Personal Finance Waterfall: A Guide to Managing Your Finances Effectively

Greetings, Readers!

Welcome to our comprehensive guide on personal finance waterfall. In this article, we will delve into the details of this financial management strategy and how it can help you achieve your financial goals. Whether you are just starting your financial journey or looking for ways to optimize your current financial situation, this guide will provide you with valuable insights and actionable steps to take control of your finances.

Introduction

Managing personal finances can sometimes feel like a daunting task, especially with the myriad of financial goals and responsibilities we have. This is where the concept of personal finance waterfall comes into play. Simply put, personal finance waterfall is a systematic approach to managing your finances, ensuring that every dollar you earn is allocated efficiently towards your financial goals. It involves prioritizing and directing your income towards various aspects of your financial life, creating a seamless flow of funds.

By implementing the personal finance waterfall strategy, you can gain a better understanding of your financial situation, make informed decisions, and ultimately achieve financial freedom. Now, let’s explore the key components of personal finance waterfall to help you get started on your journey towards financial success.

What is Personal Finance Waterfall?

🔑 Personal finance waterfall is a methodical approach to managing your money, where you prioritize and allocate your income towards different financial goals and obligations. It involves categorizing your income and expenses into various tiers, ensuring that each tier is adequately funded before moving on to the next. This approach helps you optimize your financial resources and align your spending with your long-term goals.

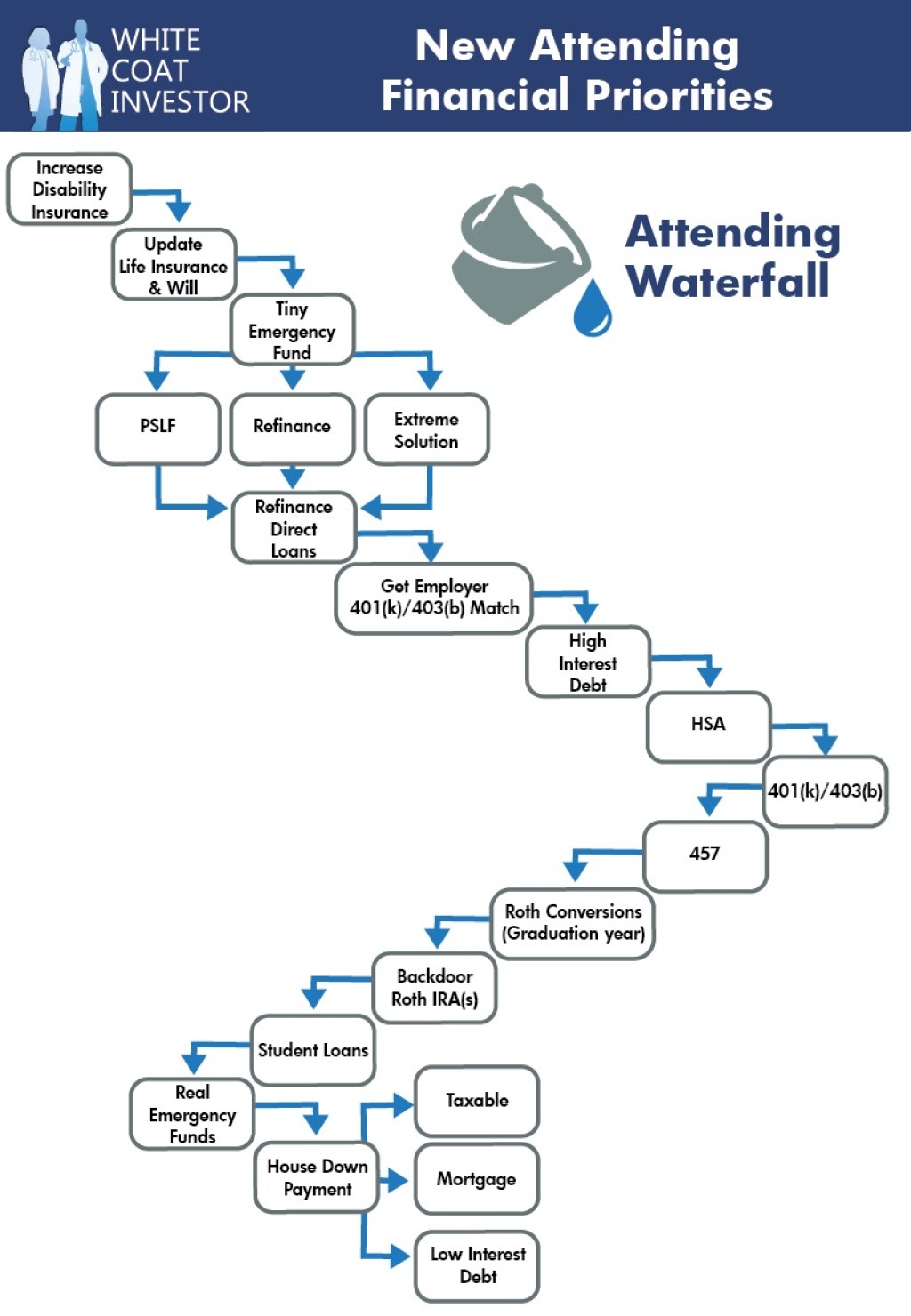

Image Source: whitecoatinvestor.com

🔑 The personal finance waterfall typically consists of several tiers, including an emergency fund, debt repayment, investments, retirement savings, and discretionary spending. Each tier serves a specific purpose and provides a solid foundation for your overall financial well-being.

Who Can Benefit from Personal Finance Waterfall?

🔑 Personal finance waterfall is beneficial for individuals of all income levels and financial backgrounds. Whether you are a fresh graduate just starting your career or a seasoned professional looking to maximize your wealth, implementing this strategy can significantly improve your financial position.

🔑 Additionally, personal finance waterfall is particularly helpful for those struggling with debt or living paycheck to paycheck. It provides a structured framework to manage your finances and prioritize debt repayment, ensuring that you are making progress towards your financial goals while also meeting your day-to-day obligations.

When Should You Start Implementing Personal Finance Waterfall?

🔑 The ideal time to start implementing the personal finance waterfall strategy is as soon as possible. Regardless of your current financial situation, taking control of your finances and planning for the future is crucial. The earlier you start, the more time you have to build a strong financial foundation and secure your financial future.

🔑 However, it’s never too late to implement the personal finance waterfall approach. Even if you’re starting later in life, you can still benefit greatly from this strategy and make significant improvements to your financial well-being.

Where to Begin with Personal Finance Waterfall?

Image Source: investopedia.com

🔑 To begin implementing personal finance waterfall, you need to start by assessing your current financial situation. Take stock of your income, expenses, and financial goals. This will help you gain clarity on your priorities and identify areas where you can make adjustments to optimize your finances.

🔑 Once you have a clear understanding of your financial landscape, you can begin creating your personal finance waterfall by establishing the different tiers and allocating your income accordingly. It’s essential to continually review and adjust your plan as your financial situation evolves.

Why is Personal Finance Waterfall Important?

🔑 Personal finance waterfall is important because it provides a structured approach to managing your finances. It ensures that you are making the most of your income by allocating it towards different financial goals and obligations. This strategy helps you avoid unnecessary debt, build an emergency fund, save for retirement, and achieve financial stability.

🔑 Additionally, personal finance waterfall encourages discipline and financial responsibility. By following this approach, you develop healthy financial habits and gain better control over your money. It empowers you to make informed decisions about your spending, avoid impulsive purchases, and stay focused on your long-term financial goals.

How to Implement Personal Finance Waterfall?

🔑 Implementing personal finance waterfall involves several key steps:

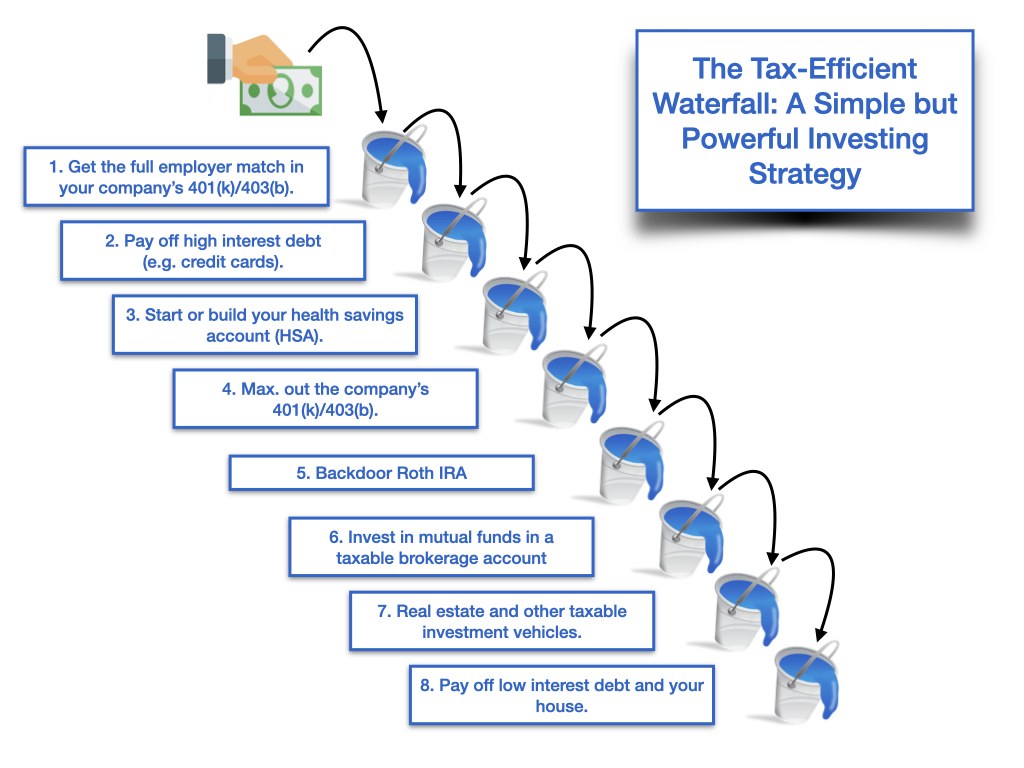

Image Source: thescopeofpractice.com

1. Create a budget: Start by tracking your income and expenses to create a realistic budget. This will help you understand your cash flow and identify areas where you can cut expenses or save more.

2. Prioritize debt repayment: If you have existing debts, allocate a portion of your income towards debt repayment. Focus on high-interest debts first and gradually work towards becoming debt-free.

3. Build an emergency fund: Set aside a portion of your income in an emergency fund. Aim to save at least three to six months’ worth of living expenses. This will provide a safety net in case of unexpected financial emergencies.

4. Save for retirement: Allocate a percentage of your income towards retirement savings. Consider opening a retirement account and take advantage of any employer matching contributions.

5. Focus on investments: Once you have established an emergency fund and started saving for retirement, you can explore investment opportunities. Consult with a financial advisor to determine the best investment options based on your risk tolerance and financial goals.

6. Allocate funds for discretionary spending: After taking care of your essential financial obligations, allocate a portion of your income for discretionary spending. This can be used for leisure activities, vacations, or any non-essential expenses.

Advantages and Disadvantages of Personal Finance Waterfall

Advantages:

1. Financial clarity: Personal finance waterfall provides a clear picture of your financial situation, allowing you to make informed decisions.

2. Debt reduction: By prioritizing debt repayment, personal finance waterfall helps you become debt-free faster.

3. Savings and investments: This strategy ensures that you are consistently saving and investing towards your long-term financial goals.

4. Financial discipline: Personal finance waterfall encourages disciplined spending and helps you avoid unnecessary debt.

5. Flexibility: While personal finance waterfall provides a structured framework, it also allows for flexibility and adjustments as needed.

Disadvantages:

1. Initial setup: Implementing personal finance waterfall requires time and effort to set up the different tiers and allocate your income accordingly.

2. Rigidity: While the strategy allows for flexibility, it may feel rigid for individuals who prefer a more spontaneous approach to their finances.

3. Habit formation: Following personal finance waterfall requires discipline and habit formation, which can be challenging for some individuals.

4. Unexpected expenses: Despite having an emergency fund, unexpected expenses can still disrupt your financial plans.

5. Investment risk: Investing involves risks, and market fluctuations can impact the returns on your investments.

Frequently Asked Questions (FAQ)

1. Can I start implementing personal finance waterfall if I have significant debt?

Yes, personal finance waterfall is especially beneficial if you have significant debt. By prioritizing debt repayment and allocating your income towards this goal, you can make significant progress in becoming debt-free.

2. How much should I allocate towards discretionary spending?

The percentage allocated towards discretionary spending will depend on your financial goals and overall financial situation. It’s important to strike a balance between enjoying your money and prioritizing long-term financial stability.

3. Is personal finance waterfall only for those with high incomes?

No, personal finance waterfall is suitable for individuals of all income levels. It helps you optimize your finances regardless of your income, allowing you to make the most of the money you have.

4. Can I make adjustments to my personal finance waterfall plan?

Yes, personal finance waterfall plans are meant to be flexible. As your financial situation evolves, you may need to make adjustments to your plan to accommodate changes in income, expenses, or financial goals.

5. How long does it take to see results with personal finance waterfall?

The time it takes to see results with personal finance waterfall will vary depending on your financial goals, income, and current financial situation. It’s important to be patient and stay committed to your plan for long-term success.

Conclusion

In conclusion, personal finance waterfall is a powerful strategy for managing your finances effectively. By implementing this approach, you can gain financial clarity, reduce debt, save for the future, and achieve your long-term financial goals. Remember, the key is to start as soon as possible and remain consistent in your efforts. Take control of your finances today and embark on a journey towards financial freedom!

Final Remarks

🔐 The information provided in this article is for educational purposes only and should not be considered financial advice. It is always recommended to consult with a qualified financial professional before making any financial decisions. Remember, everyone’s financial situation is unique, and what works for one person may not work for another. Stay informed, stay disciplined, and take proactive steps towards achieving your financial goals. Good luck!