Personal Finance KSA: Managing Your Money in Saudi Arabia

Introduction

Hello, Readers! Welcome to a comprehensive guide on personal finance in Saudi Arabia. In this article, we will explore various aspects of managing your money and making informed financial decisions in the Kingdom of Saudi Arabia. Whether you are a local resident or an expatriate, understanding personal finance is crucial for a secure and prosperous future. Let’s dive in and explore the world of personal finance in KSA!

What is Personal Finance KSA?

Personal finance refers to the management of an individual’s financial resources, including income, expenses, savings, investments, and debt. Personal finance in Saudi Arabia (KSA) encompasses the unique financial landscape and practices of the country, such as Islamic banking principles and cultural considerations.

Who Can Benefit from Personal Finance KSA?

Image Source: worldfinancialreview.com

Personal finance in KSA is relevant to everyone, regardless of their financial situation or background. Whether you are a working professional, a student, a business owner, or a homemaker, understanding personal finance can help you make sound financial decisions, achieve your financial goals, and secure a stable financial future.

When Should You Start Focusing on Personal Finance?

The best time to start focusing on personal finance is now! Regardless of your age or income level, it is never too early or too late to take control of your finances. Building good financial habits and making informed decisions early on can have a substantial positive impact on your financial well-being in the long run.

Where Can You Learn About Personal Finance KSA?

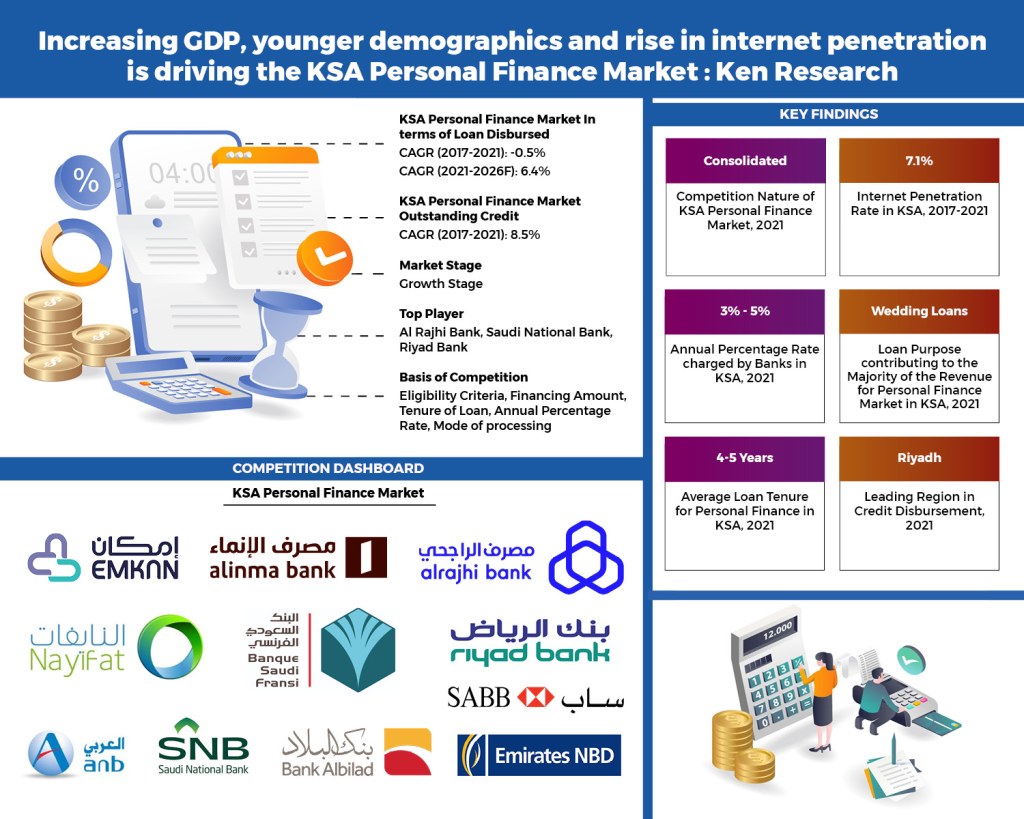

Image Source: kenresearch.com

There are various resources available to learn about personal finance in KSA. These include financial literacy courses, workshops, online resources, books, and professional financial advisors. Additionally, governmental organizations and financial institutions often provide educational materials and guidance on personal finance topics.

Why is Personal Finance Important in KSA?

Personal finance is essential in KSA to ensure financial stability, achieve financial goals, and make informed financial decisions. It allows individuals to effectively manage their income, expenses, savings, investments, and debt, enabling them to attain financial independence, protect against future uncertainties, and enjoy a better quality of life.

How to Manage Personal Finance in KSA?

Managing personal finance in KSA involves several key steps and considerations. These include creating a budget, tracking expenses, saving and investing wisely, managing debt, understanding the local taxation system, planning for retirement, and staying informed about the latest financial regulations and opportunities in the country.

Advantages and Disadvantages of Personal Finance KSA

Advantages:

Improved financial well-being and stability

Ability to achieve financial goals

Increased financial independence

Better decision-making regarding money matters

Opportunity for wealth accumulation and growth

Disadvantages:

Potential risks associated with investments and financial decisions

Complexity of local financial regulations and practices

Difficulty in managing debt

Impact of economic fluctuations on personal finances

Potential cultural and social constraints on financial decisions

Frequently Asked Questions (FAQs) About Personal Finance KSA

1. Can expatriates in Saudi Arabia access the same financial services as locals?

Yes, expatriates in Saudi Arabia can access a wide range of financial services, including banking, investments, insurance, and mortgages. However, there may be certain restrictions or requirements specific to expatriates.

2. What are the key principles of Islamic finance in KSA?

The key principles of Islamic finance in KSA include avoiding interest-based transactions (riba), promoting fairness, avoiding excessive uncertainty (gharar), and adhering to ethical guidelines.

3. Are there any tax implications for personal finance in Saudi Arabia?

Saudi Arabia does not impose income tax on individuals. However, there may be other taxes and fees applicable to specific financial transactions or assets.

4. How can I start investing in the Saudi Arabian stock market?

To start investing in the Saudi Arabian stock market, you can open a brokerage account with a licensed financial institution, conduct research on potential investments, and make informed investment decisions.

5. What are some common financial mistakes to avoid in KSA?

Some common financial mistakes to avoid in KSA include overspending, taking on excessive debt, neglecting savings and investments, and not staying informed about financial regulations and opportunities.

Conclusion

In conclusion, personal finance plays a vital role in ensuring financial stability, achieving goals, and making informed decisions in Saudi Arabia. By understanding the unique aspects of personal finance in KSA and implementing sound financial practices, individuals can pave the way for a secure and prosperous future. Take control of your finances, set financial goals, and embark on a journey towards financial well-being. Remember, your financial future is in your hands!

Final Remarks

While every effort has been made to provide accurate and up-to-date information, it is important to note that personal finance in KSA is subject to various factors and individual circumstances. It is advisable to consult with a qualified financial advisor or conduct further research before making any significant financial decisions. This article aims to serve as a starting point for your personal finance journey in Saudi Arabia, and we encourage you to continue learning and adapting your financial strategies as needed. Best of luck on your financial endeavors!