Personal Finance One Pager: Simplifying Your Financial Life

Introduction

Dear Readers,

Welcome to our comprehensive guide on personal finance one pagers. In today’s fast-paced world, managing our finances can often be overwhelming and time-consuming. However, a personal finance one pager offers a simple and efficient solution. In this article, we will explore everything you need to know about personal finance one pagers, including their benefits, how to create one, and why they are becoming increasingly popular. So, let’s dive in and simplify your financial life!

What is a Personal Finance One Pager? 📝

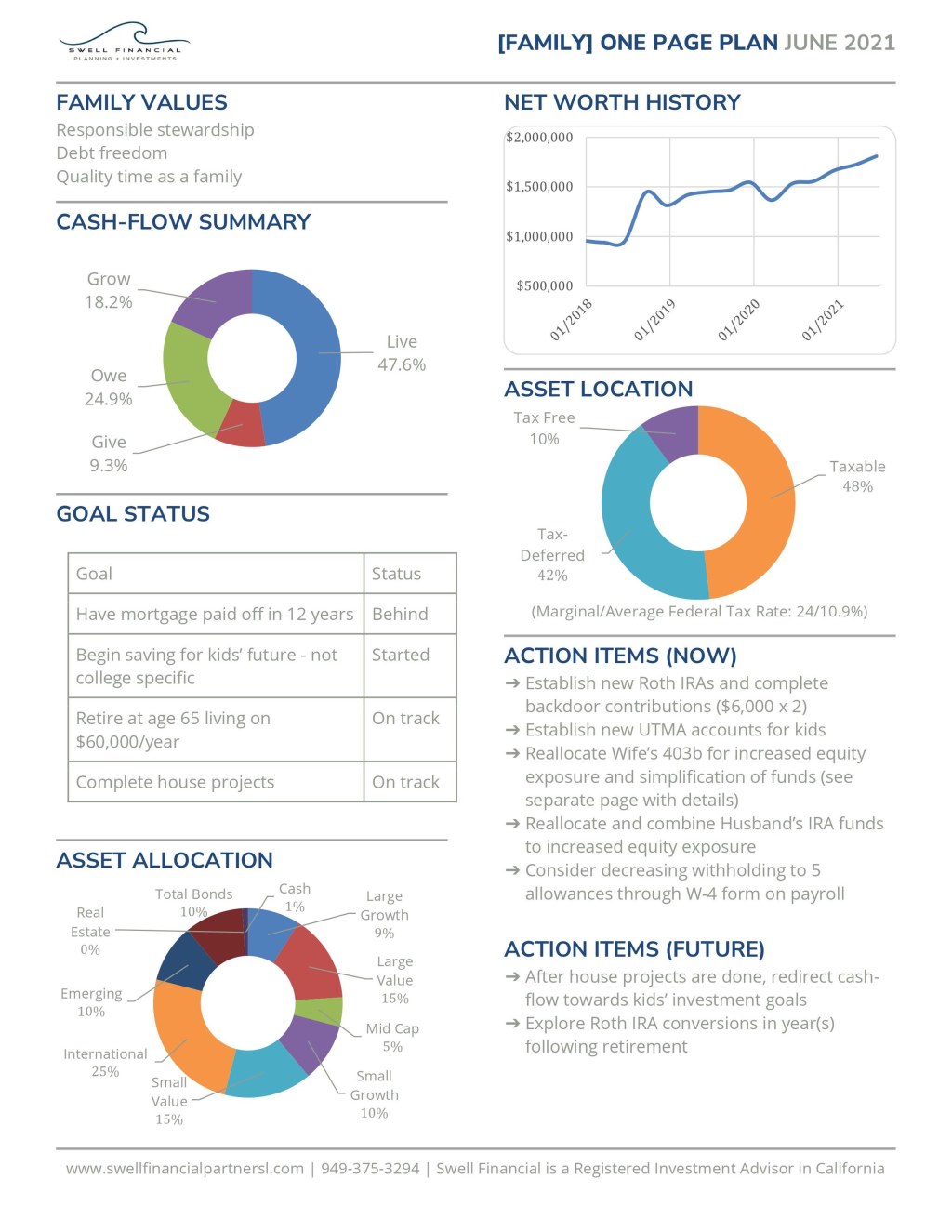

Image Source: squarespace-cdn.com

A personal finance one pager is a concise and organized document that helps individuals manage their finances effectively. It provides a snapshot of your financial situation, including income, expenses, savings, investments, and debt. With all the essential information in one place, you can easily track your progress, make informed financial decisions, and achieve your financial goals.

Who Can Benefit from a Personal Finance One Pager? 🤔

Personal finance one pagers are beneficial for individuals from all walks of life. Whether you are a working professional, a business owner, a student, or a retiree, having a clear overview of your finances can bring immense value. It is especially useful for those who find it challenging to keep track of multiple financial accounts, expenses, and investments.

When Should You Create a Personal Finance One Pager? ⏰

The ideal time to create a personal finance one pager is as soon as you start earning or managing your finances independently. However, it is never too late to create one. Whether you are just starting your financial journey or looking to streamline your existing financial management system, a personal finance one pager can be created at any point in time.

Where Can You Create a Personal Finance One Pager? 🌍

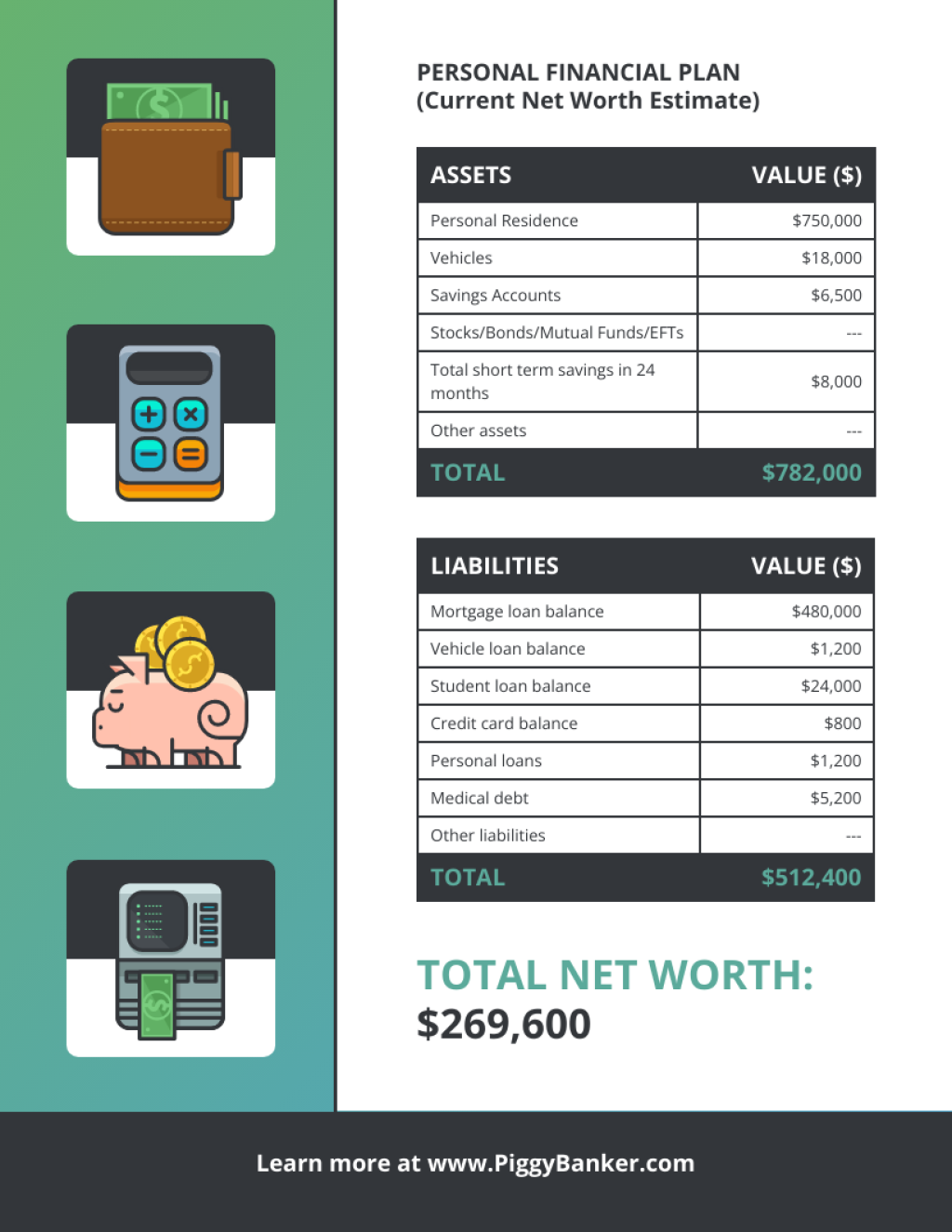

Image Source: amazonaws.com

You can create a personal finance one pager using various tools and platforms. Traditional options include Microsoft Excel or Google Sheets, where you can design a customized template based on your requirements. Alternatively, numerous digital platforms and mobile apps offer pre-designed templates and features to create and manage your personal finance one pager effortlessly.

Why Should You Use a Personal Finance One Pager? 📌

Using a personal finance one pager offers several advantages. Firstly, it simplifies your financial life by consolidating all your financial information in one place. This saves time and reduces the chances of overlooking important details. Additionally, it helps you gain a holistic view of your financial situation, facilitating better financial planning and decision-making. Lastly, it promotes financial discipline and accountability, enabling you to stay on track with your financial goals.

How to Create a Personal Finance One Pager? 📋

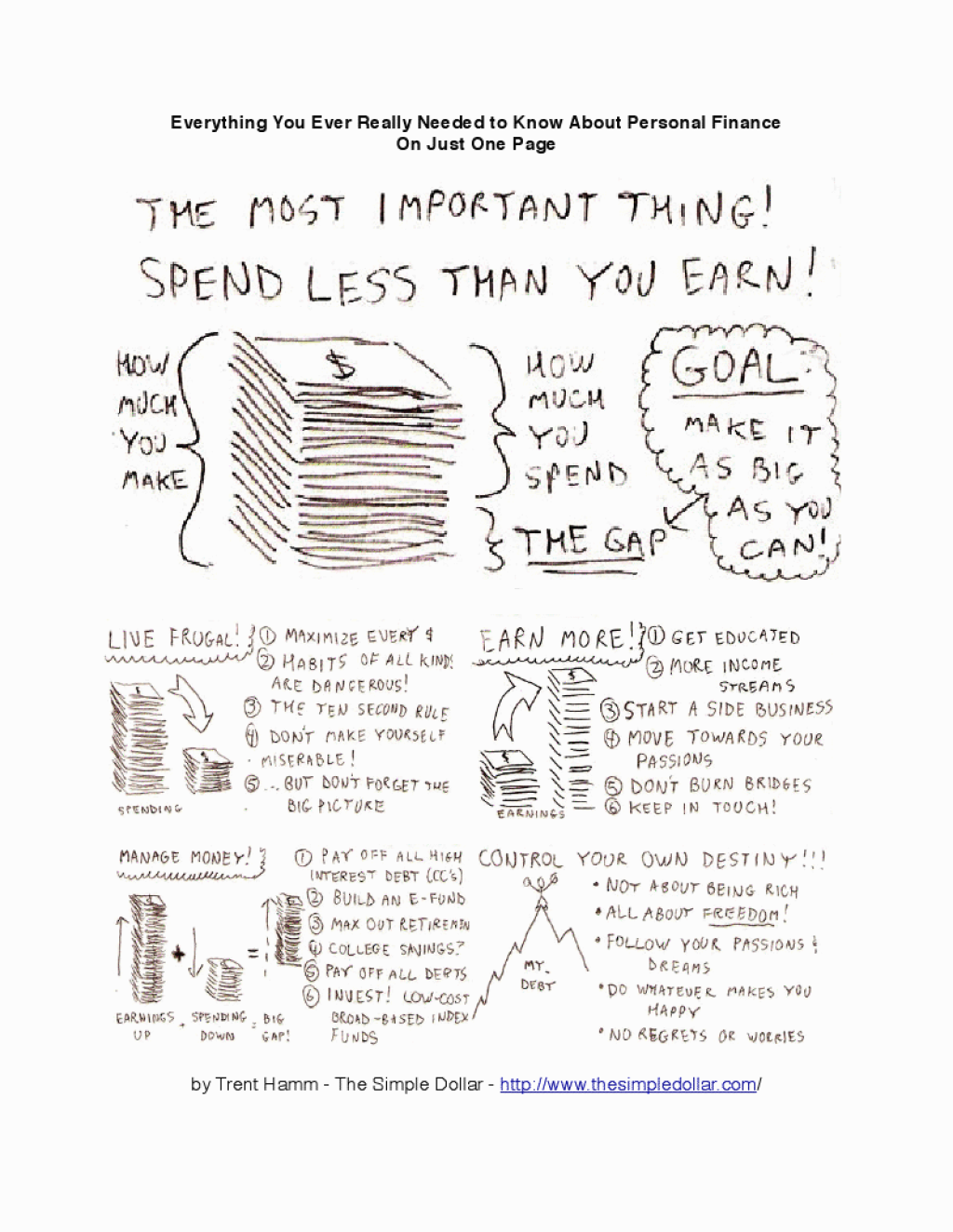

Image Source: wisebread.com

Creating a personal finance one pager involves a few simple steps. Start by gathering all your financial information, including bank statements, bills, investment statements, and loan documents. Determine the categories you want to include, such as income, expenses, savings, investments, and debt. Then, choose a template or create your own using a spreadsheet software. Input your data into the respective sections and regularly update it to ensure accuracy and relevance.

Advantages and Disadvantages of Using a Personal Finance One Pager

Advantages

1. Time-saving: By having all your financial information in one place, you save time on tracking and managing your finances.

2. Clarity: A personal finance one pager provides a clear overview of your financial situation, helping you make informed decisions.

3. Goal-oriented: It enables you to set financial goals, monitor your progress, and take necessary actions to achieve them.

4. Improved financial decision-making: With a comprehensive view of your finances, you can make better decisions regarding investments, expenses, and savings.

5. Easy identification of problem areas: It highlights areas where you may be overspending or neglecting savings, allowing you to take corrective measures.

Disadvantages

1. Initial setup time: Creating a personal finance one pager requires time and effort, especially when gathering and organizing financial information.

2. Regular updates: To ensure its effectiveness, a personal finance one pager needs to be updated regularly with the latest financial data.

3. Technical skills: Depending on the platform or software used, you may need basic technical skills to create and maintain your personal finance one pager.

4. Security concerns: Storing sensitive financial information digitally may pose a security risk if not adequately protected.

5. Dependency on accuracy: The accuracy of your personal finance one pager relies on the accuracy of the data you input. Any errors or omissions may affect its effectiveness.

Frequently Asked Questions (FAQs)

1. Can a personal finance one pager accommodate multiple sources of income?

Yes, a personal finance one pager can account for various sources of income, including salaries, freelance earnings, rental income, and investments. Simply categorize and include each income source accordingly.

2. What if I have an irregular income? Can a personal finance one pager still be useful?

Absolutely! A personal finance one pager can be particularly beneficial for individuals with irregular income. It allows you to track your earnings, plan for lean months, and ensure financial stability by managing your expenses and savings effectively.

3. Can I use a personal finance one pager for small business finances?

While personal finance one pagers are primarily designed for personal finances, they can be adapted for small business finances as well. Adjust the categories and sections to include business income, expenses, taxes, and other relevant financial information.

4. Is it necessary to have advanced knowledge of finance to create a personal finance one pager?

No, you do not need advanced financial knowledge to create a personal finance one pager. It is designed to simplify financial management for individuals of all backgrounds. However, basic knowledge of financial terms and concepts can be helpful.

5. Can I share my personal finance one pager with a financial advisor?

Absolutely! Sharing your personal finance one pager with a financial advisor can provide them with valuable insights into your financial situation. This enables them to offer personalized advice and recommendations based on your goals and aspirations.

Conclusion: Take Control of Your Finances Today! 🚀

Friends, managing your finances effectively is crucial for long-term financial stability and achieving your goals. A personal finance one pager simplifies this process by providing you with a clear and concise overview of your financial situation. Start creating your personal finance one pager today and take control of your financial future. With consistent monitoring and regular updates, you will be on your way to financial success!

Final Remarks: Disclaimer

Dear Readers,

The information provided in this article is for educational purposes only and should not be considered as financial advice. It is essential to consult with a certified financial professional or advisor before making any financial decisions. The authors and publishers of this article are not liable for any losses or damages incurred as a result of following the information provided. Always conduct thorough research and exercise due diligence when managing your finances.