Budgeting Your $35,000 Salary: A Comprehensive Guide

Introduction

Dear Readers,

Welcome to our comprehensive guide on budgeting your $35,000 salary. In this article, we will explore various strategies and tips to help you make the most of your income and achieve financial stability. Budgeting is an essential skill that can empower you to take control of your finances, save for the future, and reach your financial goals. By following the advice provided in this guide, you will be able to make informed decisions about your spending, prioritize your expenses, and build a solid financial foundation. So let’s dive in and learn how to effectively manage your $35,000 salary!

What is Budgeting?

Image Source: upthegains.co.uk

🤔 Budgeting is the process of creating a plan for your income and expenses. It involves tracking your spending, setting financial goals, and making conscious decisions about how you allocate your resources. With a solid budget in place, you can ensure that your income covers your essential expenses, while also allowing for savings and discretionary spending.

Why is Budgeting Important?

🔍 Budgeting is important because it provides you with a clear picture of your financial situation. It helps you understand where your money is going and enables you to make necessary adjustments to achieve your financial goals. Without a budget, you may find yourself living paycheck to paycheck, struggling to pay your bills, or unable to save for the future.

Who Can Benefit from Budgeting?

👥 Budgeting is beneficial for everyone, regardless of their income level. Whether you earn $35,000 or $100,000, having a budget can help you make the most of your money and achieve financial stability. It is particularly important for individuals with limited income to ensure they are making wise financial decisions and stretching their dollars as far as possible.

When Should You Start Budgeting?

Image Source: moneybliss.org

📅 It is never too late to start budgeting! Whether you are just starting your career or are well into your professional journey, creating a budget is a valuable step towards financial success. The sooner you start budgeting, the sooner you can take control of your finances and work towards achieving your financial goals.

Where to Begin with Budgeting?

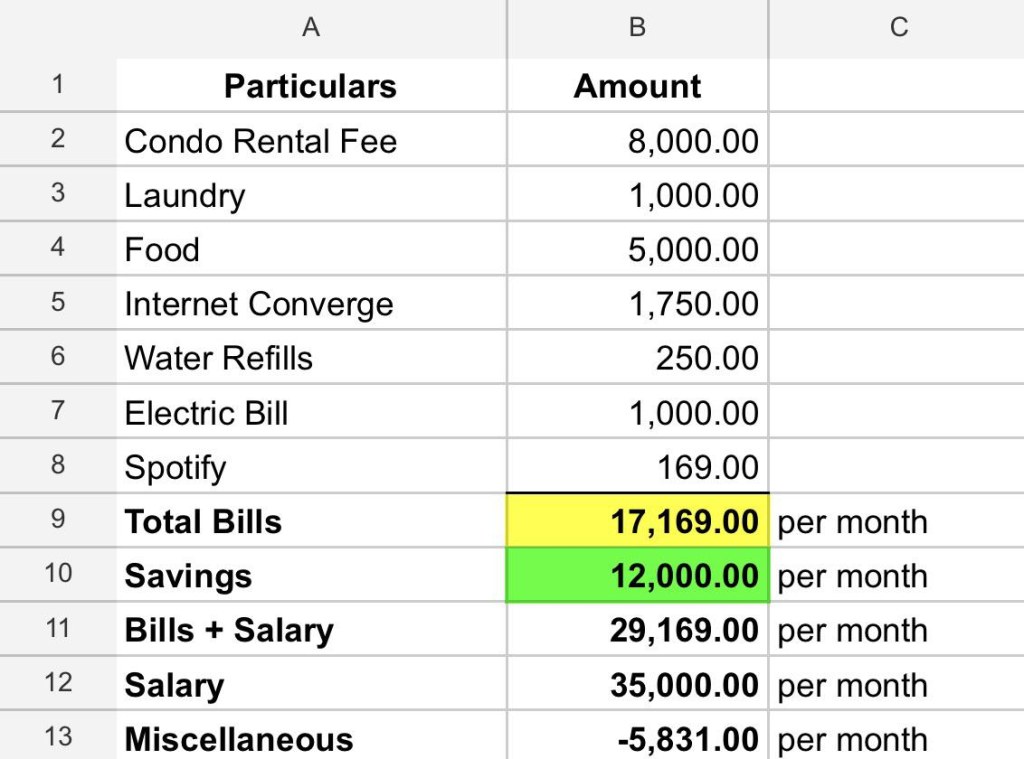

🌟 To begin budgeting your $35,000 salary, you need to gather information about your income and expenses. Start by calculating your total monthly income after taxes. Then, make a list of all your monthly expenses, including rent, utilities, groceries, transportation, and any recurring bills such as student loans or credit card payments.

How to Create a Budget?

Image Source: redd.it

📝 Creating a budget involves allocating your income to various expense categories and setting spending limits for each. Start by prioritizing your essential expenses, such as housing, utilities, and food. Then, allocate a portion of your income towards savings and debt repayment. Finally, set aside a small amount for discretionary spending, such as entertainment or dining out.

Advantages and Disadvantages of Budgeting a $35,000 Salary

Advantages

✅ 1. Financial Control: Budgeting allows you to have a clear understanding of your financial situation and take control of your money.

✅ 2. Goal Achievement: A budget helps you set and achieve financial goals, such as saving for a down payment or paying off debt.

✅ 3. Avoid Overspending: Budgeting helps you avoid overspending and ensure that your income covers all of your essential expenses.

✅ 4. Emergency Preparedness: By budgeting and saving, you can create an emergency fund to handle unexpected expenses.

✅ 5. Reduce Stress: Having a budget in place reduces financial stress and provides peace of mind.

Disadvantages

❌ 1. Restrictive: Budgeting requires discipline and may feel restrictive at times, especially when you need to limit discretionary spending.

❌ 2. Unexpected Expenses: Despite budgeting, unexpected expenses may arise, which can disrupt your budget and financial plans.

❌ 3. Time-Consuming: Creating and maintaining a budget requires time and effort, particularly when tracking expenses and updating your budget regularly.

❌ 4. Potential for Error: Mistakes in budgeting, such as misestimating expenses, can lead to financial imbalances and difficulties meeting your financial goals.

❌ 5. Unrealistic Expectations: Setting unrealistic goals or expectations in your budget can lead to frustration and discouragement.

Frequently Asked Questions (FAQ)

1. Can I Budget with a $35,000 Salary?

🤔 Absolutely! Budgeting is not limited to high-income individuals. With proper planning and prioritization, you can make the most of your $35,000 salary.

2. How Much Should I Allocate to Savings?

📈 It is recommended to allocate at least 20% of your income to savings. However, if you have debt, it is advisable to allocate a portion towards debt repayment as well.

3. What if I Have Irregular Income?

💼 If you have irregular income, it is essential to create a budget based on your average monthly earnings. Save any surplus income during high-earning months to cover expenses during low-earning months.

4. Should I Use Budgeting Apps or Spreadsheets?

📱 The choice between budgeting apps and spreadsheets depends on your personal preference. Both options can be effective in tracking expenses and managing your budget.

5. Can I Adjust My Budget Over Time?

⏰ Yes, it is normal to adjust your budget over time as your financial situation and priorities change. Regularly reviewing and updating your budget ensures it remains aligned with your goals.

Conclusion

In conclusion, budgeting your $35,000 salary is crucial for achieving financial stability and reaching your financial goals. By creating a budget, you can take control of your finances, prioritize your expenses, and make informed decisions about your spending. Budgeting allows you to live within your means, save for the future, and reduce financial stress. So start budgeting today and pave the way to a brighter financial future!

Final Remarks

Dear Readers,

While we have provided comprehensive information on budgeting a $35,000 salary, it is essential to remember that personal finance is a highly individualized matter. The strategies and tips provided in this guide may not be suitable for everyone. It is always advisable to seek personalized financial advice from a professional to ensure your budget aligns with your specific financial goals and circumstances. Remember, budgeting is an ongoing journey, requiring regular assessment and adjustment. Good luck on your financial journey!