $1200 a Month?

Now, let’s focus on budgeting with a monthly income of $1200. Here are some tips to help you make the most of your money:

Track Your Expenses: Keep a record of all your expenses to identify areas where you can cut back.

Set Financial Goals: Determine what you want to achieve financially and set realistic goals that align with your income.

Create a Budget Plan: Allocate your income towards different categories such as bills, groceries, savings, and entertainment.

Reduce Non-Essential Expenses: Cut back on discretionary spending, such as eating out or buying unnecessary items.

Save for Emergencies: Set aside a portion of your income for unexpected expenses or emergencies.

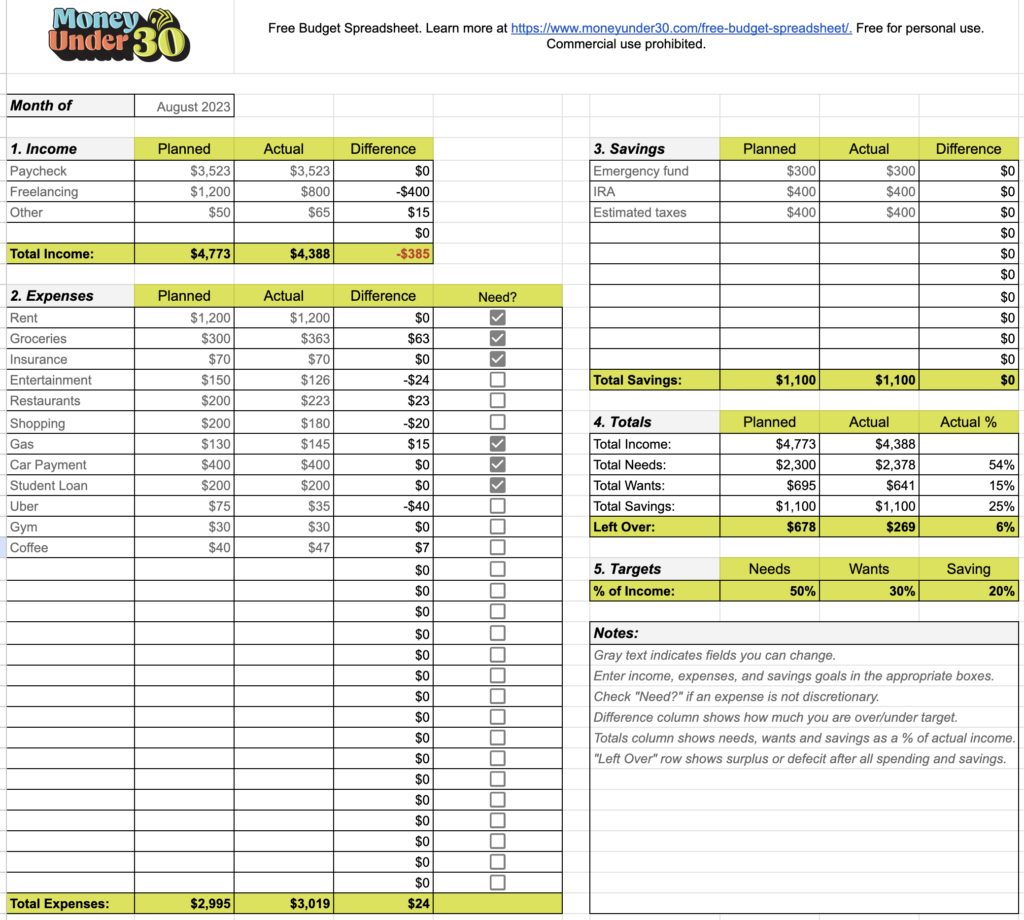

Image Source: pcdn.co

Advantages and Disadvantages of Budgeting with $1200 a Month

Like any financial strategy, budgeting with a limited income has its pros and cons. Let’s explore them in more detail:

Advantages of Budgeting with $1200 a Month

1. Better Financial Control: Budgeting allows you to have a clear overview of your finances and make informed choices.

2. Increased Savings: By carefully planning your expenses, you can save a significant amount of your income each month.

Image Source: moneyunder30.com

3. Debt Management: Budgeting helps you avoid unnecessary debt and manage your existing debts effectively.

4. Financial Goal Achievement: With a budget, you can work towards your financial goals and make progress over time.

5. Reduced Stress: When you have a well-defined budget, you can avoid financial stress and have more peace of mind.

Disadvantages of Budgeting with $1200 a Month

1. Limited Flexibility: With a tight budget, you may have less room for unexpected expenses or spontaneous purchases.

2. Sacrifices in Lifestyle: Budgeting may require cutting back on certain luxuries or non-essential expenses.

3. Limited Room for Savings: Depending on your expenses, saving a significant amount with a $1200 monthly income can be challenging.

4. Higher Risk of Financial Stress: If you don’t stick to your budget, you may face financial stress and struggle to make ends meet.

5. Difficulty in Handling Emergencies: With limited savings, unexpected expenses can be harder to manage without compromising your budget.

Frequently Asked Questions (FAQ)

Q: Can I save money with a $1200 monthly income?

A: Yes, saving money is still possible with proper budgeting. By prioritizing your expenses and making smart financial choices, you can allocate a portion of your income towards savings.

Q: How can I cut back on expenses with a limited budget?

A: Look for areas where you can reduce costs, such as cooking meals at home instead of eating out, buying items in bulk, or finding affordable alternatives for your necessities.

Q: Can budgeting help me pay off debt?

A: Absolutely! With a budget, you can allocate more money towards debt repayment, making it easier to become debt-free faster.

Q: Is it possible to enjoy life while budgeting with a limited income?

A: Yes, budgeting doesn’t mean you have to sacrifice all your enjoyment. Identify low-cost or free activities and find ways to treat yourself occasionally without breaking your budget.

Q: How often should I review my budget?

A: It is recommended to review your budget regularly, at least once a month. This allows you to make necessary adjustments and ensure you are staying on track.

Conclusion

In conclusion, budgeting with a monthly income of $1200 is not only possible but also essential for your financial well-being. By tracking your expenses, setting financial goals, and prioritizing your spending, you can make the most of your money and work towards a more secure financial future. Remember, it’s never too late to start budgeting and taking control of your finances!

Final Remarks

Dear Readers, we hope this article has provided you with valuable insights and motivation to start budgeting with a $1200 monthly income. Remember, everyone’s financial situation is unique, and it’s essential to adapt the budgeting techniques to your specific needs. Take charge of your finances and embark on a journey towards financial stability and success. Happy budgeting!