6 Budgeting Tips: How to Manage Your Finances Efficiently

Introduction

Dear Readers,

Welcome to our comprehensive guide on budgeting tips to help you manage your finances more effectively. In today’s fast-paced world, it is crucial to have a strong grip on your finances to achieve financial stability and success.

By implementing these six budgeting tips, you will be able to take control of your money, save more, and make smarter financial decisions. So, let’s dive in and learn how to budget like a pro!

What Are Budgeting Tips?

📝 Budgeting tips are strategies and techniques that individuals can use to effectively manage their income and expenses. These tips help you create a budget, track your spending, save more money, and make wiser financial decisions.

By following these tips, you will be able to analyze your financial situation, set realistic goals, and allocate your income efficiently to achieve financial stability and meet your financial objectives.

Who Should Follow Budgeting Tips?

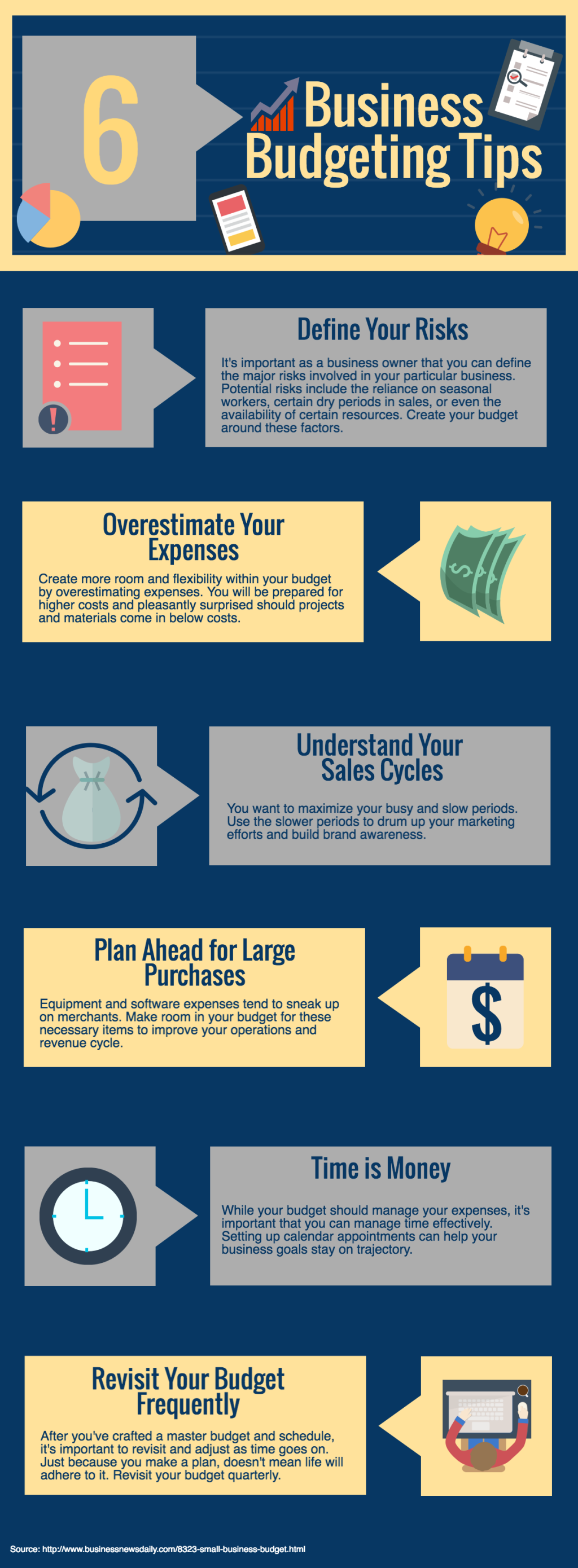

Image Source: freshbooks.com

📝 Budgeting tips are applicable to everyone, regardless of their income level or financial goals. Whether you are a student, working professional, or retiree, having a budget in place will help you make the most out of your money.

Whether you want to save for a vacation, pay off debt, or build an emergency fund, budgeting tips will provide you with the necessary knowledge and tools to accomplish your financial aspirations.

When Should You Start Budgeting?

📝 The best time to start budgeting is now! It doesn’t matter if you are just starting your career or if you have been working for years. Regardless of your current financial situation, budgeting can offer immediate benefits.

By creating a budget and sticking to it, you will gain a clearer understanding of your financial habits and take control of your spending. The sooner you start budgeting, the sooner you can start making progress toward your financial goals.

Where Can You Implement Budgeting Tips?

📝 Budgeting tips can be implemented in various areas of your life where money is involved. Whether it’s managing your personal expenses, household bills, or business finances, these tips will help you achieve financial success in every aspect.

Image Source: gotnpayments.com

By implementing budgeting tips in different areas of your life, you will be able to maintain financial discipline, avoid unnecessary expenses, and make more informed financial decisions.

Why Are Budgeting Tips Important?

📝 Budgeting tips are crucial for several reasons. Firstly, they help you gain control over your finances and reduce financial stress. With a budget in place, you’ll feel more confident and empowered to make financial decisions.

Secondly, budgeting tips enable you to save money and build a financial safety net. By tracking your expenses and allocating your income, you can set aside money for emergencies, future investments, or any other financial goals.

How to Implement Budgeting Tips?

📝 Implementing budgeting tips can be done in several steps. Firstly, you need to assess your current financial situation by examining your income, expenses, and debts. This will give you a clear understanding of where your money is going.

Next, you can create a budget by setting financial goals, prioritizing your expenses, and allocating your income accordingly. Use tools such as budgeting apps or spreadsheets to track your spending and make adjustments as needed.

Advantages and Disadvantages of Budgeting Tips

Advantages

Image Source: australianlendingcentre.com.au

1. Financial Control: Budgeting tips provide you with the necessary tools to take control of your finances and make informed financial decisions.

2. Increased Savings: By tracking your expenses and allocating your income, you can save more money and work towards your financial goals.

3. Debt Management: Budgeting tips help you manage and pay off your debts more effectively, reducing financial stress.

4. Financial Awareness: By creating a budget, you become more aware of your spending habits and can make adjustments to improve your financial situation.

5. Achieve Goals: With a budget in place, you can set realistic financial goals and work towards achieving them.

Disadvantages

1. Initial Effort: Creating and sticking to a budget requires time and effort, especially when you are just starting.

2. Lifestyle Adjustments: Budgeting may require you to make adjustments to your lifestyle and spending habits, which can be challenging.

3. Unexpected Expenses: While a budget helps you plan for regular expenses, it may not always account for unexpected emergencies or expenses.

4. Flexibility Constraints: A strict budget may limit your flexibility in spending, making it harder to adapt to changing circumstances.

5. Temptation to Overspend: Without proper discipline, a budget may not be effective in curbing impulsive spending habits.

Frequently Asked Questions (FAQs)

Q: Can budgeting tips help me save for retirement?

A: Absolutely! Budgeting tips can help you allocate a portion of your income towards retirement savings, ensuring a financially secure future.

Q: Are budgeting apps effective in managing expenses?

A: Yes, budgeting apps can be highly effective in tracking your expenses, categorizing them, and providing insights into your spending habits.

Q: How long does it take to see the benefits of budgeting?

A: The benefits of budgeting can be seen immediately, as it helps you gain control over your finances and make informed financial decisions.

Q: Is it necessary to stick to a strict budget?

A: While sticking to a strict budget is ideal, it is essential to allow for some flexibility to adapt to unexpected expenses or changes in circumstances.

Q: Can budgeting tips help me pay off my debts?

A: Absolutely! Budgeting tips help you allocate a portion of your income towards debt repayment, allowing you to pay off your debts more effectively.

Conclusion

In conclusion, implementing these six budgeting tips will empower you to take control of your finances, save more money, and achieve your financial goals. By creating a budget, tracking your expenses, and making informed financial decisions, you can pave the way for a financially secure future.

Remember, budgeting is a continuous process. Regularly review and adjust your budget as your financial situation changes, and don’t hesitate to seek professional advice if needed.

Start today and embark on a journey towards financial freedom!

Final Remarks

Dear Readers,

While we strive to provide accurate and up-to-date information, it is essential to note that financial situations may vary, and it is advisable to consult with a financial professional before making any significant financial decisions. The information provided in this article is for general informational purposes only and should not be considered as financial advice.

Thank you for choosing to read our budgeting tips article, and we hope you found it valuable in your financial journey. Here’s to a bright and prosperous future!