3 Budgeting Tools: Making Financial Management Easier

Introduction

Hello readers, welcome to our informative article on budgeting tools. In today’s digital age, managing finances can be overwhelming, but it doesn’t have to be. By utilizing the right budgeting tools, individuals can gain better control over their money and achieve their financial goals. In this article, we will explore three budgeting tools that can help you simplify your financial management. So, let’s dive in!

1. Mint 🌿

What is Mint? Mint is a popular budgeting tool that allows users to track their income, expenses, and create budgets all in one place. With its user-friendly interface and powerful features, Mint makes it easier for individuals to gain a comprehensive view of their financial health. By syncing their bank accounts, Mint automatically categorizes transactions, provides spending insights, and sends alerts for bill reminders. Whether you want to save for a vacation or pay off debt, Mint can help you achieve your financial goals.

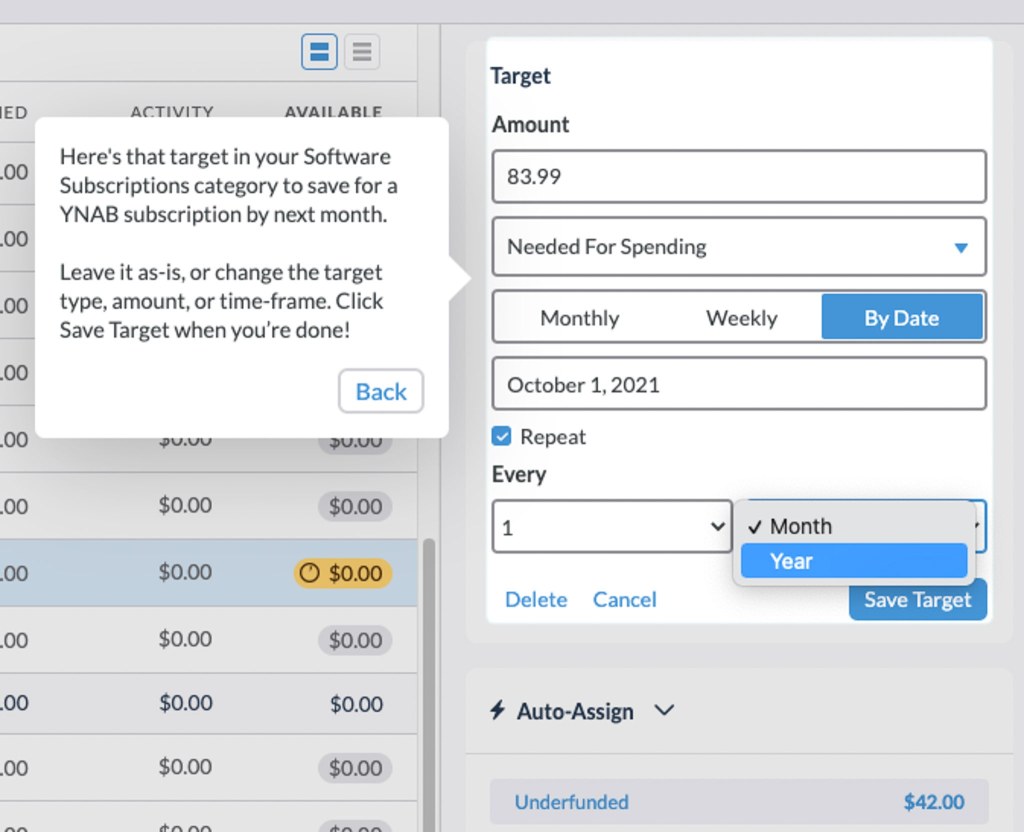

2. YNAB 💰

Image Source: thewirecutter.com

Who can benefit from using YNAB? YNAB, short for You Need a Budget, is a budgeting tool suitable for individuals who want to develop a proactive approach to their finances. YNAB focuses on four rules: give every dollar a job, embrace your true expenses, roll with the punches, and age your money. By following these principles, users can prioritize their spending, reduce debt, and build savings. YNAB’s goal-oriented features, such as goal tracking and debt paydown plans, help individuals stay on top of their financial game.

3. Personal Capital 💼

When should you consider using Personal Capital? Personal Capital is an all-in-one financial tool designed for individuals who want to monitor their investments, plan for retirement, and manage their overall financial picture. This tool provides a holistic view of your finances by syncing all your accounts, including bank accounts, investment portfolios, and retirement plans. With its robust analytics and retirement planner, Personal Capital helps individuals make informed investment decisions, optimize their portfolio, and plan for a secure financial future.

What are the Advantages and Disadvantages of using these Budgeting Tools?

Mint:

Advantages:

– User-friendly interface for easy navigation

– Automatically categorizes transactions for better expense tracking

– Provides personalized financial insights and alerts

Disadvantages:

– Limited customization options for budget categories

– Some users may find the ads intrusive

YNAB:

Advantages:

– Focuses on proactive budgeting and goal setting

– Encourages users to live within their means and reduce debt

– Provides excellent customer support and educational resources

Disadvantages:

– Requires a subscription fee

– Steep learning curve for new users

Personal Capital:

Advantages:

– Comprehensive view of all financial accounts in one place

– Advanced investment analysis and retirement planning tools

– Offers a free version with premium features available

Disadvantages:

– Not suitable for budgeting purposes only

– Some users may find the interface overwhelming

Frequently Asked Questions (FAQs)

1. Can I trust budgeting tools with my financial information?

Yes, reputable budgeting tools prioritize the security of your data. They use encryption protocols and secure servers to protect your information.

2. Are these budgeting tools suitable for small businesses?

While these tools primarily cater to personal finance management, Mint offers features that can be useful for small business owners to track expenses and manage cash flow.

3. Can I access these budgeting tools from my mobile device?

Absolutely! All three budgeting tools have mobile apps available for iOS and Android devices, allowing you to manage your finances on the go.5. Do these budgeting tools have customer support?

Yes, all three tools offer customer support through various channels, including email, live chat, and comprehensive knowledge bases to assist users with any queries or issues they may encounter.

Conclusion

In conclusion, utilizing budgeting tools such as Mint, YNAB, and Personal Capital can significantly simplify your financial management. These tools empower individuals to track their income, expenses, and create budgets that align with their financial goals. Whether you’re looking to pay off debt, save for the future, or monitor your investments, these budgeting tools provide the necessary features and insights to help you succeed. Start using these tools today and take control of your financial future!

Disclaimer: The information provided in this article is for informational purposes only and should not be considered financial advice. Always consult with a professional financial advisor before making any financial decisions.

Final Remarks

Thank you for taking the time to explore the world of budgeting tools with us. We hope this article has provided you with valuable insights and guidance on choosing the right tool for your financial needs. Remember, consistency and discipline are key when it comes to effective budgeting. Start implementing these tools into your financial routine, and you’ll be on your way to achieving financial success. Wishing you all the best on your financial journey!