Budgeting for Grade 8

Introduction

Hello Readers,

Welcome to our article on budgeting for grade 8. As students enter the eighth grade, they begin to have more financial responsibilities and it is important to teach them the fundamentals of budgeting. In this article, we will provide you with a comprehensive guide on how to effectively budget for grade 8. By learning these skills, students will develop valuable financial habits that will benefit them throughout their lives.

In this article, we will cover various aspects of budgeting for grade 8, including what it entails, who should be involved, when to start, where to allocate funds, why it is important, and how to create a budget. So, let’s dive in and explore the world of budgeting!

What is Budgeting for Grade 8? 📊

Budgeting for grade 8 refers to the process of managing and allocating financial resources for students in the eighth grade. It involves planning and tracking expenses to ensure that money is used wisely and efficiently. By budgeting, students will learn valuable financial skills such as setting financial goals, making informed spending decisions, and saving for future expenses.

Importance of Budgeting for Grade 8

Budgeting is an essential life skill that helps students develop financial discipline and responsibility. By learning to budget at an early age, grade 8 students can avoid falling into debt, make wise financial decisions, and achieve their financial goals. It also promotes a sense of independence and self-reliance as students learn to manage their own finances.

Who Should be Involved in Budgeting?

Image Source: easypeasyfinance.com

When it comes to budgeting for grade 8, it is important to involve both students and their parents or guardians. By including parents or guardians in the budgeting process, students can benefit from their guidance and expertise. This collaborative approach ensures that students receive the necessary support and advice while also learning to take responsibility for their own finances.

When Should You Start Budgeting?

It is never too early to start budgeting. As students enter grade 8 and begin to have more financial responsibilities, it is the perfect time to introduce them to budgeting concepts. Starting early allows students to develop good financial habits and understand the importance of managing their money from a young age.

Where Should You Allocate Funds?

When creating a budget for grade 8, it is important to allocate funds to various categories. These may include educational expenses, such as textbooks and school supplies, extracurricular activities, transportation costs, personal savings, and leisure activities. By allocating funds to these categories, students can prioritize their spending and ensure that they are meeting both their academic and personal needs.

Why is Budgeting Important for Grade 8 Students?

Budgeting is important for grade 8 students as it teaches them valuable financial skills that will benefit them throughout their lives. By learning to budget, students can develop a strong foundation for financial success, avoid unnecessary debt, and make informed financial decisions. It also promotes responsible spending habits and encourages them to prioritize their financial goals.

How to Create a Budget

Creating a budget for grade 8 is a simple process that involves the following steps:

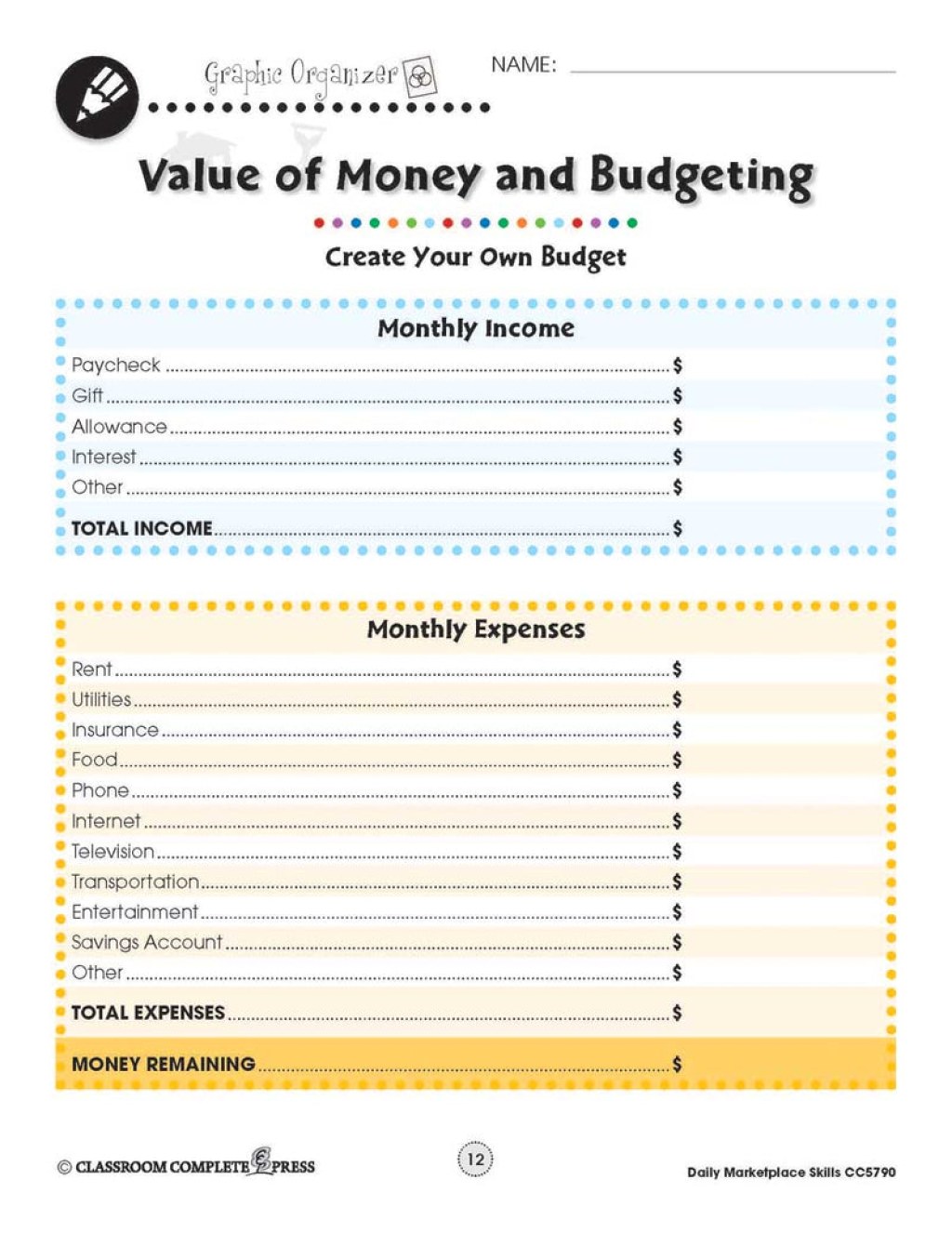

Image Source: classroomcompletepress.com

Set Financial Goals: Start by setting short-term and long-term financial goals. These could include saving for a specific item or event, or building an emergency fund.

Track Expenses: Keep track of all expenses by maintaining a record of income and expenditures. This will help identify areas where spending can be reduced.

Create Categories: Divide expenses into categories such as education, transportation, entertainment, and savings. Allocate a specific amount of money to each category.

Differentiate Between Needs and Wants: Teach students to differentiate between essential needs and discretionary wants. Prioritize needs over wants when allocating funds.

Monitor and Adjust: Regularly review the budget and make necessary adjustments. Track expenses to ensure that spending aligns with the budget and financial goals.

Save for the Future: Encourage students to save a portion of their income for future expenses or emergencies. This promotes financial security and responsible money management.

Seek Guidance: If needed, seek guidance from parents, teachers, or financial advisors. They can provide valuable insights and tips on budgeting effectively.

Advantages and Disadvantages of Budgeting for Grade 8

Like any other financial practice, budgeting for grade 8 has its advantages and disadvantages. Let’s take a closer look at both:

Advantages of Budgeting for Grade 8

1. Financial Discipline: Budgeting instills discipline in students and helps them develop responsible financial habits.

2. Goal Setting: By creating a budget, students can set financial goals and work towards achieving them.

3. Decision Making: Budgeting teaches students to make informed financial decisions and prioritize their spending.

4. Saving Money: Students can learn to save money by allocating a portion of their income towards savings.

5. Financial Independence: Budgeting empowers students to take control of their finances and become financially independent.

Disadvantages of Budgeting for Grade 8

1. Restricts Flexibility: Strict budgeting may limit students’ flexibility in spending and restrict their ability to indulge in certain activities.

2. Time-Consuming: Creating and maintaining a budget requires time and effort, which some students may find burdensome.

3. Requires Discipline: Budgeting requires discipline and self-control, which can be challenging for some students.

4. Unexpected Expenses: Budgeting may not account for unexpected expenses, which can disrupt the financial plan.

5. Potential for Stress: Strict adherence to a budget may cause stress and anxiety if students feel restricted in their spending choices.

Frequently Asked Questions (FAQs)

1. Q: How often should I review my budget?

A: It is recommended to review your budget at least once a month to ensure it aligns with your financial goals and current circumstances.

2. Q: Should I save all of my money?

A: It is important to strike a balance between saving and spending. Allocate a portion of your income towards savings while also allowing yourself to enjoy your money responsibly.

3. Q: What happens if I overspend?

A: Overspending occasionally is normal. When it happens, review your budget, identify areas where you can adjust, and make the necessary changes to get back on track.

4. Q: Can I make adjustments to my budget?

A: Absolutely! In fact, it is encouraged to make adjustments to your budget as needed. Life circumstances and financial goals may change, and your budget should reflect those changes.

5. Q: Can budgeting help me save for college?

A: Yes, budgeting can be a great tool to save for college. By allocating funds towards education and setting financial goals, you can save money over time to contribute to your college expenses.

Conclusion

Budgeting is a valuable skill that grade 8 students should learn to ensure their financial success in the future. By understanding the importance of budgeting, involving parents or guardians, starting early, allocating funds effectively, and following the steps to create a budget, students can develop responsible financial habits that will benefit them throughout their lives. Remember, practice makes perfect, so keep budgeting and enjoy the rewards of financial freedom!

Final Remarks

In conclusion, budgeting for grade 8 is an essential skill that prepares students for a lifetime of financial responsibility. It is important to remember that budgeting is not about restricting oneself, but rather about making informed and intentional financial decisions. By following the tips and guidelines in this article, grade 8 students can embark on a journey of financial independence and success. Remember, everyone’s financial circumstances are unique, so it is important to tailor your budget to your specific needs and goals. Here’s to a future filled with financial stability and wise money management!