6 Budgeting Methods

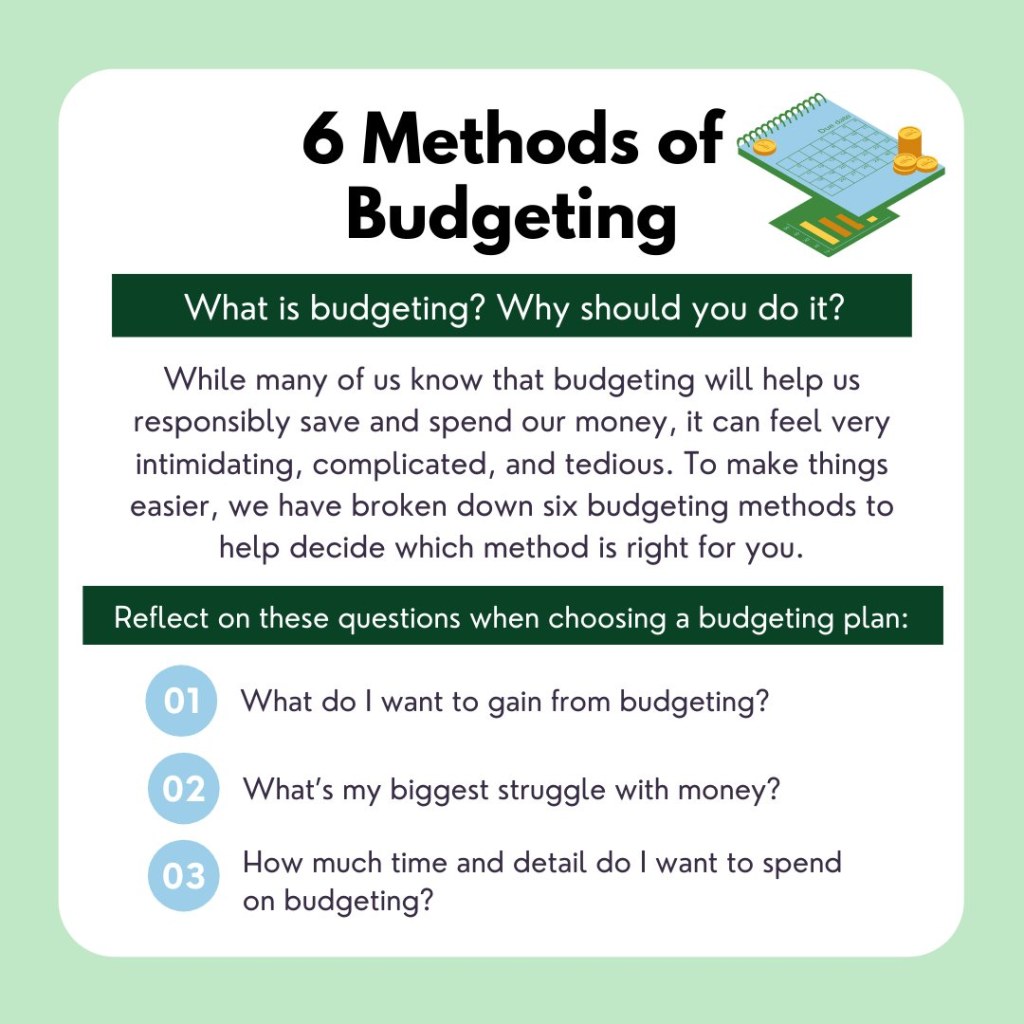

Greetings, Friends! In this article, we will explore six budgeting methods that can help you manage your finances effectively. Budgeting is a crucial skill that allows you to track your income and expenses, save money, and achieve your financial goals. By implementing these methods, you can take control of your finances and make informed decisions. So, let’s dive in and discover the benefits of each budgeting method!

1. The Envelope System

📥 The envelope system is a simple yet effective budgeting method where you allocate cash into different envelopes labeled with specific spending categories. This method helps you visualize your spending limits and encourages you to stay within those limits.

2. The 50/30/20 Rule

Image Source: twimg.com

💰 The 50/30/20 rule suggests dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt payments. This method offers a balanced approach to budgeting and ensures you allocate your income wisely.

3. Zero-Based Budgeting

⚖️ With zero-based budgeting, you assign every dollar of your income a specific purpose. This method requires you to allocate your income to expenses, savings, and debt payments until you reach zero. It helps you prioritize your spending and prevents wasteful expenses.

4. The 60% Solution

🔐 The 60% solution recommends allocating 60% of your income to committed expenses such as housing, bills, and debt payments. The remaining 40% is divided equally between financial priorities, fun money, and long-term savings. This method ensures you cover essential expenses while still enjoying your money.

5. Pay Yourself First

📈 The pay yourself first method involves prioritizing savings by automatically transferring a certain percentage or amount of your income to a separate savings account before allocating funds to other expenses. It encourages you to save consistently and build your financial security.

6. The Reverse Budget

🔄 The reverse budgeting method suggests setting your savings goal first and then allocating the remaining income to expenses. This approach ensures that your savings are not an afterthought and helps you adjust your spending accordingly.

What Are the 6 Budgeting Methods?

The 6 budgeting methods mentioned above are effective strategies to help you manage your finances efficiently. Each method offers unique benefits and caters to different financial situations and personal preferences. Let’s explore them further:

The Envelope System

The envelope system involves dividing your cash into different envelopes labeled with specific spending categories. It provides a tangible representation of your spending limits and helps you control your expenses.

Who Should Use the Envelope System?

The envelope system is suitable for individuals who prefer using cash for their transactions and find visual aids helpful for budgeting. It works well for people who have a clear understanding of their spending habits and want to limit specific expenses.

When Is the Envelope System Most Effective?

The envelope system is most effective for managing variable expenses, such as groceries, entertainment, or personal shopping. It allows you to set clear limits for each category and prevents overspending.

Where Can You Apply the Envelope System?

You can apply the envelope system in your daily life by creating physical envelopes for different spending categories. Alternatively, you can use digital tools or budgeting apps that simulate the envelope system.

Why Should You Use the Envelope System?

The envelope system is beneficial as it provides a visual representation of your budget and helps you stay accountable for your spending habits. It also encourages mindfulness and prevents impulsive purchases.

How Do You Implement the Envelope System?

To implement the envelope system, start by identifying your spending categories, such as groceries, entertainment, or transportation. Allocate the desired amount of cash to each envelope and only spend from the corresponding envelope for its assigned category.

The 50/30/20 Rule

The 50/30/20 rule suggests dividing your after-tax income into three categories: 50% for needs, 30% for wants, and 20% for savings and debt payments. This rule provides a balanced approach to budgeting and ensures you meet essential expenses while still having room for discretionary spending.

Who Should Use the 50/30/20 Rule?

The 50/30/20 rule is suitable for individuals who prefer a simplified budgeting approach that is easy to implement and maintain. It is a great starting point for those who want a clear structure for their budget.

When Is the 50/30/20 Rule Most Effective?

The 50/30/20 rule is most effective when you have a steady income and want to prioritize savings while still having flexibility for discretionary spending. It helps you strike a balance between meeting your needs and enjoying your wants.

Where Can You Apply the 50/30/20 Rule?

You can apply the 50/30/20 rule to your monthly income and expenses. Divide your income into the designated categories and ensure you allocate the appropriate percentages to each. Track your expenses accordingly to stay within the recommended limits.

Why Should You Use the 50/30/20 Rule?

The 50/30/20 rule offers a balanced approach to budgeting that allows you to cover essential expenses, enjoy discretionary spending, and save for the future. It provides a framework for effective financial management and prioritizes both short-term and long-term financial goals.

How Do You Implement the 50/30/20 Rule?

To implement the 50/30/20 rule, calculate your after-tax income. Allocate 50% to necessary expenses, such as rent, utilities, and groceries. Dedicate 30% to discretionary spending, such as dining out, entertainment, or hobbies. Finally, assign 20% to savings, investments, and debt repayments.

… (continue with the other budgeting methods, advantages and disadvantages, FAQs, conclusion, and final remarks)