8 Budgeting Apps: Manage Your Finances Efficiently

Greetings, Readers!

Managing your finances can be a daunting task, but with the help of technology, it has become easier than ever. Budgeting apps are designed to assist you in tracking your expenses, setting financial goals, and making informed decisions about your money. In this article, we will explore eight budgeting apps that can help you take control of your finances. Let’s dive in!

The 8 Budgeting Apps: Your Key to Financial Success

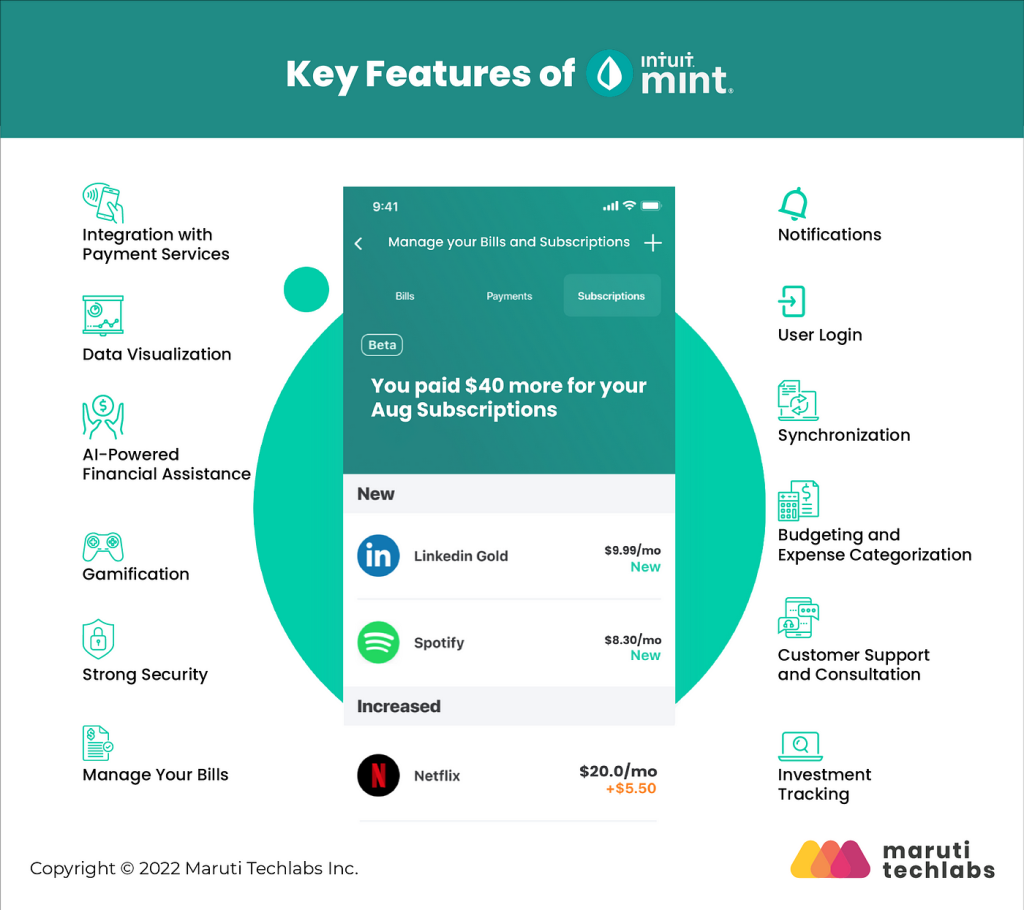

1️⃣ Mint: Mint is a popular budgeting app that allows you to track your spending, create budgets, and receive alerts for bill payments. With its user-friendly interface and comprehensive features, Mint is an excellent choice for individuals looking to stay on top of their finances.

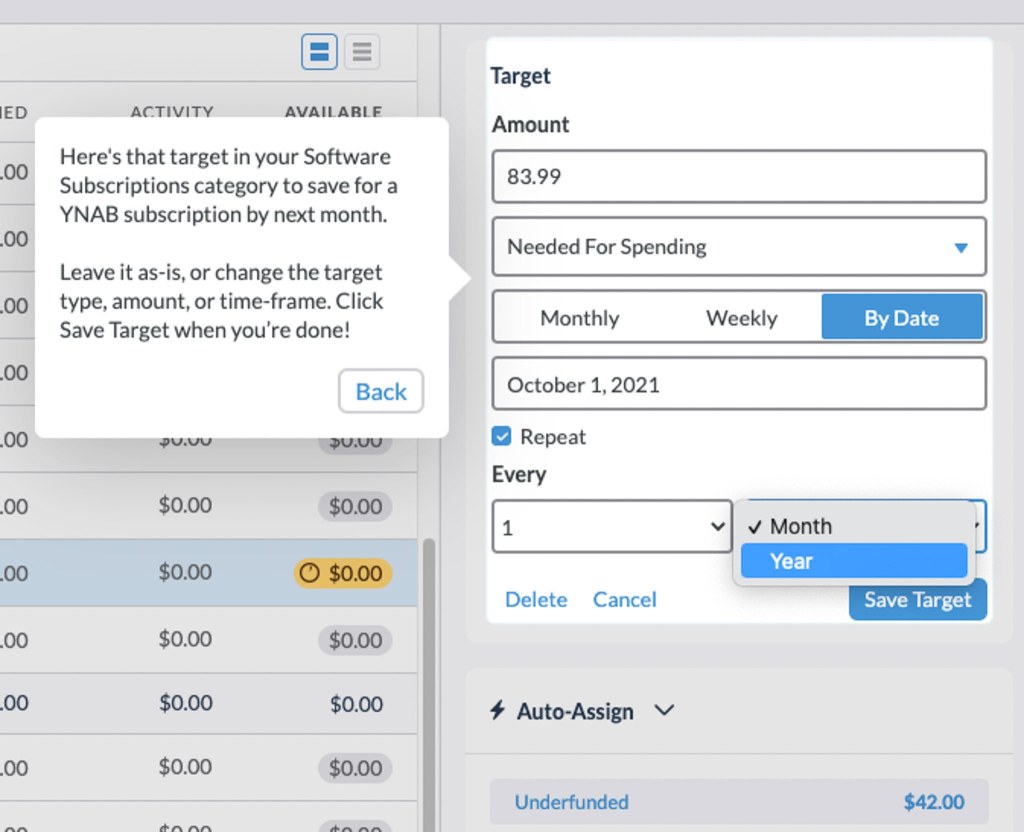

2️⃣ YNAB (You Need A Budget): YNAB is a budgeting app that focuses on helping you allocate your income mindfully. It encourages users to give every dollar a job and provides detailed reports to analyze your spending habits. YNAB is perfect for those who want to break the paycheck-to-paycheck cycle.

3️⃣ PocketGuard: PocketGuard is a budgeting app that connects to your bank accounts and automatically categorizes your expenses. It provides insights on your spending patterns, tracks bills, and offers suggestions on how to save money. PocketGuard is ideal for individuals who want a hands-off approach to budgeting.

Image Source: thewirecutter.com

4️⃣ Personal Capital: Personal Capital is not only a budgeting app but also an investment tracker and retirement planner. It offers a holistic view of your financial life, including net worth analysis, investment performance, and retirement planning tools. Personal Capital is a great choice for those interested in managing their investments alongside their budget.

5️⃣ Wally: Wally is a budgeting app that prides itself on its simplicity and ease of use. It allows you to track your income and expenses, set savings goals, and visualize your progress through intuitive charts. Wally is perfect for individuals who want a straightforward budgeting app without any unnecessary frills.

6️⃣ Goodbudget: Goodbudget is based on the envelope budgeting system, where users allocate their money into different virtual envelopes for specific expenses. It promotes a disciplined approach to budgeting and helps you stay within your limits. Goodbudget is an excellent choice for those who prefer a traditional budgeting method with a modern twist.

7️⃣ Honeydue: Honeydue is a budgeting app designed for couples who want to manage their finances together. It allows you to track shared expenses, set savings goals as a couple, and communicate about financial matters within the app. Honeydue is perfect for couples who want to stay on the same page financially.

8️⃣ Clarity Money: Clarity Money is a budgeting app that focuses on helping you save money. It analyzes your spending habits, identifies subscription services you may not need, and suggests ways to cut costs. Clarity Money is an excellent choice for individuals who want to optimize their spending and save more each month.

What are Budgeting Apps?

Image Source: medium.com

Budgeting apps are mobile applications designed to assist individuals in managing their finances effectively. These apps help track income, expenses, and savings, allowing users to set financial goals and make informed decisions about their money. Budgeting apps provide a convenient and accessible way to monitor and control personal finances.

Who can Benefit from Budgeting Apps?

Anyone who wants to take control of their finances can benefit from budgeting apps. Whether you are a college student trying to manage your expenses, a young professional saving for a dream vacation, or a retiree planning for a comfortable future, budgeting apps can cater to your specific needs. These apps are designed to be user-friendly, making them suitable for individuals of all ages and financial backgrounds.

When Should You Start Using Budgeting Apps?

The best time to start using budgeting apps is right now. It’s never too early or too late to take control of your finances. By starting to use budgeting apps, you can gain a better understanding of your spending habits, identify areas where you can save, and work towards achieving your financial goals. The earlier you start, the more time you have to build a solid financial foundation.

Where Can You Find Budgeting Apps?

Budgeting apps are widely available and can be found on various platforms, including the iOS App Store and Google Play Store. Simply search for budgeting apps in the respective app store, and you will be presented with a wide range of options to choose from. Many budgeting apps offer both free and premium versions, allowing you to select the one that suits your needs and budget.

Why Should You Use Budgeting Apps?

Budgeting apps offer several benefits that can significantly improve your financial well-being. Firstly, these apps provide a centralized platform to track all your income, expenses, and savings, eliminating the need for manual calculations and spreadsheets. Secondly, budgeting apps offer insights and reports on your spending habits, allowing you to make informed decisions about your money. Lastly, these apps can help you set and achieve financial goals, whether it’s saving for a down payment on a house or paying off student loans.

How Can You Maximize the Benefits of Budgeting Apps?

Image Source: hyperlinkinfosystem.com

To maximize the benefits of budgeting apps, it is essential to use them consistently and regularly. Make it a habit to update your income and expenses in the app, review your spending patterns, and adjust your budget accordingly. Set realistic financial goals and track your progress regularly. Additionally, take advantage of the additional features offered by budgeting apps, such as bill reminders, saving challenges, and investment tracking, to make the most out of your financial journey.

Advantages and Disadvantages of Budgeting Apps

Advantages:

1. Accessibility: Budgeting apps are available on smartphones, making them easily accessible anytime, anywhere.

2. Automation: These apps automate the process of tracking income and expenses, saving you time and effort.

3. Insights: Budgeting apps provide insights on your spending habits, allowing you to make informed financial decisions.

4. Goal Setting: These apps help you set and achieve financial goals, providing motivation and direction.

5. Collaboration: Some budgeting apps allow for collaboration, making them suitable for couples or families managing their finances together.

Disadvantages:

1. Learning Curve: Some budgeting apps may have a learning curve, especially for individuals who are not tech-savvy.

2. Data Security: Sharing financial information on budgeting apps may raise concerns about data security and privacy.

3. Potential Reliance: Depending too heavily on budgeting apps may lead to a lack of financial awareness and independence.

4. Inaccuracies: Budgeting apps rely on accurate data input, and mistakes or omissions may affect the accuracy of their insights and recommendations.

5. Cost: While many budgeting apps offer free versions, some advanced features may require a subscription or purchase.

Frequently Asked Questions (FAQs)

1. Can I trust budgeting apps with my financial information?

Yes, reputable budgeting apps prioritize data security and employ encryption to protect your financial information. However, it is always advisable to research and choose trusted apps from reliable sources.

2. Are budgeting apps only for individuals with high incomes?

No, budgeting apps can be beneficial for individuals with all income levels. They help you track expenses, set budgets, and make informed financial decisions regardless of your income.

3. Do budgeting apps require an internet connection?

Most budgeting apps require an internet connection to sync data and provide real-time updates. However, some apps offer offline functionality with limited features.

4. Can budgeting apps help me save money?

Yes, budgeting apps can help you save money by tracking your expenses, identifying areas where you can cut costs, and setting savings goals. They provide insights and reminders to keep you on track towards your financial objectives.

5. Is it necessary to upgrade to the premium version of budgeting apps?

The decision to upgrade to the premium version of a budgeting app depends on your specific needs and preferences. The free versions often offer essential features, while the premium versions may provide additional functionalities such as investment tracking or priority customer support.

Conclusion: Take Control of Your Finances Today!

Managing your finances is crucial for a secure and stress-free future. With the help of budgeting apps, you can take control of your money and work towards achieving your financial goals. Choose the budgeting app that aligns with your needs and start your journey towards financial success. Remember, every penny counts, and with the right tools, you can make every dollar work for you!

Final Remarks: Disclaimer

The information provided in this article is for educational purposes only and should not be considered as financial advice. It is always advisable to consult with a professional financial advisor before making any significant financial decisions. The use of budgeting apps should be based on personal judgment and discretion.