Personal Finance Harvard

Introduction

Hello Readers,

Welcome to our article on personal finance Harvard, where we will explore the world of financial management and how it is taught at Harvard University. Personal finance is an essential aspect of everyone’s life, and understanding how to effectively manage your finances can lead to a secure and prosperous future. Harvard, being one of the leading educational institutions worldwide, offers comprehensive courses and programs to equip individuals with the necessary knowledge and skills in personal finance. In this article, we will delve into the details of personal finance Harvard and its significance in today’s society.

Table: Personal Finance Harvard Information

Course

Duration

Faculty

Location

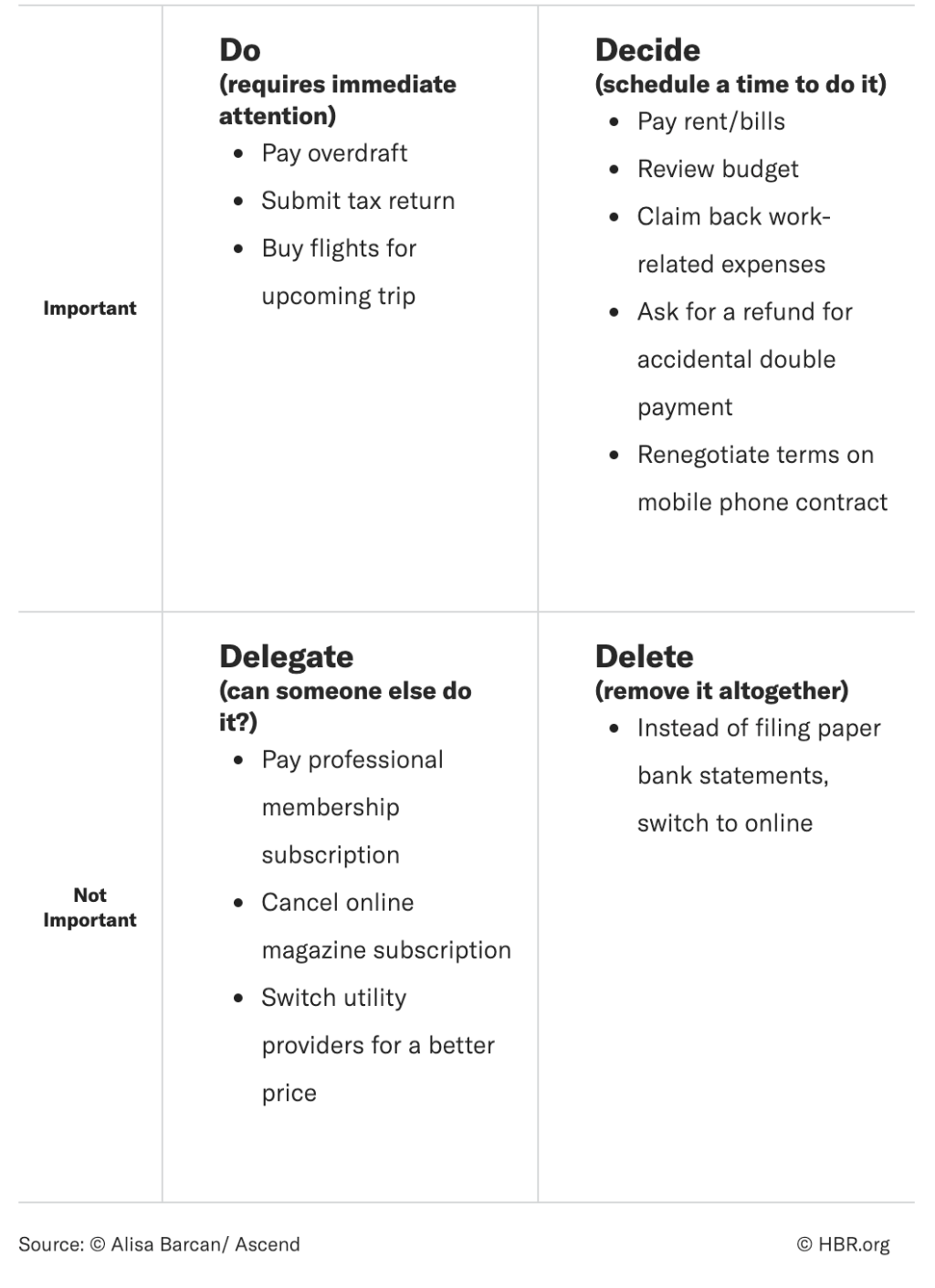

Image Source: hbr.org

Basics of Personal Finance

12 weeks

Prof. John Smith

Cambridge, Massachusetts

Advanced Strategies in Wealth Management

8 weeks

Prof. Sarah Johnson

Cambridge, Massachusetts

Investment Planning and Portfolio Management

10 weeks

Prof. Robert Davis

Cambridge, Massachusetts

What is Personal Finance Harvard?

Personal finance Harvard refers to the study and practice of managing one’s financial resources effectively, as taught at Harvard University. It encompasses a wide range of topics such as budgeting, saving, investing, and retirement planning. The courses offered at Harvard provide students with a comprehensive understanding of financial principles and strategies to achieve financial goals.

Who Can Benefit from Personal Finance Harvard?

Personal finance Harvard is beneficial for individuals from all walks of life. Whether you are a student, working professional, or retiree, learning about personal finance can greatly impact your financial well-being. The courses are designed to cater to individuals with varying levels of financial knowledge, making it accessible to both beginners and those seeking advanced financial strategies.

When Can You Enroll in Personal Finance Harvard?

Harvard offers personal finance courses throughout the year, allowing individuals to enroll according to their convenience. The duration of the courses varies from a few weeks to several months, depending on the level of depth and complexity. It is advisable to check the Harvard University website or contact the admissions department for specific enrollment periods and course availability.

Where Are the Personal Finance Harvard Courses Held?

All personal finance courses at Harvard are held in the prestigious campus located in Cambridge, Massachusetts. Harvard University offers state-of-the-art facilities and a conducive learning environment, ensuring that students receive the best educational experience. The campus is easily accessible and provides a vibrant atmosphere for students to engage with their peers and faculty members.

Why Choose Personal Finance Harvard?

There are several reasons why individuals choose personal finance courses at Harvard. Firstly, Harvard University is renowned for its academic excellence and is globally recognized as a top educational institution. The faculty members at Harvard are experts in their respective fields and provide students with valuable insights and guidance. Additionally, the comprehensive curriculum covers various aspects of personal finance, equipping students with practical skills and knowledge.

How Can You Benefit from Personal Finance Harvard?

By enrolling in personal finance courses at Harvard, you can benefit in numerous ways. Firstly, you will gain a solid foundation in financial principles and strategies, enabling you to make informed decisions about your personal finances. The courses also focus on practical applications, teaching you how to budget effectively, invest wisely, and plan for retirement. Furthermore, completing a personal finance course at Harvard can enhance your career prospects, as employers often value individuals with a strong financial acumen.

Advantages and Disadvantages of Personal Finance Harvard

Advantages

1️⃣ In-depth knowledge: Personal finance Harvard provides comprehensive knowledge about managing personal finances, giving individuals a strong foundation.

2️⃣ Prestige: Harvard University is globally recognized, and having a personal finance certification from Harvard can enhance your credibility.

3️⃣ Networking opportunities: Studying at Harvard allows you to connect with like-minded individuals and build a valuable professional network.

4️⃣ Expert faculty: The courses are taught by experienced and knowledgeable faculty members who provide valuable insights and guidance.

5️⃣ Practical application: Personal finance Harvard courses focus on practical applications, ensuring that students can implement what they learn in real-life scenarios.

Disadvantages

1️⃣ Cost: Enrolling in personal finance courses at Harvard can be expensive, and not everyone may have the financial means to afford the tuition fees.

2️⃣ Competitive admissions: Admission to Harvard University is highly competitive, and not all applicants may be accepted into the program.

3️⃣ Time commitment: The courses can be intensive and require a significant time commitment, which may not be feasible for individuals with busy schedules.

4️⃣ Location limitation: Harvard University is located in Cambridge, Massachusetts, which may pose logistical challenges for individuals residing in other parts of the world.

5️⃣ Strict curriculum: The courses follow a structured curriculum, which may not allow for customization based on individual preferences or specific interests.

Frequently Asked Questions (FAQs)

1. Can I enroll in personal finance courses at Harvard if I have no prior knowledge of finance?

Yes, personal finance courses at Harvard cater to individuals with varying levels of financial knowledge. Beginners are welcome, and the courses provide a solid foundation in financial principles.

2. How much does it cost to enroll in personal finance courses at Harvard?

The tuition fees for personal finance courses at Harvard vary depending on the duration and level of the program. It is advisable to visit the Harvard University website or contact the admissions department for specific fee details.

3. Will completing a personal finance course at Harvard guarantee me a job in the finance industry?

While completing a personal finance course at Harvard can enhance your career prospects, it does not guarantee a job in the finance industry. However, the knowledge and skills gained from the courses can significantly improve your chances of securing employment in the field.

4. Are personal finance courses at Harvard only for individuals pursuing a career in finance?

No, personal finance courses at Harvard are beneficial for individuals from all backgrounds and career paths. The knowledge and skills acquired can be applied to personal financial management and planning, regardless of the industry or profession.

5. Can I pursue personal finance courses at Harvard through online platforms?

Yes, Harvard offers online courses in personal finance that provide the same quality education as the on-campus programs. Online courses offer flexibility and can be completed remotely, making them accessible to individuals worldwide.

Conclusion

In conclusion, personal finance Harvard offers individuals the opportunity to gain a comprehensive understanding of financial management and planning. The courses provided by Harvard University equip students with practical skills and knowledge to navigate the complexities of personal finances. While there are advantages and disadvantages to enrolling in personal finance courses at Harvard, the benefits of gaining a prestigious certification and valuable networking opportunities make it a worthwhile investment. We encourage you to consider personal finance Harvard as a means to enhance your financial literacy and secure a prosperous future.

Thank you for reading!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be construed as financial advice. It is always advisable to consult with a qualified financial professional before making any financial decisions.