Budgeting 400 a Month: Managing Your Finances Wisely

Greetings, Readers!

Are you struggling to make ends meet on a limited budget? Do you find it challenging to save money and cover all your expenses? If so, this article is for you. In today’s fast-paced world, it’s essential to have a solid budgeting plan in place. In this article, we will explore the concept of budgeting 400 a month and provide you with valuable tips and insights on how to effectively manage your finances. So let’s dive in!

Introduction

Before we delve into the specifics of budgeting 400 a month, let’s first understand what budgeting is and why it’s crucial for financial stability. Budgeting is the process of creating a plan for your money, allocating funds for different expenses, and tracking your spending habits. It helps you prioritize your financial goals and make informed decisions about your spending.

1️⃣ What is budgeting 400 a month?

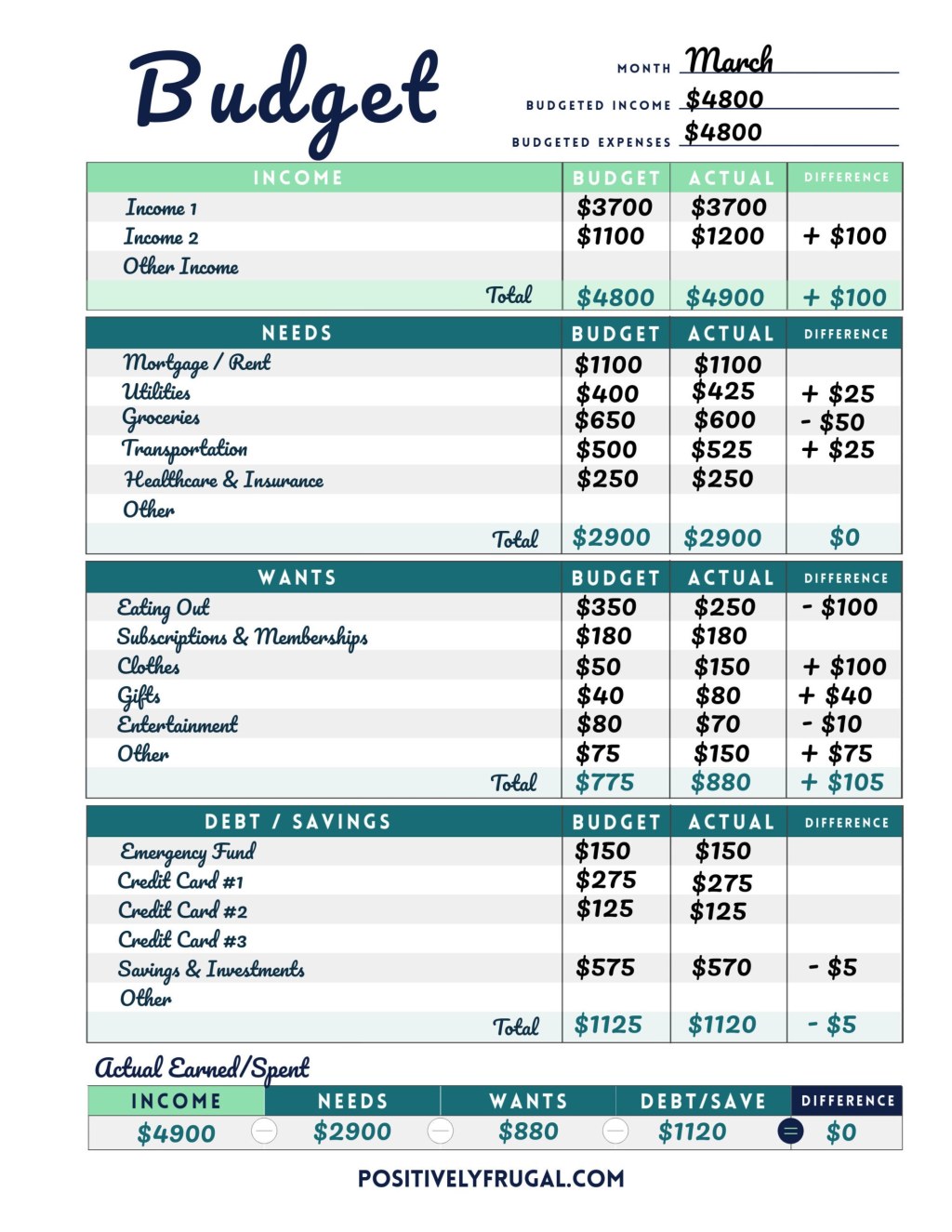

Image Source: positivelyfrugal.com

Budgeting 400 a month refers to the practice of allocating and managing your finances with a monthly budget of $400. This budget covers your essential expenses, such as rent, utilities, groceries, transportation, and other necessities.

2️⃣ Who can benefit from budgeting 400 a month?

Budgeting 400 a month is beneficial for anyone who wants to make the most of their limited income. It is especially useful for college students, young professionals, and individuals living on a fixed income.

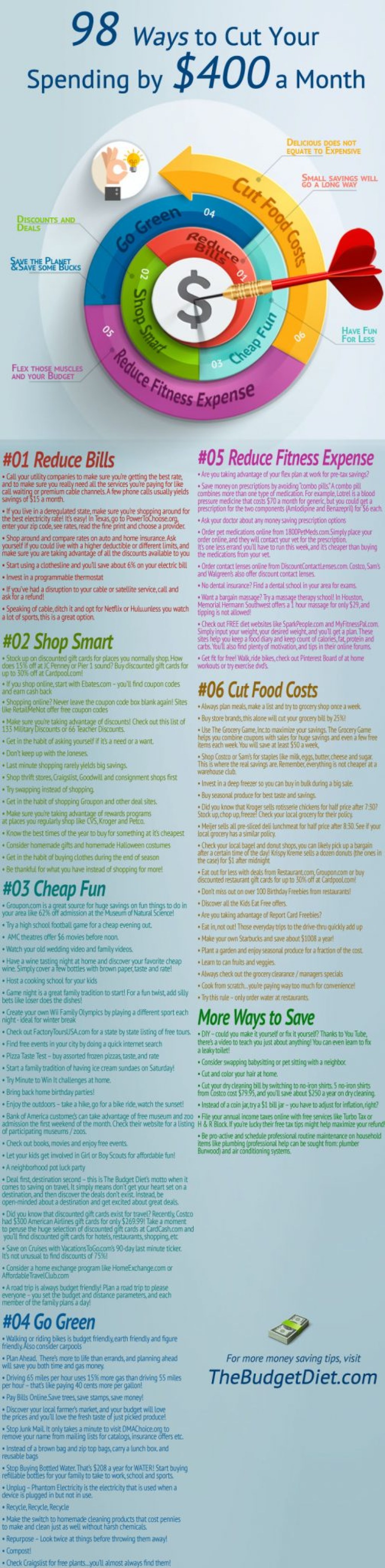

Image Source: thebudgetdiet.com

3️⃣ When should you start budgeting 400 a month?

It’s never too early or too late to start budgeting 400 a month. Whether you’re just starting your career or looking to improve your financial situation, budgeting can help you gain control over your money and achieve your financial goals.

4️⃣ Where should you allocate your budgeted 400 a month?

When budgeting 400 a month, it’s essential to allocate your funds wisely. Prioritize your essential expenses, such as housing, utilities, transportation, and groceries. Additionally, set aside a portion of your budget for savings and emergencies.

5️⃣ Why is budgeting 400 a month important?

Budgeting 400 a month is crucial because it allows you to live within your means, avoid debt, and save for the future. It helps you make conscious decisions about your spending and ensures that you can cover your essential expenses without financial stress.

6️⃣ How can you effectively budget 400 a month?

Effectively budgeting 400 a month requires careful planning and discipline. Start by tracking your expenses and income, prioritize your needs over wants, cut back on unnecessary expenses, and find creative ways to save money. Additionally, consider seeking professional advice or using budgeting tools and apps to streamline your financial management.

Advantages and Disadvantages of Budgeting 400 a Month

Like any budgeting strategy, budgeting 400 a month has its pros and cons. Let’s explore a few of them:

Advantages:

1. Increased financial discipline: Budgeting 400 a month forces you to become more disciplined with your spending habits, helping you develop better financial habits in the long run.

2. Improved savings: By allocating a specific amount for savings, budgeting 400 a month allows you to build an emergency fund or work towards your financial goals.

3. Reduced financial stress: Knowing exactly how much you can spend each month and having a plan in place helps alleviate financial stress and uncertainty.

Disadvantages:

1. Limited flexibility: Budgeting 400 a month may limit your ability to make spontaneous purchases or handle unexpected expenses that may arise.

2. Restrictive lifestyle: Depending on your income and expenses, budgeting 400 a month may require you to make sacrifices and cut back on non-essential expenses.

3. Inaccurate estimations: It can be challenging to accurately estimate your expenses and allocate the right amount for each category, potentially leading to budgeting setbacks.

Frequently Asked Questions

1. Q: Can I budget 400 a month if my income is irregular?

A: Yes, you can still budget 400 a month even with irregular income. It’s crucial to create a budget based on your average monthly income and adjust it as needed.

2. Q: How can I handle unexpected expenses while budgeting 400 a month?

A: It’s essential to allocate a portion of your budget for emergencies and unexpected expenses. Consider building an emergency fund to cover such situations.

3. Q: Is budgeting 400 a month suitable for families?

A: Budgeting 400 a month may be challenging for families with multiple members. However, it can still serve as a starting point for better financial management and can be adjusted based on individual circumstances.

4. Q: Can I still enjoy leisure activities while budgeting 400 a month?

A: Absolutely! Budgeting 400 a month doesn’t mean completely eliminating leisure activities. It means finding cost-effective ways to enjoy yourself, such as free events, discounts, or DIY projects.

5. Q: Should I seek professional help for budgeting 400 a month?

A: If you’re struggling to create an effective budget or manage your finances, seeking professional help from a financial advisor can provide invaluable guidance and support.

Conclusion

In conclusion, budgeting 400 a month is an effective way to manage your finances, especially if you have limited income. It allows you to live within your means, save for the future, and avoid unnecessary debt. By following the tips and strategies mentioned in this article, you can take control of your financial situation and work towards a more secure future. Start budgeting today and experience the freedom that comes with financial stability!

Remember, managing your finances is a lifelong journey, and it’s essential to adapt your budget as your circumstances change. Stay disciplined, seek knowledge, and always strive to improve your financial well-being. Best of luck on your budgeting journey, and remember, your financial future is in your hands! 💪

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Consult with a professional financial advisor before making any significant financial decisions.