Budgeting Worksheet Grade 8: A Comprehensive Guide to Financial Planning

Introduction

Welcome, dear readers, to our informative guide on budgeting worksheets for grade 8 students. In today’s fast-paced world, it is crucial for young individuals to learn the importance of financial planning and develop good money management skills early on. By introducing budgeting worksheets, we aim to empower grade 8 students with the tools they need to make informed financial decisions both now and in the future.

In this article, we will provide a detailed overview of budgeting worksheets for grade 8 students, explaining its purpose, benefits, and how to effectively use them. So, let’s dive in and explore this essential topic!

What is a Budgeting Worksheet Grade 8?

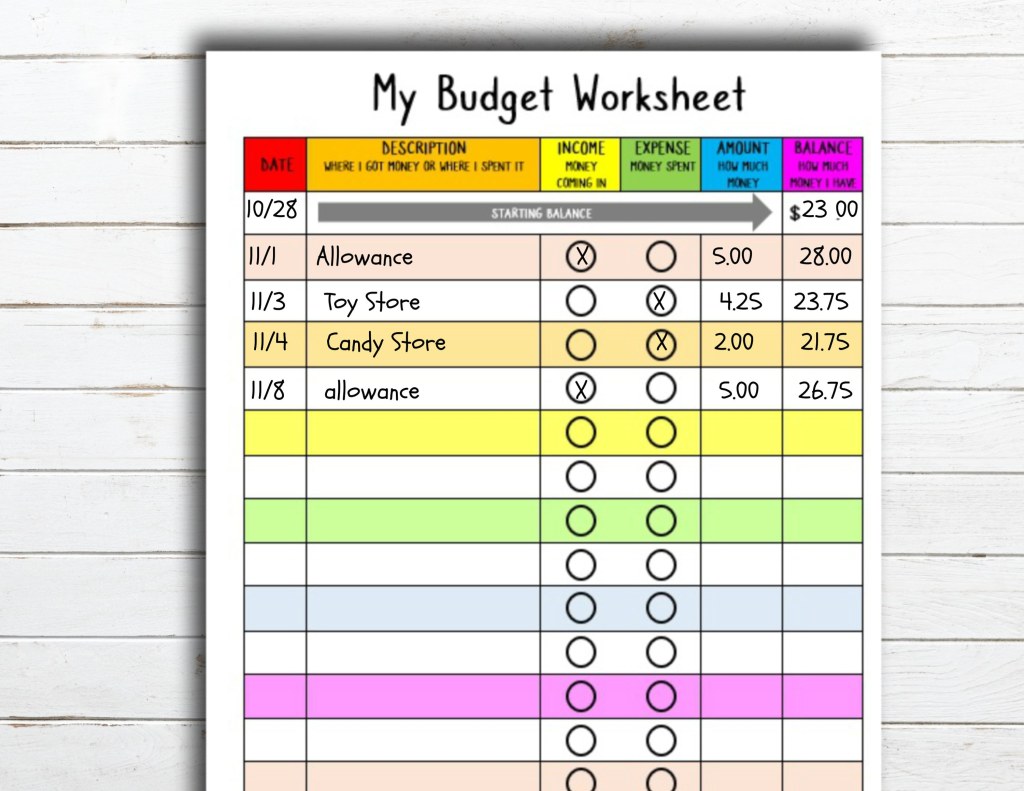

Image Source: etsystatic.com

A budgeting worksheet for grade 8 is a practical tool designed to help students manage their money effectively. It provides a structured format to track income, expenses, savings, and goals. By using a budgeting worksheet, grade 8 students can gain a better understanding of their financial situation and make informed decisions about spending and saving.

📝 To download a sample budgeting worksheet for grade 8, click here.

Who Should Use a Budgeting Worksheet Grade 8?

Grade 8 students are at a crucial stage in their lives where they start to develop more independence and make decisions regarding their finances. Therefore, a budgeting worksheet is invaluable for any grade 8 student who wants to take control of their money and learn essential financial skills.

When to Start Using a Budgeting Worksheet Grade 8?

It is never too early to start learning about budgeting and financial planning. Grade 8 is an ideal time to introduce budgeting worksheets, as students are beginning to earn money through allowances or part-time jobs. By starting early, they can develop healthy financial habits that will benefit them throughout their lives.

Where Can You Find Budgeting Worksheet Grade 8?

There are various resources available online that offer free budgeting worksheets for grade 8 students. These worksheets can be downloaded and printed for personal use. Additionally, many schools and educational institutions provide budgeting worksheets as part of their financial literacy curriculum.

Why Is Budgeting Worksheet Grade 8 Important?

Introducing budgeting worksheets to grade 8 students is essential for several reasons. Firstly, it teaches them the concept of financial responsibility and the importance of planning for both short-term and long-term goals. Additionally, budgeting worksheets help students develop critical thinking skills, such as prioritizing expenses and making informed financial decisions.

Moreover, budgeting worksheets instill financial discipline and promote good money management habits from an early age. By gaining a deeper understanding of their spending patterns and financial goals, grade 8 students can avoid unnecessary debt and make smarter financial choices as they grow older.

How to Use a Budgeting Worksheet Grade 8 Effectively?

Using a budgeting worksheet effectively involves several key steps. Firstly, students should gather all relevant financial information, including income sources, expenses, and savings goals. They should then allocate their income to different expense categories, such as entertainment, education, savings, and charity.

Regularly updating the budgeting worksheet and tracking expenses is crucial to ensure accuracy and make adjustments as needed. By periodically reviewing their budgeting worksheet, grade 8 students can identify areas where they may need to cut back on spending or find opportunities to increase savings.

Advantages and Disadvantages of Budgeting Worksheet Grade 8

1. Advantages:

✅ Develops financial literacy skills early on.

✅ Encourages responsible money management.

✅ Fosters a sense of control and empowerment.

✅ Prepares students for future financial challenges.

✅ Teaches the value of goal setting and prioritization.

2. Disadvantages:

❌ May require time and effort to maintain regularly.

❌ Students may find it challenging to stick to the budget initially.

❌ Limited flexibility in unexpected financial situations.

❌ Can be overly restrictive if not properly balanced.

❌ Relies on accurate tracking of expenses and income.

Frequently Asked Questions (FAQs)

1. What happens if I overspend in one category?

💡 It’s essential to review your budgeting worksheet regularly and make adjustments if necessary. If you overspend in one category, consider reducing expenses in other areas to balance your budget.

2. Can I modify the budgeting worksheet to suit my specific needs?

💡 Absolutely! Budgeting worksheets are meant to be personalized according to individual financial goals and circumstances. Feel free to adjust the categories or add additional sections that align with your needs.

3. How often should I update my budgeting worksheet?

💡 It is recommended to update your budgeting worksheet at least once a month or whenever there are significant changes in your income or expenses.

4. Should I include savings as part of my budget?

💡 Yes, it’s crucial to allocate a portion of your income towards savings. Set specific savings goals and prioritize saving for emergencies, education, or other future plans.

5. What if my income fluctuates each month?

💡 If your income varies from month to month, it’s essential to create a budget that considers your lowest expected income. This approach ensures that you have enough funds to cover your expenses even during lean months.

Conclusion

In conclusion, budgeting worksheets for grade 8 students play a vital role in instilling financial literacy skills and promoting responsible money management. By using these worksheets effectively, students can develop a strong foundation for their financial future and make informed financial decisions.

Start your journey to financial independence today by downloading a budgeting worksheet for grade 8 and taking control of your money!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as financial advice. It is always recommended to consult with a financial professional or advisor for personalized guidance based on your specific circumstances.