3 Budgeting Apps

Greetings, Readers! Today, we will explore three budgeting apps that can help you manage your finances effectively. In this article, we will provide you with a comprehensive overview of these apps, including their features, benefits, and drawbacks.

Introduction

In today’s fast-paced world, it is essential to have a reliable tool to track and manage your expenses. Budgeting apps have emerged as a popular solution for individuals and businesses alike. These apps offer a range of features to help users set financial goals, track expenses, and monitor saving progress. In this article, we will introduce you to three budgeting apps that stand out from the rest: Mint, PocketGuard, and YNAB.

Now, let’s dive into the details of each app and discover how they can assist you in achieving your financial goals.

Mint

Mint is a widely popular budgeting app that offers comprehensive financial management tools. It allows users to link their bank accounts, credit cards, and investments to get a real-time overview of their financial situation. With its user-friendly interface, Mint provides a simple and intuitive way to track expenses, set budgets, and monitor spending patterns. It also offers personalized advice and recommendations to help users save money and reduce unnecessary expenses.

What is Mint?

Mint is a free budgeting app that enables users to manage their finances effectively. It offers various features, including expense tracking, budgeting tools, and financial goal-setting.

Who can benefit from Mint?

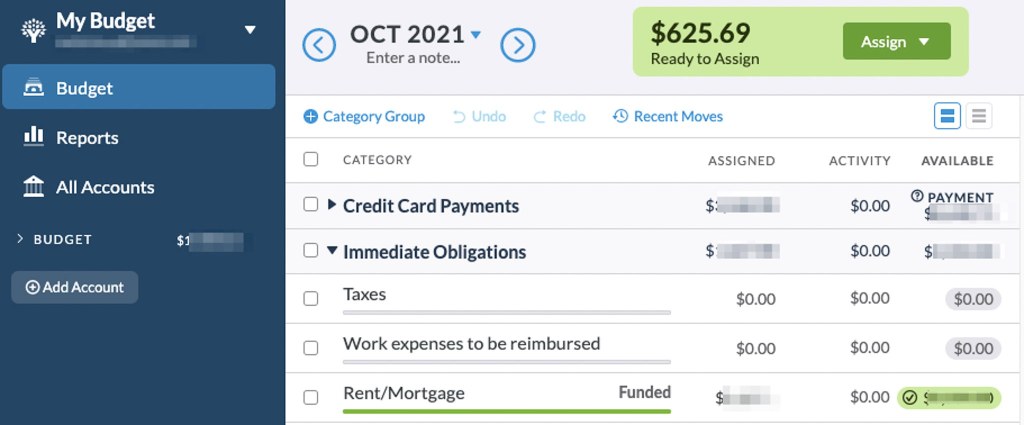

Image Source: thewirecutter.com

Mint is suitable for individuals of all ages and financial backgrounds who want to track their spending, improve their saving habits, and gain control over their finances. Whether you are a student, young professional, or retiree, Mint can help you achieve your financial goals.

When should you use Mint?

Mint is an excellent choice if you are looking for a budgeting app that provides a comprehensive overview of your finances in real-time. It is especially beneficial if you have multiple bank accounts, credit cards, and investments that you want to manage simultaneously.

Where can you use Mint?

Mint is available as a mobile app for iOS and Android devices, making it convenient to access your financial data on the go. Additionally, you can also access Mint through its website, allowing you to manage your finances from any computer with an internet connection.

Why should you choose Mint?

Mint offers a range of features that make it a compelling choice for individuals seeking to improve their financial well-being. Its ability to sync with various financial institutions and provide real-time updates ensures that you always have an accurate picture of your finances. Mint’s user-friendly interface and personalized recommendations further enhance the user experience, making it easier to stick to your budget and achieve your financial goals.

How can you start using Mint?

To start using Mint, simply download the app from the App Store or Google Play Store. Once installed, create an account and link your bank accounts, credit cards, and investment accounts. Mint will then import your financial data and provide you with a comprehensive overview of your finances.

PocketGuard

Image Source: thewirecutter.com

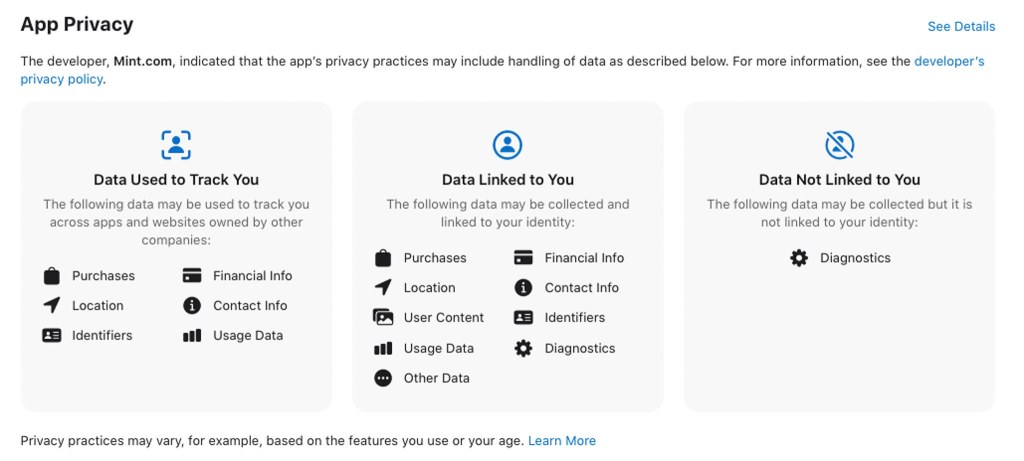

PocketGuard is another popular budgeting app that offers unique features to help users manage their money efficiently. It focuses on providing a simplified view of your finances, allowing you to track your income, expenses, and savings effortlessly. With its intuitive interface and smart categorization, PocketGuard makes it easy to understand your spending patterns and identify areas where you can save money.

What is PocketGuard?

PocketGuard is a budgeting app that aims to simplify the financial management process. It offers a simplified view of your finances and provides insights on how to save money and improve your financial well-being.

Who can benefit from PocketGuard?

PocketGuard is ideal for individuals who want a hassle-free way to track their expenses and save money. Whether you are new to budgeting or a seasoned pro, PocketGuard can help you achieve your financial goals.

When should you use PocketGuard?

PocketGuard is best suited for individuals who prefer a straightforward approach to budgeting. If you want a budgeting app that focuses on simplicity and ease of use, PocketGuard is an excellent choice.

Where can you use PocketGuard?

PocketGuard is available as a mobile app for iOS and Android devices. You can also access your PocketGuard account through their website, allowing you to manage your finances from any device with an internet connection.

Why should you choose PocketGuard?

Image Source: shortpixel.ai

PocketGuard’s simple and intuitive interface sets it apart from other budgeting apps. It offers a hassle-free way to track your expenses, save money, and achieve your financial goals. With its smart categorization and personalized insights, PocketGuard helps you make informed financial decisions and avoid unnecessary expenses.

How can you start using PocketGuard?

To start using PocketGuard, download the app from the App Store or Google Play Store. After creating an account, link your bank accounts and credit cards to import your financial data. PocketGuard will then analyze your financial situation and provide personalized recommendations to help you save money.

YNAB

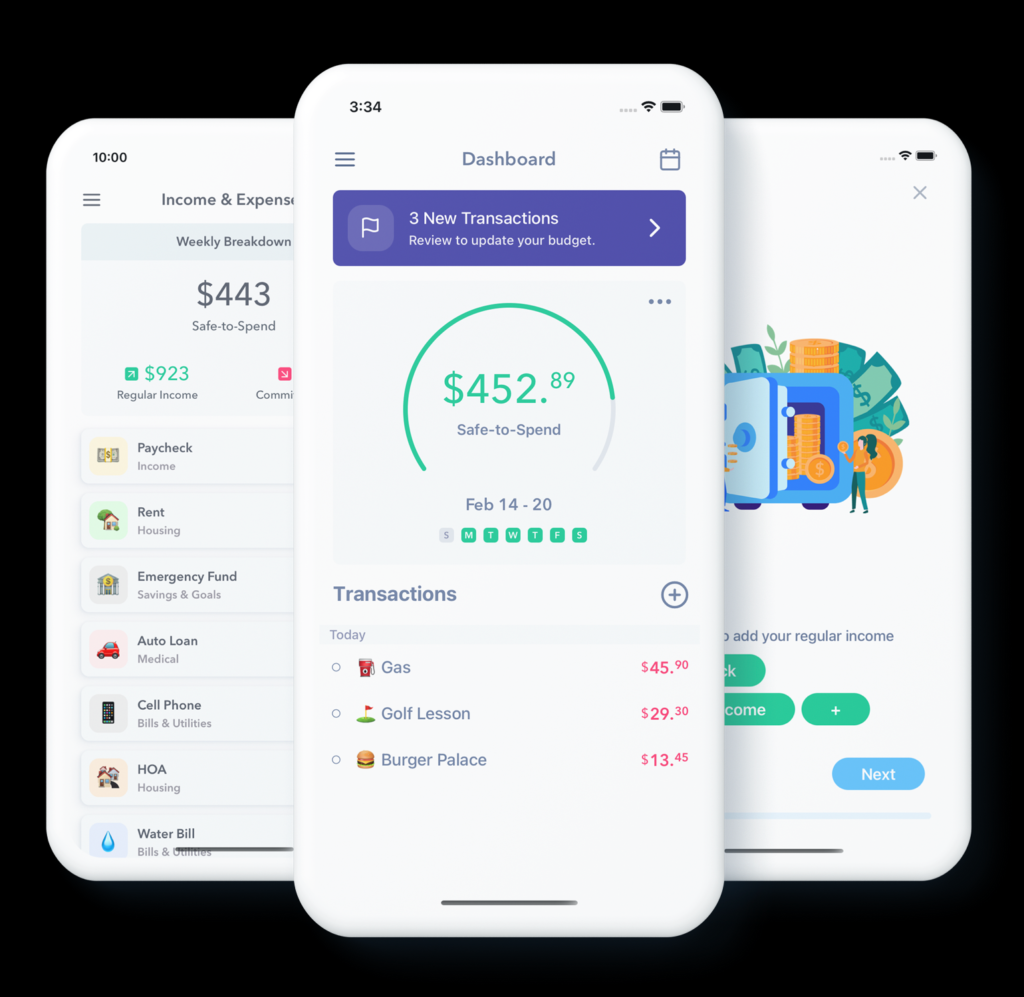

YNAB, short for You Need a Budget, is a budgeting app that focuses on helping users gain control of their finances. It follows a unique budgeting philosophy that encourages users to allocate every dollar they earn into specific categories. YNAB provides tools and features that enable users to track expenses, set financial goals, and save for the future.

What is YNAB?

YNAB is a budgeting app that aims to help individuals gain control of their finances by following a unique budgeting philosophy. It provides tools and features to track expenses, set financial goals, and save money.

Who can benefit from YNAB?

YNAB is suitable for individuals who want to take a proactive approach to budgeting and gain control over their finances. Whether you are living paycheck to paycheck or have a steady income, YNAB can help you manage your money effectively.

When should you use YNAB?

YNAB is best suited for individuals who are committed to following a budgeting philosophy that involves allocating every dollar they earn into specific categories. If you want to gain control of your finances and make informed financial decisions, YNAB is the right choice.

Where can you use YNAB?

YNAB is available as a mobile app for iOS and Android devices. You can also access your YNAB account through their website, allowing you to manage your finances from any device with internet access.

Why should you choose YNAB?

YNAB’s unique budgeting philosophy sets it apart from other budgeting apps. By allocating every dollar you earn into specific categories, YNAB helps you prioritize your spending, save money, and achieve your financial goals. Its user-friendly interface and educational resources further enhance the user experience, making it easier to build healthy financial habits.

How can you start using YNAB?

To start using YNAB, download the app from the App Store or Google Play Store. After creating an account, follow the onboarding process to set up your budget and link your bank accounts. YNAB will then guide you through the process of allocating your income, tracking expenses, and achieving your financial goals.

Advantages and Disadvantages of the Budgeting Apps

While budgeting apps offer numerous benefits, it is essential to consider their drawbacks as well. Let’s take a closer look at the advantages and disadvantages of Mint, PocketGuard, and YNAB.

Mint

Advantages:

Real-time overview of your finances

Easy expense tracking and budgeting

Personalized recommendations to save money

Disadvantages:

Ads and promotional offers within the app

May require frequent account syncing

Some users find the categorization feature less accurate

PocketGuard

Advantages:

Simplified view of your finances

Intuitive interface and effortless expense tracking

Smart categorization and personalized insights

Disadvantages:

May not offer advanced budgeting features

Limited customization options

Some users find the syncing process unreliable

YNAB

Advantages:

Unique budgeting philosophy to gain control of your finances

Tools and features to track expenses and set financial goals

User-friendly interface and educational resources

Disadvantages:

Requires a proactive approach and commitment to the budgeting philosophy

May have a learning curve for new users

Does not offer investment tracking

Frequently Asked Questions (FAQ)

1. Can I use multiple budgeting apps simultaneously?

Yes, you can use multiple budgeting apps simultaneously if it helps you achieve your financial goals. However, it is essential to ensure that the apps are compatible and do not cause confusion in managing your finances.

2. Are these budgeting apps secure?

Yes, all three budgeting apps mentioned in this article take security seriously and use advanced encryption techniques to protect your financial data. However, it is always advisable to use strong, unique passwords and enable two-factor authentication for added security.

3. Can these apps help me save money?

Yes, all three apps offer features and recommendations to help you save money and improve your saving habits. By tracking your expenses, setting budgets, and providing personalized insights, these apps can assist you in achieving your saving goals.

4. Are these apps available globally?

Yes, all three budgeting apps discussed in this article are available globally. However, some features may vary depending on your location and the financial institutions they support.

5. Can I use these apps for business budgeting?

While these apps are primarily designed for personal budgeting, they can also be used for business budgeting to some extent. However, if you require advanced features, such as invoicing or payroll management, it is recommended to explore dedicated business budgeting solutions.

Conclusion

In conclusion, budgeting apps like Mint, PocketGuard, and YNAB offer valuable tools and features to help you manage your finances effectively. Whether you are a beginner or an experienced budgeter, these apps can assist you in tracking your expenses, setting budgets, and achieving your financial goals. However, it is essential to consider your specific needs and preferences before choosing the app that best suits you. Start using one of these budgeting apps today and take control of your financial future!

Final Remarks

Disclaimer: The information provided in this article is for general informational purposes only and should not be considered as financial advice. Before making any financial decisions, it is recommended to consult with a qualified professional.