Personal Finance 101: A Comprehensive Guide to Managing Your Finances

Greetings, Readers! Today, we will delve into the world of personal finance. In this article, we will explore the ins and outs of managing your finances effectively, providing you with valuable insights and tips to improve your financial well-being. Whether you’re just starting your financial journey or looking to enhance your existing knowledge, this guide is designed to help you navigate the complex world of personal finance.

Introduction: Understanding Personal Finance

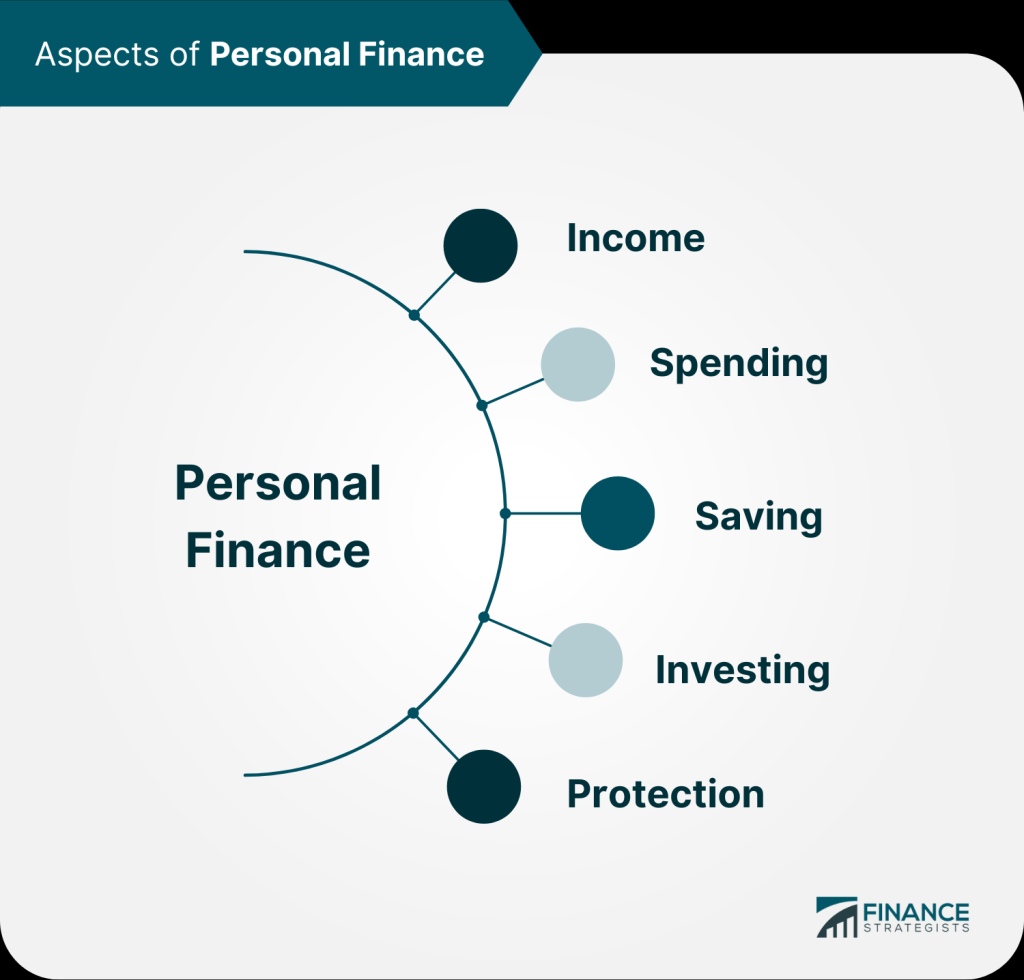

Before we dive into the specifics, let’s first understand what personal finance entails. Personal finance refers to the management of an individual’s financial resources, including income, expenses, savings, investments, and debt. It involves making informed decisions about budgeting, saving, investing, and planning for the future. By mastering the principles of personal finance, individuals can achieve financial stability and pave the way for a secure future.

Now, let’s explore the key components of personal finance in greater detail.

1. What is Personal Finance? 🤔

Personal finance encompasses a wide range of financial activities, such as budgeting, saving, investing, and retirement planning. It involves understanding your financial goals, tracking your income and expenses, and making sound financial decisions to achieve those goals. By effectively managing your personal finances, you can improve your financial well-being and achieve financial freedom.

Understanding Budgeting

Image Source: financestrategists.com

Budgeting is the foundation of personal finance. It involves creating a plan for how you will allocate your income to cover your expenses, savings, and investments. By creating a budget, you can gain better control over your finances and ensure that you’re not overspending.

Importance of Saving

Saving money is crucial for financial stability. It allows you to build an emergency fund, save for future goals, and protect yourself from unexpected expenses. By making saving a priority, you can establish a strong financial foundation and secure your financial future.

Investing for Long-Term Growth

Image Source: oberlo.com

Investing is a key component of personal finance that helps you grow your wealth over time. By investing in stocks, bonds, mutual funds, or real estate, you can potentially earn higher returns than traditional savings accounts. However, it’s essential to understand the risks associated with investing and seek professional advice if needed.

Retirement Planning

Planning for retirement is crucial to ensure financial security during your golden years. It involves estimating your retirement needs, setting aside funds, and investing them wisely to generate income after you stop working. The earlier you start planning for retirement, the better prepared you’ll be.

2. Who Should Focus on Personal Finance? 🧐

Personal finance is relevant to everyone, regardless of their age, income, or financial situation. Whether you’re a young professional just starting your career or a seasoned individual nearing retirement, understanding personal finance is essential for achieving financial stability and reaching your goals.

Young Professionals

For young professionals, building a strong foundation in personal finance is crucial. By starting early, they can develop good financial habits, save for future goals, and take advantage of long-term investment opportunities.

Families and Parents

Managing personal finances becomes even more critical when you have a family to support. By effectively budgeting, saving, and planning for the future, families can ensure financial security and provide a better life for their children.

Pre-Retirees and Retirees

Individuals nearing retirement should focus on personal finance to ensure a comfortable retirement. By evaluating their retirement savings, managing expenses, and making smart investment decisions, they can enjoy their golden years without financial worries.

3. When Should You Start Managing Personal Finance? ⏰

The answer is simple: the sooner, the better. It’s never too early to start managing your personal finances. Whether you’re a student receiving your first paycheck or a working professional, developing good financial habits early on can set you up for long-term success.

Teaching Children about Personal Finance

As children grow, it’s essential to educate them about personal finance. Teaching them the value of money, budgeting, saving, and investing from a young age can equip them with essential life skills and set them on the path to financial independence.

Re-Evaluating Personal Finances

Even if you’ve been managing your personal finances for years, it’s crucial to periodically re-evaluate your financial situation. Life circumstances change, and reviewing your financial goals, budget, and investments can help ensure you’re on track to achieve your objectives.

4. Where Can You Learn about Personal Finance? 📚

There are various resources available to learn about personal finance. From books and online courses to financial advisors and educational websites, you can choose the learning method that suits your preferences and needs.

Books on Personal Finance

There are countless books written on personal finance that cater to individuals with different levels of financial knowledge. Some highly recommended titles include The Total Money Makeover by Dave Ramsey, Rich Dad Poor Dad by Robert Kiyosaki, and The Millionaire Next Door by Thomas J. Stanley and William D. Danko.

Online Courses and Webinars

Many reputable websites offer online courses and webinars on personal finance. These platforms provide comprehensive lessons on various topics, such as budgeting, investing, and retirement planning. Some popular online learning platforms include Coursera, Udemy, and Khan Academy.

Financial Advisors

If you prefer personalized guidance, seeking advice from a financial advisor can be beneficial. A qualified financial advisor can assess your financial situation, help you set realistic goals, and provide recommendations to achieve them. However, it’s crucial to choose a reputable advisor with the necessary credentials and experience.

5. Why is Personal Finance Important? 🤷♂️

Personal finance plays a pivotal role in achieving financial stability and long-term success. Here are a few reasons why it’s crucial to prioritize personal finance:

Financial Stability

By effectively managing your personal finances, you can achieve financial stability. This stability provides a sense of security and allows you to weather unexpected expenses or financial downturns.

Debt Management

Personal finance helps you manage your debt effectively. By understanding your borrowing capacity, making timely payments, and avoiding unnecessary debt, you can maintain a healthy financial position.

Goal Achievement

Whether it’s buying a house, starting a business, or traveling the world, personal finance is the key to achieving your goals. By budgeting, saving, and investing wisely, you can turn your dreams into reality.

Retirement Security

Planning for retirement is vital to ensure financial security in your golden years. By saving and investing for retirement, you can enjoy a comfortable lifestyle and pursue your passions without financial constraints.

6. How to Manage Personal Finance Effectively? 📝

Managing personal finance effectively requires discipline, knowledge, and consistent effort. Here are some essential tips to help you get started:

Create a Budget

Start by creating a budget to track your income and expenses. Allocate your income to cover essential expenses, savings, investments, and discretionary spending.

Track Your Expenses

Monitor your expenses regularly to identify areas where you can cut back and save money. Utilize mobile apps or spreadsheets to keep track of your spending.

Save Regularly

Make saving a priority by setting aside a portion of your income each month. Aim to save at least 10-20% of your income for short-term and long-term goals.

Invest Wisely

Educate yourself about different investment options and choose investments that align with your risk tolerance and financial goals. Diversify your investment portfolio to minimize risk.

Plan for Retirement

Start planning for retirement early to take advantage of compound interest. Contribute to retirement accounts such as 401(k)s or IRAs and regularly review your retirement savings.

Seek Professional Advice

If you’re unsure about certain financial decisions or need guidance, don’t hesitate to seek advice from a qualified financial advisor. They can provide valuable insights tailored to your specific situation.

Advantages and Disadvantages of Personal Finance 💰

Advantages:

1. Financial Freedom

Effectively managing your personal finances can lead to financial freedom. By having control over your money, you can make informed decisions and enjoy more flexibility in your life.

2. Goal Achievement

Personal finance enables you to set and achieve financial goals. Whether it’s buying a home, starting a business, or funding your children’s education, managing your finances helps you work towards these milestones.

3. Better Financial Security

By saving money, managing debt, and investing wisely, you can enhance your financial security. This security provides peace of mind and protects you from unexpected financial crises.

Disadvantages:

1. Time and Effort

Managing personal finances requires time and effort. It involves tracking expenses, researching investment options, and making informed decisions. If not given proper attention, personal finances can become overwhelming.

2. Financial Risks

Investing in the financial markets carries inherent risks. Personal finance management involves understanding and managing these risks effectively. Lack of knowledge or poor decision-making can result in financial losses.

3. Emotional Stress

Unforeseen financial challenges or setbacks can cause emotional stress. Managing personal finances can be mentally taxing, especially during times of financial difficulty. Building resilience and seeking support can help overcome these challenges.

Frequently Asked Questions (FAQs) ❓

Q1: How do I create a budget?

A1: Creating a budget starts with determining your monthly income and tracking your expenses. Categorize your expenses into fixed and variable costs, and allocate your income accordingly. Consider using budgeting apps or spreadsheets to streamline the process.

Q2: Is it necessary to have an emergency fund?

A2: Yes, an emergency fund is essential. It provides a safety net to cover unexpected expenses, such as medical bills or car repairs. Aim to save at least three to six months’ worth of living expenses in your emergency fund.

Q3: Should I pay off my debt before investing?

A3: It depends on the interest rates of your debt. If your debt carries high-interest rates, it’s advisable to prioritize paying off the debt before investing. However, if the interest rates are low, you can focus on investing while making timely payments towards your debt.

Q4: How can I save money on a tight budget?

A4: Saving money on a tight budget requires careful planning. Look for opportunities to reduce discretionary expenses, such as eating out or entertainment. Consider negotiating bills, using coupons, and opting for cost-effective alternatives.

Q5: Is it possible to recover from financial mistakes?

A5: Absolutely! Everyone makes financial mistakes, but it’s never too late to recover. Assess the situation, learn from the mistakes, and make a plan to improve your financial situation. Seeking professional guidance can also be beneficial.

Conclusion: Take Control of Your Financial Future 💪

In conclusion, personal finance is a crucial aspect of our lives that requires attention and effort. By understanding the fundamentals of personal finance, setting clear financial goals, and implementing effective strategies, you can take control of your financial future. Start today by creating a budget, building an emergency fund, and investing for the long term. Remember, financial success is a journey, and with determination and perseverance, you can achieve your goals. Here’s to a financially secure future!

Disclaimer: The information provided in this article is for educational purposes only and should not be considered financial advice. Consult with a qualified financial advisor before making any financial decisions.