Budgeting 300 a Week: Managing Your Finances with Ease

Introduction

Hello Readers,

Welcome to our guide on budgeting 300 a week. In today’s fast-paced world, managing our finances effectively is crucial for a stress-free life. By creating a budget and sticking to it, you can ensure that your expenses are in check and your savings are growing. In this article, we will provide you with valuable insights and tips on how to budget 300 a week successfully. So let’s dive in and take control of your financial future!

What is Budgeting 300 a Week?

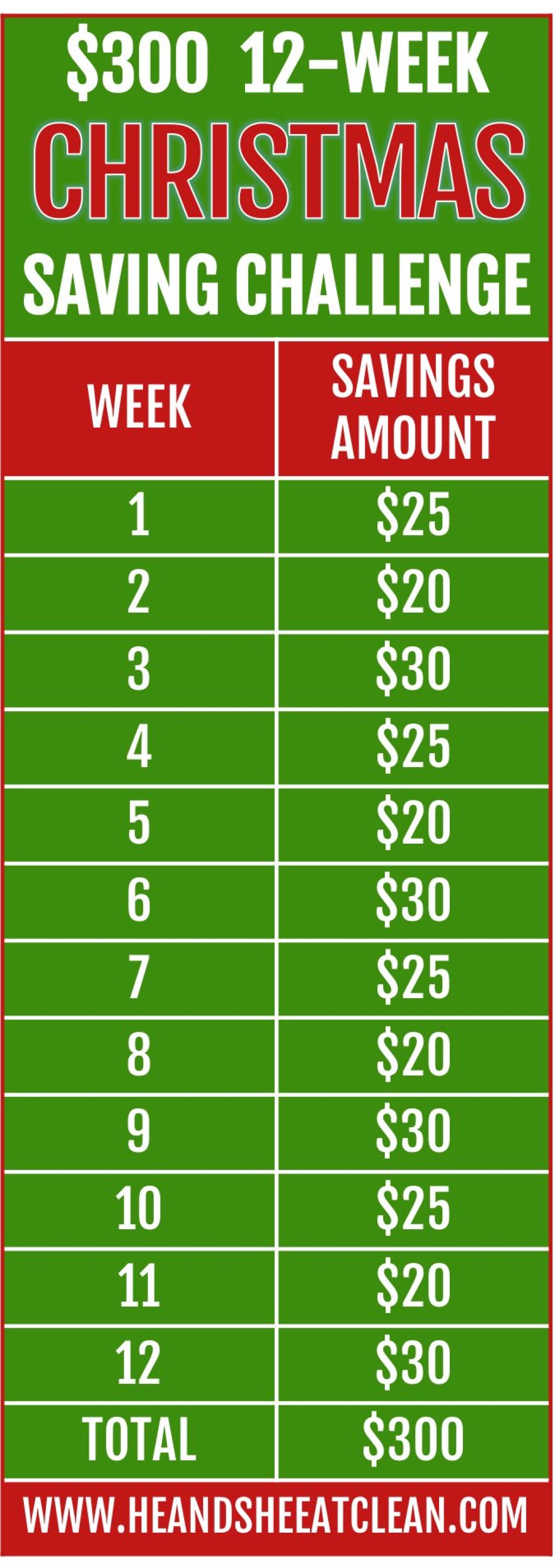

Image Source: pinimg.com

🔍 Budgeting 300 a week refers to the practice of allocating and managing your weekly expenses within a set limit of $300. It involves carefully tracking your income and expenditures to ensure that you stay within this budget. By doing so, you can save money, reduce debt, and achieve your financial goals.

🔍 The key to successful budgeting is planning and prioritizing your spending based on your income and financial obligations. By understanding where your money goes and making informed decisions, you can make the most out of your weekly budget.

🔍 Let’s explore the important aspects of budgeting 300 a week, including who can benefit from it, when to start, where to allocate your funds, why it is essential, and how to implement it effectively.

Who Can Benefit from Budgeting 300 a Week?

🔍 Budgeting 300 a week is beneficial for anyone looking to improve their financial well-being. Whether you’re a college student, a young professional, a stay-at-home parent, or even a retiree, budgeting can help you gain control over your finances.

🔍 If you find yourself living from paycheck to paycheck or struggling to meet your financial goals, budgeting 300 a week can be a game-changer. It allows you to make intentional decisions about how you spend your money and ensures that you have enough for your needs while still having room for savings.

When Should You Start Budgeting 300 a Week?

🔍 The answer is simple – start budgeting 300 a week as soon as possible. It’s never too early or too late to take control of your finances. Regardless of your current financial situation, budgeting can help you make better financial decisions and improve your overall financial health.

🔍 Whether you’re just starting your first job or nearing retirement, budgeting can provide you with peace of mind and long-term financial security. The earlier you start, the more time you have to save and invest, setting yourself up for a brighter future.

Where Should You Allocate Your Funds?

🔍 When budgeting 300 a week, it’s essential to allocate your funds wisely. Prioritize your basic needs such as housing, food, transportation, and healthcare. These necessities should be the first to be covered by your budget.

🔍 Additionally, set aside a portion of your budget for savings and emergency funds. Building a financial safety net is crucial to protect yourself from unexpected expenses or a sudden loss of income.

🔍 Finally, allocate some funds for discretionary expenses such as entertainment, dining out, or hobbies. While it’s important to enjoy life, be mindful of overspending and ensure that these expenses fit within your overall budget.

Why Is Budgeting 300 a Week Essential?

🔍 Budgeting 300 a week is essential for several reasons. Firstly, it helps you prioritize and make informed decisions about your spending. By knowing where your money is going, you can cut unnecessary expenses and use your funds more wisely.

🔍 Secondly, budgeting allows you to save and invest for the future. By consistently setting aside a portion of your income, you can build an emergency fund, save for retirement, or work towards other financial goals.

🔍 Lastly, budgeting provides financial stability and reduces stress. When you have a clear plan for your money, you can avoid debt and have peace of mind knowing that you are in control of your finances.

How to Implement Budgeting 300 a Week Effectively?

🔍 Implementing budgeting 300 a week requires careful planning and discipline. Here are some steps to help you get started:

1. Assess your current financial situation by tracking your income and expenses.

2. Set realistic goals for saving and spending based on your financial priorities.

3. Create a detailed budget that includes all your income sources and expenses.

4. Monitor your spending regularly and make adjustments as needed.

5. Use budgeting tools and apps to help you stay organized and on track.

6. Stay committed to your budget and make conscious choices about your spending habits.

7. Review and evaluate your budget periodically to ensure it aligns with your financial goals.

Advantages and Disadvantages of Budgeting 300 a Week

Advantages:

1. Better control over your finances and reduced stress related to money.

2. Increased savings and the ability to achieve your financial goals.

3. Improved decision-making when it comes to spending.

4. Enhanced awareness of your financial habits and areas for improvement.

5. Reduced debt and the ability to avoid financial emergencies.

Disadvantages:

1. Requires discipline and commitment to stick to your budget.

2. Potential limitations on certain discretionary expenses or lifestyle choices.

3. The need for ongoing monitoring and adjustments to your budget.

4. Can be challenging to adapt to unexpected changes in income or expenses.

5. The temptation to overspend or deviate from your budget.

FAQs about Budgeting 300 a Week

Q: Can I budget 300 a week if my income fluctuates?

A: Yes, it is possible to budget 300 a week even if your income fluctuates. Start by calculating your average weekly income and adjust your expenses accordingly.

Q: How can I stick to my budget when faced with unexpected expenses?

A: Build an emergency fund within your budget to handle unexpected expenses. Additionally, consider reevaluating your discretionary expenses and finding ways to cut back temporarily.

Q: Is it necessary to track every single expense?

A: While tracking every expense can provide a more accurate picture of your spending habits, focus on categorizing your expenses and monitoring your overall progress towards your budgeting goals.

Q: What if my budget doesn’t allow for any savings?

A: If your budget doesn’t allow for savings initially, start by reducing discretionary expenses and finding ways to increase your income. Gradually allocate a portion of your budget towards savings as your financial situation improves.

Q: Can I make changes to my budget once it’s set?

A: Yes, your budget should be flexible and adaptable. Life circumstances and financial goals may change, so it’s important to review and adjust your budget as needed.

Conclusion

In conclusion, budgeting 300 a week is a powerful tool that can transform your financial health. By creating a budget and sticking to it, you can gain control over your finances, reduce debt, and achieve your financial goals. Remember, budgeting is a continuous process that requires discipline and regular monitoring. Start today, and take the first step towards a more secure financial future.

Final Remarks

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. It is essential to consult with a qualified financial professional before making any significant financial decisions. Every individual’s financial situation is unique, and what works for one person may not work for another.