Personal Finance Statistics 2023

Introduction

Dear Readers,

Welcome to our comprehensive analysis of the personal finance statistics for the year 2023. In this article, we will delve into the latest data and trends in personal finance, providing you with valuable insights to manage your finances effectively. Whether you are an individual looking to make informed decisions or a business seeking to understand consumer behavior, this article is tailored to meet your needs. So, let’s dive into the intriguing world of personal finance statistics for 2023!

Before we proceed, let’s take a moment to define personal finance. It refers to the management of an individual’s financial resources, including income, expenses, savings, investments, and debt. It encompasses various aspects such as budgeting, retirement planning, insurance, and investment strategies. Understanding personal finance statistics allows us to gain a holistic view of the financial landscape and make informed decisions.

Table of Contents

Overview of Personal Finance Statistics 2023

What are the main factors influencing personal finance in 2023?

Who are the key players in the personal finance industry?

When should individuals start planning for their financial future?

Where are the emerging markets for personal finance in 2023?

Why is financial literacy crucial in the current economic climate?

How can individuals improve their personal finance management?

Advantages and disadvantages of personal finance statistics 2023

FAQs about personal finance statistics 2023

Conclusion

Final Remarks

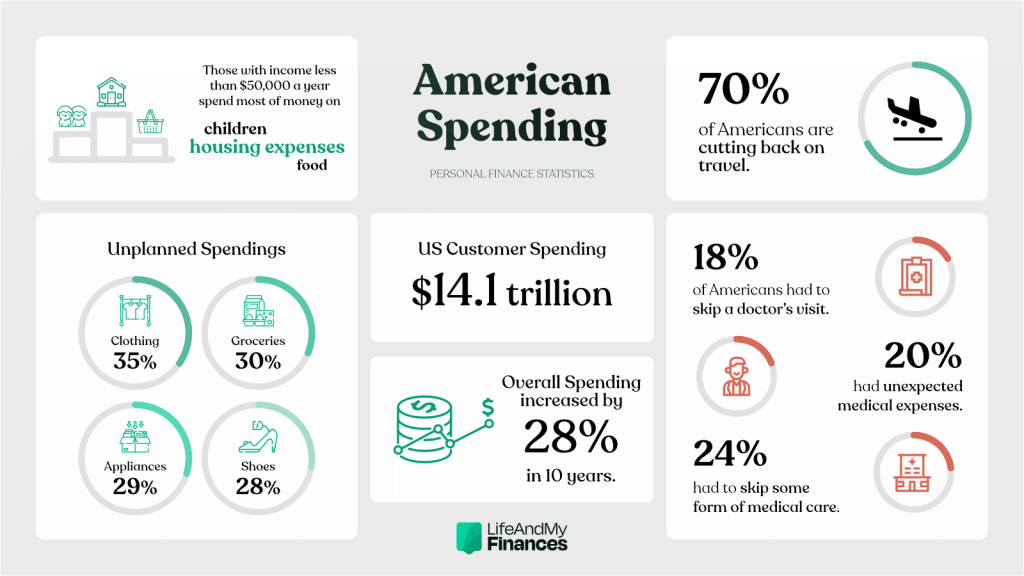

Overview of Personal Finance Statistics 2023

Image Source: ctfassets.net

In the year 2023, personal finance continues to gain importance as individuals seek financial stability and security. According to recent data, the global personal finance industry is projected to reach a market size of $XX trillion by the end of the year. This growth can be attributed to several key factors, including increasing disposable income, rising awareness about financial planning, and the availability of innovative financial products and services.

One of the significant trends observed in 2023 is the growing adoption of digital platforms for personal finance management. With the advancement of technology, individuals now have access to a wide range of mobile apps and online tools to track their expenses, set financial goals, and invest in various instruments. This digital transformation has revolutionized the way people manage their finances, providing convenience and efficiency.

Furthermore, the COVID-19 pandemic has had a profound impact on personal finance in 2023. The economic disruptions caused by the pandemic have prompted individuals to prioritize saving and emergency funds. The pandemic has also highlighted the importance of insurance coverage and retirement planning, with more people seeking financial protection and long-term financial planning strategies.

Now that we have a high-level overview of personal finance statistics for 2023, let’s delve deeper into the main factors influencing personal finance, the key players in the industry, and when individuals should start planning for their financial future.

What are the main factors influencing personal finance in 2023?

The personal finance landscape in 2023 is shaped by several key factors. Firstly, the global economic recovery post-pandemic plays a crucial role in determining the financial well-being of individuals. As economies rebound, job opportunities increase, and disposable incomes rise, individuals are likely to have more resources to allocate towards savings and investments.

Secondly, technological advancements continue to have a significant impact on personal finance. The emergence of fintech companies and digital payment platforms has made financial transactions more accessible and convenient. Automation and artificial intelligence are also transforming processes such as budgeting, investment management, and financial planning.

Thirdly, changing demographics, such as an aging population and the rise of the millennial generation, have implications for personal finance. Older individuals may focus on retirement planning and estate management, while millennials prioritize student loan debt, homeownership, and sustainable investing.

Fourthly, government policies and regulations influence personal finance decisions. Tax laws, retirement rules, and financial education initiatives all shape the behavior and choices of individuals. Staying informed about changes in regulations is crucial for effective financial planning.

Fifthly, societal trends and consumer behavior impact personal finance. The growing focus on sustainable investing, social impact, and ethical consumption has led to a rise in demand for responsible financial products.

Lastly, global events, such as geopolitical tensions, economic crises, and natural disasters, can have immediate and long-term effects on personal finance. These events can disrupt financial markets, affect currency exchange rates, and prompt changes in investment strategies.

Who are the key players in the personal finance industry?

The personal finance industry comprises various stakeholders who play crucial roles in shaping the landscape. Banks and financial institutions are the traditional players, providing services such as savings accounts, loans, mortgages, and investment opportunities. These institutions have adapted to the digital era by offering online banking, mobile apps, and robo-advisory services.

Insurance companies are another significant part of the personal finance industry. They offer various types of coverage, including life insurance, health insurance, and property insurance. Insurers help individuals mitigate risks and protect their financial well-being.

Fintech companies have emerged as innovative disruptors in the personal finance space. They leverage technology to provide user-friendly platforms for budgeting, investing, and financial planning. Fintech companies often offer personalized recommendations and utilize algorithms to optimize investment portfolios.

Furthermore, financial advisors and certified planners play a vital role in assisting individuals with their financial goals. These professionals provide personalized advice, create comprehensive financial plans, and help clients navigate complex financial situations.

Lastly, educational institutions and nonprofit organizations contribute to the personal finance industry through financial literacy programs. These initiatives aim to equip individuals with the knowledge and skills necessary to make informed financial decisions.

When should individuals start planning for their financial future?

The earlier individuals start planning for their financial future, the better equipped they will be to achieve their goals. It is never too early to begin the journey towards financial security. Young adults can benefit from developing good financial habits such as budgeting, saving, and investing as they enter the workforce.

Furthermore, life milestones such as getting married, having children, or buying a home often come with increased financial responsibilities. Planning ahead and being prepared for these milestones can alleviate financial stress and ensure a smoother transition.

Retirement planning is another critical aspect of personal finance. Starting to save for retirement early allows individuals to take advantage of compounding interest and grow their retirement nest egg over time. The power of compounding can significantly impact the final retirement savings amount.

In summary, individuals should start planning for their financial future as soon as possible. Taking small steps towards financial literacy and building good financial habits early on can lead to a more secure and prosperous future.

Where are the emerging markets for personal finance in 2023?

In 2023, several emerging markets are poised to experience significant growth in the personal finance sector. These markets present unique opportunities for individuals and businesses alike.

One such market is Southeast Asia, where rapid economic development, urbanization, and a young population drive increased demand for personal finance services. Countries like Indonesia, Malaysia, and Thailand are experiencing a surge in fintech adoption, mobile banking, and digital payments.

Latin America is another region to watch, with countries like Brazil, Mexico, and Colombia witnessing a growing middle class and an increasing number of people accessing formal financial services. Fintech startups are thriving, offering innovative solutions tailored to the needs of the population.

In Africa, the mobile money revolution is transforming personal finance. Countries like Kenya, Nigeria, and South Africa have seen remarkable success in mobile banking and digital payments, providing financial access to previously unbanked populations.

Finally, the Middle East is experiencing a digital transformation in personal finance. Countries like the United Arab Emirates, Saudi Arabia, and Qatar are embracing fintech and digital banking, creating a favorable environment for financial innovation.

As these emerging markets continue to grow and evolve, individuals and businesses should pay attention to the unique opportunities and challenges they present.

Why is financial literacy crucial in the current economic climate?

The current economic climate is characterized by rapid changes, uncertainty, and increasing complexity. In such an environment, financial literacy plays a crucial role in empowering individuals to make informed decisions and navigate the complexities of personal finance.

Financial literacy equips individuals with the knowledge and skills to manage their money effectively. It enables them to create realistic budgets, understand financial products and services, evaluate investment opportunities, and protect themselves against scams and fraud.

Moreover, financial literacy promotes financial well-being and reduces financial stress. It allows individuals to set and achieve financial goals, make informed decisions about borrowing and saving, and plan for retirement. By understanding personal finance concepts and strategies, individuals can better prepare for unexpected events and build a solid foundation for their future.

In the current economic climate, financial literacy is even more critical due to the increasing complexity of financial products and the prevalence of digital platforms. Individuals need to be able to navigate complex financial systems, differentiate between reliable and fraudulent sources of information, and adapt to changing economic conditions.

Overall, financial literacy is a lifelong skill that empowers individuals to make informed financial decisions, adapt to changing economic conditions, and achieve their financial goals.

How can individuals improve their personal finance management?

Improving personal finance management requires a combination of knowledge, discipline, and practical strategies. Here are a few tips to help individuals enhance their financial well-being:

Creating a budget: Developing a budget allows individuals to track their income and expenses, identify areas for potential savings, and prioritize their financial goals.

Automating savings: Setting up automatic transfers to a savings account ensures consistent savings over time, without the need for manual intervention.

Investing wisely: Understanding different investment options and diversifying one’s portfolio can help individuals grow their wealth over the long term. It is essential to consider one’s risk tolerance and financial goals when making investment decisions.

Paying off debt: Prioritizing debt repayment and minimizing interest payments can significantly improve one’s financial situation. Individuals should consider strategies such as the debt snowball or debt avalanche method to accelerate debt repayment.

Seeking professional advice: Consulting a financial advisor or certified planner can provide personalized guidance and help individuals navigate complex financial situations. These professionals can offer insights tailored to individual goals and circumstances.

Continuing financial education: Staying informed about the latest trends, regulations, and strategies in personal finance is essential for making informed decisions. Individuals can attend seminars, read books and articles, and participate in online courses to enhance their financial knowledge.

Practicing mindful spending: Being conscious of spending habits and distinguishing between needs and wants can help individuals make more intentional purchasing decisions and avoid unnecessary expenses.

By implementing these strategies and continuously improving their financial knowledge, individuals can enhance their personal finance management and achieve their financial goals.

Advantages and Disadvantages of Personal Finance Statistics 2023

Personal finance statistics for 2023 offer numerous advantages and disadvantages. Let’s explore them in detail:

Advantages:

Improved decision-making: Personal finance statistics provide individuals with valuable insights and data to make informed financial decisions. They can help individuals identify trends, evaluate risks, and optimize their financial strategies.

Financial planning guidance: Personal finance statistics guide individuals in planning for their financial future. By understanding trends and projections, individuals can set realistic goals, allocate resources effectively, and adapt their strategies according to changing circumstances.

Investment opportunities: Personal finance statistics highlight emerging trends and industries, enabling individuals to identify potential investment opportunities. By staying informed about market developments, individuals can make informed investment decisions.

Risk management: Personal finance statistics allow individuals to assess risks, both at the individual and global levels. By understanding factors such as economic indicators, inflation rates, and market volatility, individuals can make informed decisions to mitigate risks and protect their financial well-being.

Financial education: Personal finance statistics contribute to financial education by providing individuals with data-driven insights. They promote a better understanding of personal finance concepts, investment strategies, and economic trends.

Disadvantages:

Information overload: With the abundance of personal finance statistics available, individuals may feel overwhelmed and find it challenging to filter and interpret the data effectively.

Inaccurate or misleading data: Not all personal finance statistics are accurate or reliable. Individuals should exercise caution when interpreting data and consider multiple sources to ensure they have a comprehensive and accurate view.

Complexity: Personal finance statistics can be complex, especially for individuals with limited financial knowledge. Understanding and interpreting statistical data may require some level of financial literacy.

Potential biases: Personal finance statistics can be influenced by various factors, including the methodology used, sample size, and potential biases in data collection. Individuals should be aware of these limitations and consider multiple perspectives.

Rapidly changing landscape: Personal finance statistics may become outdated quickly due to the dynamic nature of markets and economies. Individuals should regularly update their knowledge and stay informed about the latest developments.

Despite these disadvantages, personal finance statistics provide valuable insights and guidance for individuals seeking to make informed financial decisions.

FAQs about Personal Finance Statistics 2023

1. What are the key trends in personal finance for 2023?

The key trends in