Personal Finance Empower

Introduction

Welcome, readers! Today, we will be discussing an important topic that can greatly impact your financial well-being: personal finance empower. In this article, we will dive into the details of what personal finance empower entails, who can benefit from it, when and where it can be implemented, why it is essential, and how you can make the most out of it. So, let’s get started and empower ourselves to take control of our financial lives!

What is Personal Finance Empower?

🔑 Personal finance empower refers to the process of gaining knowledge, skills, and confidence to make informed financial decisions that align with your goals and values. It involves understanding various financial aspects such as budgeting, investing, saving, and managing debt. By empowering yourself in personal finance, you can achieve financial stability and build a secure future.

Who can Benefit from Personal Finance Empower?

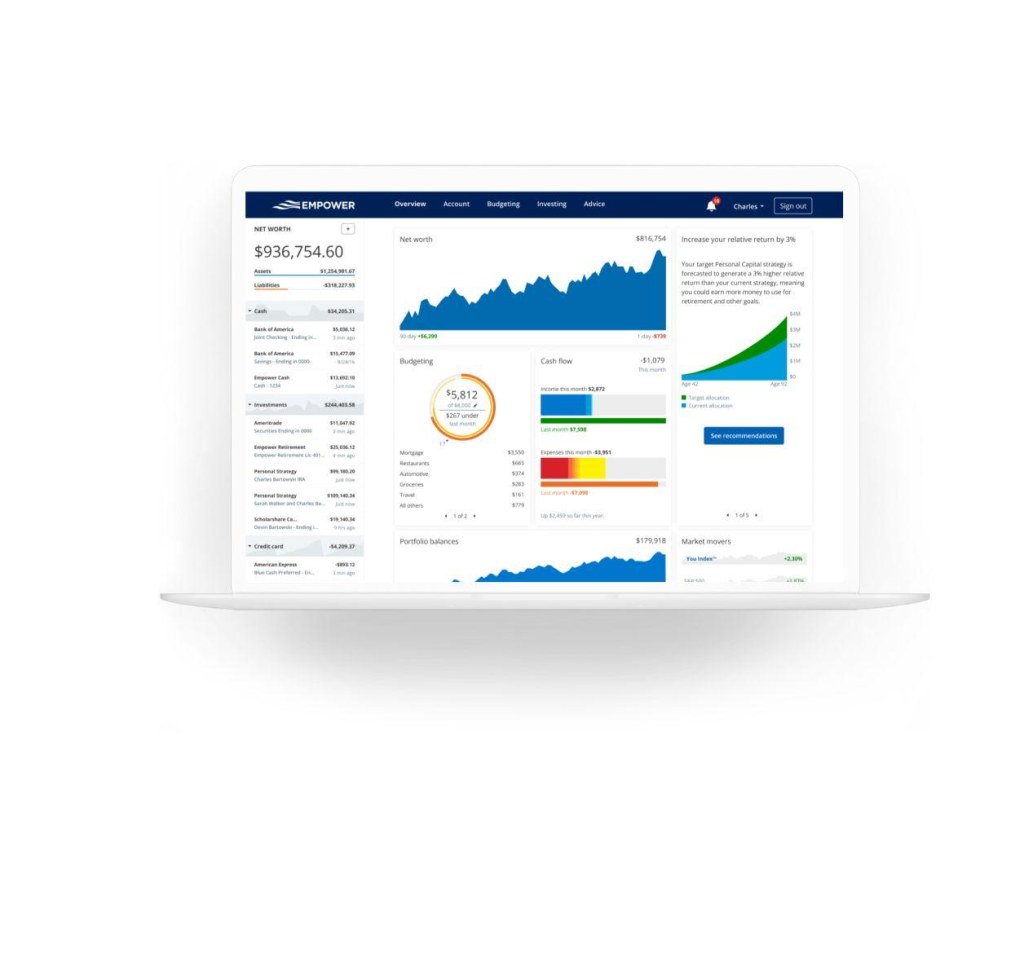

Image Source: empower.com

🤝 Personal finance empower is relevant to everyone, regardless of their income level, age, or occupation. Whether you are a young professional starting your career, a family striving to achieve financial goals, or a retiree planning for a comfortable life, personal finance empower can benefit you. It equips you with the knowledge and tools to make sound financial decisions and create a better financial future.

When and Where to Implement Personal Finance Empower?

⌚ Personal finance empower is an ongoing process that can be implemented at any stage of life. It is never too early or too late to start. Whether you are just starting your first job or nearing retirement, developing good financial habits and empowering yourself in personal finance can have a positive impact. Additionally, personal finance empower can be implemented anywhere, as it is not bound by geographical boundaries. The principles and strategies can be applied globally.

Why is Personal Finance Empower Essential?

💡 Personal finance empower is essential for several reasons. First and foremost, it allows you to take control of your financial situation and avoid common financial pitfalls. It helps you establish financial goals and work towards achieving them. Additionally, personal finance empower enables you to make informed decisions about spending, saving, investing, and managing debt, leading to long-term financial stability. It also provides a sense of financial security and peace of mind.

How to Make the Most Out of Personal Finance Empower?

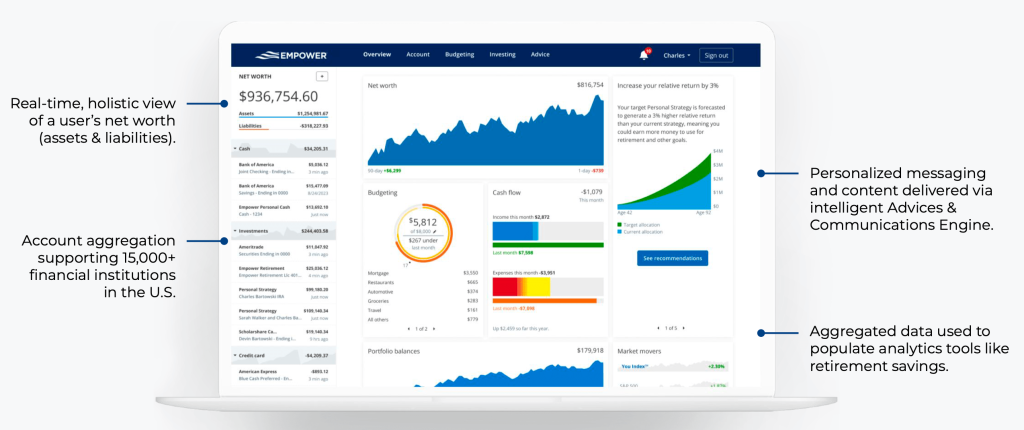

Image Source: i2.wp.com

✅ To make the most out of personal finance empower, it is important to educate yourself about various financial topics. Attend workshops, read books, or take online courses to expand your knowledge. Set financial goals that are specific, measurable, achievable, relevant, and time-bound (SMART). Create a budget to track your income and expenses. Invest wisely and diversify your portfolio. Regularly review and update your financial plan. Seek advice from financial experts if needed. By taking these steps, you can maximize the benefits of personal finance empower.

Advantages and Disadvantages of Personal Finance Empower

Advantages:

1. 📈 Improved Financial Decision Making: Personal finance empower equips you with the knowledge and skills to make informed financial decisions, leading to better outcomes.

2. 💰 Financial Stability: By effectively managing your finances, you can achieve financial stability and reduce the stress associated with money-related issues.

3. 🌟 Goal Achievement: Personal finance empower helps you set and achieve financial goals, such as buying a house, saving for retirement, or starting a business.

4. 📚 Financial Education: Engaging in personal finance empower provides an opportunity to learn and expand your knowledge about various financial topics.

5. 💪 Empowerment: Taking control of your financial situation through personal finance empower gives you a sense of empowerment and control over your future.

Disadvantages:

1. 💸 Initial Learning Curve: Personal finance empower may require some initial effort to understand financial concepts and implement effective strategies.

2. 🤷♂️ Time Commitment: Managing personal finances effectively may require dedicating time for budgeting, financial planning, and monitoring.

3. 💼 Complexities: Depending on your financial situation, certain aspects of personal finance empower, such as tax planning or investment management, may involve complexities best handled by professionals.

4. 💔 Potential Mistakes: Without proper knowledge or guidance, there is a risk of making mistakes in financial decision-making, which can have negative consequences.

5. 🔄 Changing Financial Landscape: The financial landscape is constantly evolving, and staying updated with the latest trends and regulations may be challenging.

Frequently Asked Questions (FAQs)

Q: Can personal finance empower help me get out of debt?

A: Absolutely! Personal finance empower provides strategies and tools to manage and eliminate debt effectively.

Q: Is personal finance empower only for wealthy individuals?

A: Not at all. Personal finance empower is relevant for individuals of all income levels. It helps in building financial stability and long-term wealth.

Q: Is it necessary to work with a financial advisor for personal finance empower?

A: While working with a financial advisor can provide valuable insights, personal finance empower can also be achieved through self-education and research.

Q: How long does it take to see the benefits of personal finance empower?

A: The benefits of personal finance empower can vary depending on individual circumstances. However, with consistent effort and discipline, positive changes can be seen in the short to medium term.

Q: Can personal finance empower improve my credit score?

A: Yes, personal finance empower includes strategies to manage credit effectively, which can lead to an improved credit score over time.

Conclusion

In conclusion, personal finance empower is a crucial aspect of leading a financially healthy life. By understanding the principles and strategies of personal finance, you can take control of your financial situation, achieve your goals, and build a secure future. Remember to continuously educate yourself, stay disciplined, and seek professional advice when needed. Start your journey towards personal finance empower today, and reap the benefits for years to come. Empower yourself and secure your financial future!

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered as professional financial advice. The strategies and concepts discussed may not be suitable for everyone, and it is recommended to consult with a qualified financial advisor before making any financial decisions. The author and publisher of this article are not liable for any damages or losses incurred by the reader as a result of the information provided.