Personal Finance Homeschool Course: Empowering Students to Master Money Management

Introduction

Dear Readers,

Welcome to an informative article on the importance of a personal finance homeschool course. In today’s rapidly changing financial landscape, it has become crucial for individuals to have a solid understanding of money management. As parents and educators, it is our responsibility to equip our children with the necessary skills to navigate their financial future. This article aims to shed light on the benefits, curriculum, and resources available for a personal finance homeschool course.

Table of Contents

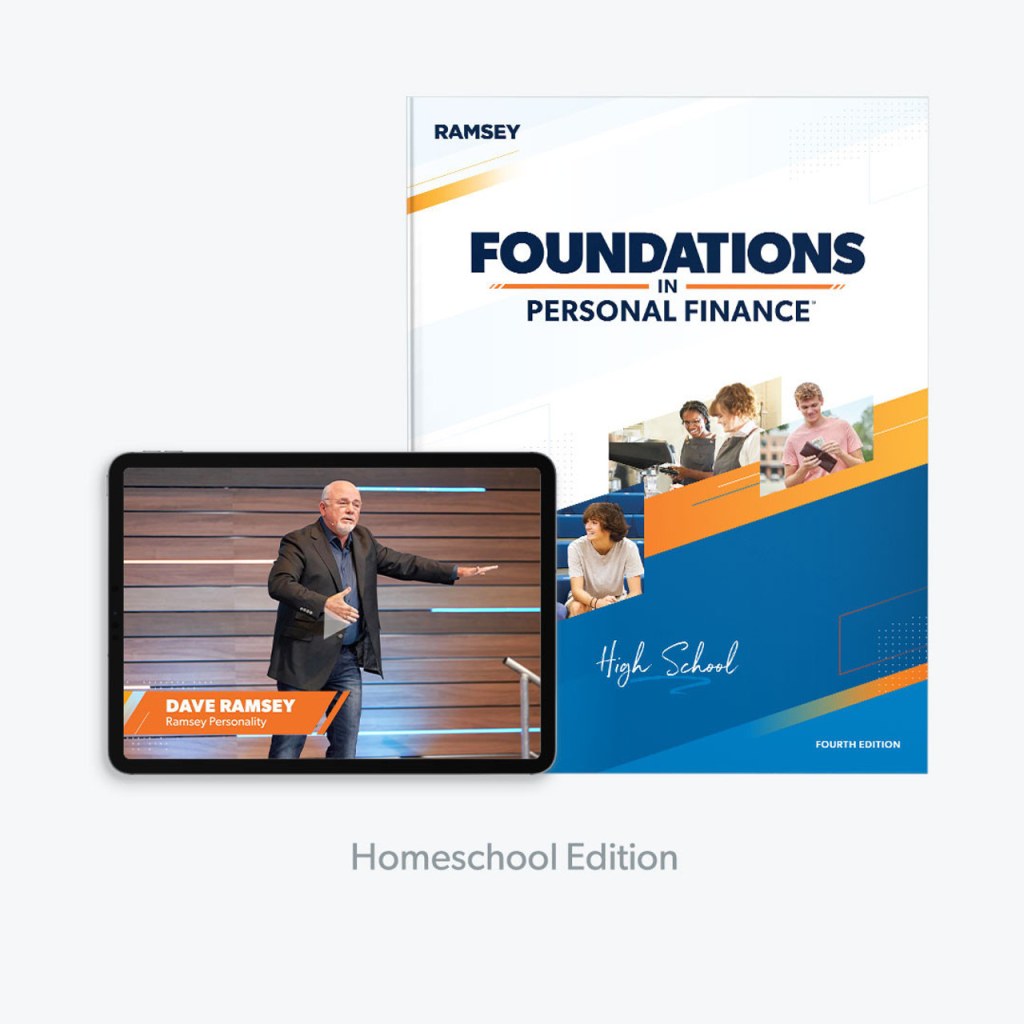

Image Source: bigcommerce.com

What is a personal finance homeschool course?

Who can benefit from it?

When should it be introduced?

Where can you find curriculum and resources?

Why is it important?

How to implement a personal finance homeschool course?

Advantages and disadvantages of personal finance homeschool course

Frequently Asked Questions

Conclusion

Final Remarks

What is a personal finance homeschool course?

A personal finance homeschool course is designed to provide students with the knowledge and skills necessary to effectively manage their finances. It covers a wide range of topics, including budgeting, saving, investing, credit management, and entrepreneurship. This course empowers students to make informed financial decisions and develop responsible financial habits.

Who can benefit from it?

A personal finance homeschool course is beneficial for students of all ages. Whether you have young children learning about money for the first time or teenagers preparing for their financial independence, this course caters to various age groups. By starting early, students can develop a strong foundation in financial literacy, which will serve them well throughout their lives.

When should it be introduced?

Image Source: organizedhomeschooler.com

It is never too early to introduce personal finance education. Basic concepts like saving and budgeting can be taught to young children through fun activities and games. As students grow older, the complexity of financial topics can increase to match their level of understanding. However, it is essential to ensure that the course content remains relevant and up-to-date with the current financial landscape.

Where can you find curriculum and resources?

Several organizations provide comprehensive curriculum and resources for a personal finance homeschool course. Online platforms, such as Khan Academy and The National Endowment for Financial Education, offer free and interactive lessons covering various financial topics. Additionally, books, educational games, and workshops dedicated to personal finance can be valuable resources for homeschooling parents.

Why is it important?

Financial literacy is crucial for individuals to lead financially secure lives. By equipping students with the knowledge and skills to manage their money effectively, we empower them to make informed decisions and avoid common financial pitfalls. A personal finance homeschool course not only provides practical skills but also instills values such as responsibility, discipline, and delayed gratification.

How to implement a personal finance homeschool course?

Implementing a personal finance homeschool course requires careful planning and consideration. Start by setting clear learning objectives and identifying the specific topics you want to cover. Utilize a combination of textbooks, online resources, and real-life examples to make the course engaging and relatable. Encourage discussions and hands-on activities to reinforce learning and practical application.

Advantages and Disadvantages of Personal Finance Homeschool Course

Advantages:

Empowers students with essential life skills

Customizable curriculum to cater to individual needs

Flexible scheduling and pace of learning

Opportunity to teach real-world financial scenarios

Promotes financial responsibility from an early age

Disadvantages:

Requires significant parental involvement

Limited peer interaction compared to traditional classrooms

May require additional financial resources for curriculum and materials

Parents need to stay updated with the latest financial trends

May involve more effort to ensure accountability and assessment

Frequently Asked Questions

1. How long should a personal finance homeschool course be?

Answer: The duration of the course depends on the depth and breadth of the curriculum. It can range from a semester-long course to a year-long comprehensive program.

2. Can I incorporate real-life financial scenarios into the course?

Answer: Absolutely! In fact, incorporating real-life scenarios is highly encouraged as it helps students apply their knowledge to practical situations.

3. Is there any financial assistance available for homeschooling parents?

Answer: Some organizations provide scholarships or grants specifically for homeschooling families. It’s worth exploring these options to alleviate financial burdens.

4. Can I teach personal finance without being an expert?

Answer: Yes, you can teach personal finance without being an expert. Utilize available resources and learning materials to enhance your own knowledge while teaching your child.

5. Are there any standardized tests for personal finance homeschooling?

Answer: Currently, there are no standardized tests specifically for personal finance homeschooling. However, you can assess your child’s progress through assignments, quizzes, and projects.

Conclusion

In conclusion, a personal finance homeschool course offers invaluable knowledge and skills that empower students to navigate their financial futures successfully. By incorporating comprehensive curriculum, utilizing various resources, and providing real-life examples, parents can equip their children with the tools necessary for financial independence. Start early, stay engaged, and make personal finance education an integral part of your homeschooling journey.

Final Remarks

Dear Readers,

The information provided in this article is intended to guide you in implementing a personal finance homeschool course effectively. However, it is essential to adapt the curriculum and teaching methods to suit your child’s individual needs and learning style. Remember to stay updated with the latest financial trends and resources to ensure the relevance and efficacy of the course. With dedication and proper guidance, you can empower your child to become financially savvy individuals. Best of luck!